Module 4 Assignment

Question 1

Correct

Mark 13.00 out of 13.00

Question text

Compute and Interpret Coverage, Liquidity and Solvency Ratios

Selected balance sheet and income statement information from Amazon for 2016 through 2018 follows.

| $ millions | 2018 | 2017 | 2016 |

|---|---|---|---|

| Net operating profit after tax (NOPAT) | $10,978 | $3,222 | $2,556 |

| Net income | 10,073 | 3,033 | 2,371 |

| Operating profit | 12,421 | 4,106 | 4,186 |

| Interest expense | 1,417 | 848 | 484 |

| Cash from operating activities | 30,723 | 18,365 | 17,203 |

| Current assets | 75,101 | 60,197 | 45,781 |

| Current liabilities | 68,391 | 57,883 | 43,816 |

| Cash and cash equivalents | 31,750 | 20,522 | 19,334 |

| Marketable securities | 9,500 | 10,464 | 6,647 |

| Total debt | 23,495 | 24,743 | 7,694 |

| Assets | 162,648 | 131,310 | 83,402 |

| Liabilities | 119,099 | 103,601 | 64,117 |

| Equity | 43,549 | 27,709 | 19,285 |

| Net operating assets (NOA) | 25,794 | 21,466 | 998 |

a. Compute profitability measures RNOA and ROE for 2018 and 2017. In which year are the measures stronger? Round answers to one decimal place (ex: 0.2345 = 23.5%).

b. Compute coverage metrics Times interest earned and Cash from operating activities to total debt for 2018 and 2017. Round answers to two decimal places.

c. Determine liquidity for the company for 2018 and 2017 by computing the current ratio and quick ratio.

Round answers to two decimal places.

d. Compute the Total liabilities‑to‑equity ratio and the Total debt to equity ratio for 2018 and 2017.

Round answers to two decimal places.

Solution

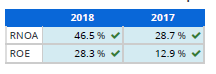

a. Compute profitability measures RNOA and ROE for 2018 and 2017. In which year are the measures stronger?

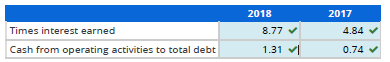

b. Compute coverage metrics Times interest earned and Cash from operating activities to total debt for 2018 and 2017.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Related:

Question 2

Question text

Compute and Interpret Ratios

Selected balance sheet and income statement information from Illinois Tool Works follows.

| $ millions | 2019 | 2018 | 2017 |

|---|---|---|---|

| Net operating profit after tax (NOPAT) | $2,610 | $2,711 | |

| Net income | 2,521 | 2,563 | |

| Total assets | 15,068 | 14,870 | $16,780 |

| Equity | 3,026 | 3,254 | 3,254 |

| Net operating profit after tax (NOA) | 8,869 | 9,462 | 10,089 |

| Treasury stock | 18,982 | 17,545 | 15,562 |

a. Compute profitability measures: RNOA, ROA and ROE for 2019 and 2018 using the numbers as reported by the company.

Note: Round answers to one decimal place (ex: 0.2345 = 23.5%).

b. Adjust equity and total assets for the amount of treasury stock.

Using these restated numbers, recompute RNOA, ROA and ROE for both years.

Note: Round answers to one decimal place (ex: 0.2345 = 23.5%).

c. Which profitability measures (from part a or part b) better reflect the company’s profit levels during the two years?

Of the three measures, which one is least influenced by the company’s stock repurchase activity?

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Question 3

Correct

Mark 3.00 out of 3.00

Question text

Compute and Interpret Altman’s Z-scores

Following is selected financial information for Netflix, for 2018 and 2017.

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

| In thousands, except per share data | 2018 | 2017 |

|---|---|---|

| Current assets | $9,694,135 | $7,669,974 |

| Current liabilities | 6,487,320 | 5,466,312 |

| Total assets | 25,974,400 | 19,012,742 |

| Total liabilities | 20,735,635 | 15,430,786 |

| Shares outstanding | 436,599 | 433,393 |

| Retained earnings | 2,942,359 | 1,731,117 |

| Stock price per share | 268.00 | 191.96 |

| Sales | 15,794,341 | 11,692,713 |

| Earnings before interest and taxes | 1,605,226 | 838,679 |

Compute and interpret Altman Z-scores for the company for both years.

Is the company’s bankruptcy risk increasing or decreasing over this period?