MOS 3310 Corporate Finance Final Exam

QUESTION 1 (17 marks) (35 minutes)

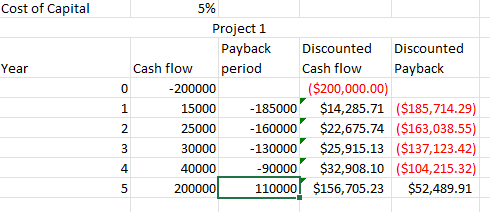

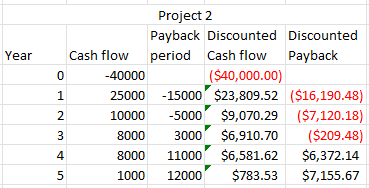

a) Phoenix Growth Inc. is considering two mutually exclusive projects that differ greatly on the required investment and projected cash flows. The initial investment required for Project 1 is $200,000. While for Project 2 it is $40,000. Proposed after-tax cash flows are shown below:

$ Cash Flows

Year Project 1 Project 2

1 15,000 25,000

2 25,000 10,000

3 30,000 8,000

4 40,000 8,000

5 200,000 1,000

The opportunity cost of capital for Phoenix Growth Inc. is 5%

REQUIRED: (10 marks)

For each project calculate the following:

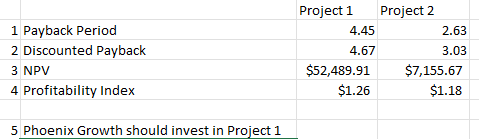

i) Pay back period (2 marks)

ii) Discounted pay back period (3 marks)

iii) NPV (3 marks)

iv) Profitability Index (2 marks)

v) Which project should Phoenix Growth invest in? (1 mark)

Correct Answer – Phoenix Growth Inc. is considering two mutually exclusive projects

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20

b) The cash flows for two mutually exclusive projects are as follows:

C0 C1 C2 C3

Project A -30,000 14,000 14,000 14,000

Project B -50,000 24,000 24,000 24,000

REQUIRED: (7 marks)

i) Calculate NPV for each project if the required rate of return is 12%. (3 marks)

ii) Calculate the Internal Rate of Return (IRR) for each project. (3 marks)

iii) Which project should the company invest in? Why? (1 mark)

Correct Answer – The cash flows for two mutually exclusive projects are as follows:

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20

QUESTION 2 (14 marks) (30 minutes)

The following table summarizes sales forecasts for Stirling Corp. The unit price is $40. The unit cost is $25. In addition, annual fixed expenses are expected to be $35,000.

Year Unit Sales

1 22,000

2 30,000

3 14,000

4 9,000

5 5,000

Thereafter 0

Stirling has developed a new improved water flow system that requires an additional investment of $425,000. Old equipment is the same asset class (25% CCA rate) can be sold for $25,000. After 5 years the asset will have a value of zero. The firm’s tax rate is 35%.

The net working capital requirement (including the initial working capital needed in year 0) is expected to be 25% of the following years sales. The company requires a 12% return on projects of this nature.

REQUIRED:

Calculate the net present value of the project to determine if the company should invest in this equipment. Show all calculations.

Correct Answer – The following table summarizes sales forecasts for Stirling Corp. The unit price is $40. The unit cost is $25.

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20

QUESTION 3 (14 marks) (30 minutes)

You have been asked to estimate the weighted average cost of capital (WACC) for Knollwood Inc., a large camping supplies company. To assist with your calculations, you have been provided with the following information.

1. Bonds — Knollwood has 25,000 of $100 face value bonds outstanding. The bonds carry a 6% coupon rate with interest paid semi-annually. At their current market price of $92.89 per bond, they are priced to provide a yield to maturity of 7%. The bonds have 10 years remaining until maturity.

2. Preferred shares — Knollwood has 2 million preferred shares outstanding. The shares carry a stated dividend of $1.60 per share and have a current market price of $22 per share.

3. Common shares — Knollwood has 3 million common shares outstanding. The current market price of the shares is $53.20 each. The shares paid a dividend of $2.70 per share last year and investment analysts believe the dividends should grow at an average annual rate of 5% for the foreseeable future.

REQUIRED:

a) Calculate Knollwood’s weighted average cost of capital (WACC), assuming that the company intends to issue new common shares. The company’s tax rate is 40%.(10 marks)

b) If a firm changes its mix of debt and equity financing, its weighted average cost of capital will change for 2 main reasons. Identify these 2 reasons, and briefly explain why the firm’s WACC will change. (4 marks)

Correct Answer – You have been asked to estimate the weighted average cost of capital (WACC) for Knollwood Inc.,

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20

QUESTION 4 (16 marks) (35 minutes)

The financial statements for Medway Inc. (are provided below). Although the company has not been growing, it now plans to expand and will increase net fixed assets by $200,000 per year at the end of the next 5 years.

- Medway forecasts that the ratio of Revenues to total assets will remain at 1.5

- Net working capital will equal 50% of the end of year net fixed assets

- Annual depreciation is 10% of net fixed assets at the start of the year

- Fixed Costs are expected to remain at $75,000 and variable costs at 80% of revenue.

- The company’s policy is to pay out 2/3 of its net income as dividends

- Maintain a Debt Ratio of 25% of total assets (eg $1,500 x 25% = $375 Debt)

- Revenues are expected to increase by 20% in 2020

REQUIRED:

i) Prepare a Pro-forma Income Statement and Balance Sheet for 2023. (12 marks)

ii) Now assume that the balancing item is debt and that no equity is to be issued. Prepare the Liabilities and Equity portion of the Pro-forma Balance Sheet for 2023. What is the projected debt ratio for 2023? (4 marks)

Medway Inc.

Income Statement

for year-ended December 31, 2022

($000’s)

Revenue $2,250

Fixed Costs 75

Variable Costs (80% of revenue) 1,800

Depreciation 100

Interest (8% of begin yr. debt) 30

Taxable income 245

Taxes @ 40% 98

Net income $ 147

Dividends 98

Addition to retained earnings 49

Balance Sheet

As at Dec 31, 2022

Assets

Net working capital $ 500

Net fixed assets 1,000 net of depreciation)

Total assets $1,500

Liabilities and shareholder’s equity

Debt $ 375

Shareholder’s Equity 1,125

Total Liabilities and Shareholder’s Equity $1,500

Correct Answer – The financial statements for Medway Inc. (are provided below).

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20

QUESTION 5 (10 marks) (15 minutes)

Answer the following independent questions.

a) Explain why and how a change in interest rates on other financial assets will affect the required rate of return on equity. (2 marks)

b) An analyst has provided you with the following information about the common shares of two companies. Silvana Inc. and Oxbow Ltd.

Common Shares Silvana Oxbow

Beta 1.25 0.8

Expected rate of return 9.5% 6.0%

Standard deviation of return 11% 16%

Market price of risk 5% 5%

Risk-free rate of return 2.5% 2.5%

i) Indicate whether a well-diversified investor would prefer to invest in the shares of Silvana or the shares of Oxbow. Show all calculations. (3 marks)

ii) Indicate whether an investor who can invest in the shares of only one company would prefer to invest in the shares of Silvana or Oxbow. (2 marks)

iii) Identify the circumstances in which an investment in both shares would lead to benefits from diversification. Provide an example of how such circumstances might arise. (3 marks)

Correct Answer – Explain why and how a change in interest rates on other financial assets will affect

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20

QUESTION 6 (11marks) (15 minutes)

The Parkview Company has annual sales of $8,000,000 (unit sale price is $400), a Contribution Margin (CM) ratio of 25% and fixed costs of $1,000,000 (excluding depreciation). Annual depreciation is $400,000. Tax rate is 40%.

REQUIRED:

a) Prepare an income statement for the Parkview Company (3 marks)

b) Calculate operating breakeven point in units and dollars (4 marks)

c) Explain the meaning of Degree of Operating Leverage (DOL) (1 marks)

d) Calculate at the current level of production the: (1 marks)

- degree of operating leverage (DOL)

e) Assume that sales are to increase by 20%, using the results in part (d), calculate the percentage increase in operating income and net income. (2 marks)

Correct Answer – The Parkview Company has annual sales of $8,000,000 (unit sale price is $400), a Contribution Margin (CM) ratio of 25%

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20

QUESTION 7 (10 marks) (20 minutes)

Pine Haven Inc. is reviewing its credit policy. Presently, the company offers terms of 1/10, net 30. This policy results in monthly sales of 150,000 units at $10 each, of which 10% are cash sales. Cash sales are entitled to the discount. For those sales made on account, 25% qualify for the discount and are paid within 10 days. The balance of sales are paid on the 30th day. Bad debts amount to 2% of credit sales and variable costs of production are $7 per unit.

The new policy being proposed would offer 2/10, net 60. It is expected that this policy would result in credit sales of an additional 15,000 units per month. Cash sales are expected to remain at 15,000 units per month. For those sales made on account, 45% are expected to be paid within the discount period and the balance, except for bad debts will be paid on the 60th day. Bad debts are expected to increase to 3% of credit sales if the new policy is adopted. An additional $50,000 investment in inventory will be required.

Working capital is financed at the bank at 12%. The company’s tax rate is 40%.

REQUIRED:

Should the company change its credit policy? Support your recommendation with calculations.

Correct Answer – Pine Haven Inc. is reviewing its credit policy. Presently, the company offers terms of 1/10, net 30.

…Please click on the Icon below to purchase the FULL FINAL EXAM ANSWERS at only $20