MOS3370 Chapter 11 Practice Problems

Question 1

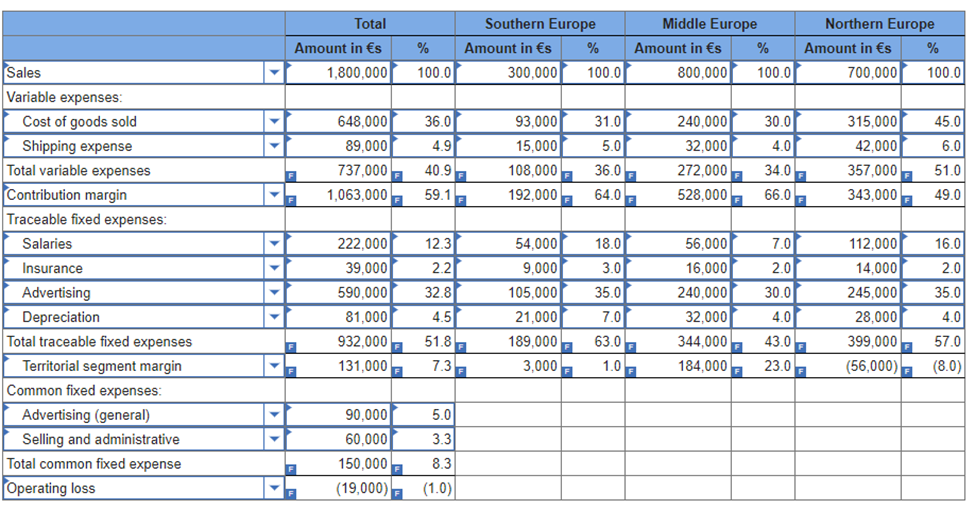

Brabant NV of the Netherlands is a wholesale distributor of Dutch cheeses that it sells throughout the European Union. Unfortunately, the company’s profits have been declining, which has caused considerable concern. To help understand the condition of the company, the managing director of the company has requested that the monthly income statement be segmented by sales territory. Accordingly, the company’s accounting department has prepared the following statement for March, the more recent month. (The Dutch currency is the euro, which is designated by €.)

| Sales Territory | ||||

| Southern Europe | Middle Europe | Northern Europe | ||

| Sales | 300,000 | 800,000 | 700,000 | |

| Territorial expenses (traceable): | ||||

| Cost of goods sold | 93,000 | 240,000 | 315,000 | |

| Salaries | 54,000 | 56,000 | 112,000 | |

| Insurance | 9,000 | 16,000 | 14,000 | |

| Advertising | 105,000 | 240,000 | 245,000 | |

| Depreciation | 21,000 | 32,000 | 28,000 | |

| Shipping | 15,000 | 32,000 | 42,000 | |

| Total territorial expenses | 297,000 | 616,000 | 756,000 | |

| Territorial income (loss) before corporate expenses | 3,000 | 184,000 | (56,000) | |

| Corporate expenses: | ||||

| Advertising (general) | 15,000 | 40,000 | 35,000 | |

| Selling and administrative | 20,000 | 20,000 | 20,000 | |

| Total corporate expenses | 35,000 | 60,000 | 55,000 | |

| Operating income (loss) | (32,000) | 124,000 | (111000) | |

Cost of goods sold and shipping expenses are both variable; other costs are all fixed. Brabant NV purchases cheeses at auction and from farmers’ cooperatives, and it distributes them in the three territories shown in the statement above. Each of the three sales territories has its own manager and sales staff. The cheeses vary widely in profitability; some have a high margin and some have a low margin. (Certain cheeses, after having been aged for long periods, are the most expensive and carry the highest margins.)

Required:

1.This part of the question is not part of your Connect assignment.

2. This part of the question is not part of your Connect assignment.

3. Prepare a new segmented contribution format income statement for May. Show a Total column as well as data for each territory. Include percentages on your statement for all columns. (Round your percentage answers to 1 decimal place.)

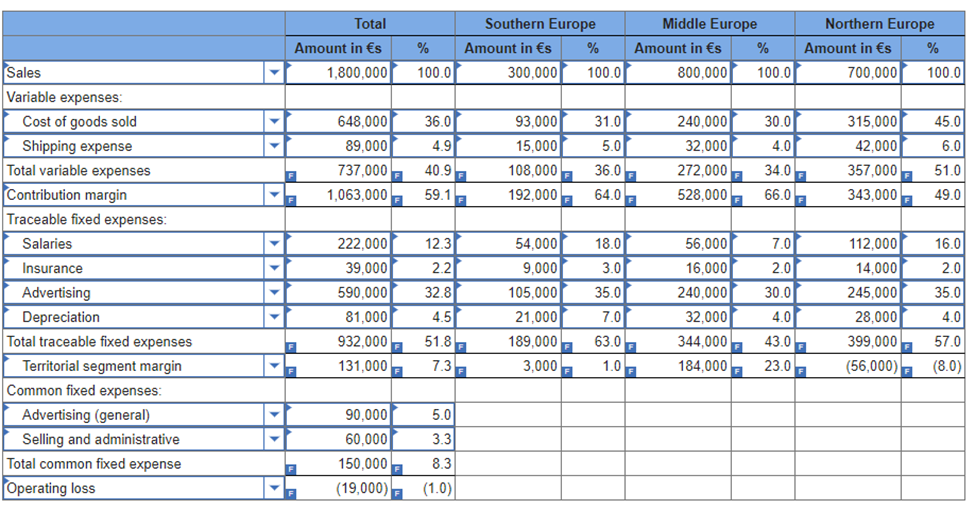

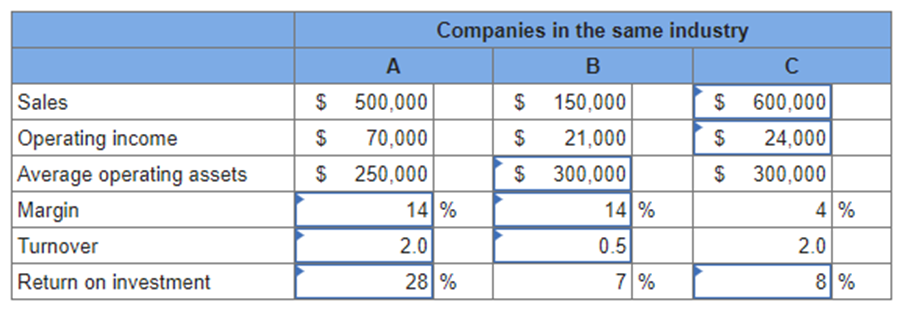

The following are comparative data submitted by three companies in the food services:

Required:

1. This part of the question is not part of your Connect assignment.

2. Fill in the missing information below. (Round “Turnover” answers to 1 decimal place.)

| Companies in the same industry | |||

| A | B | C | |

| Sales | $500000 | $150000 | |

| Operating income | $700000 | $21000 | |

| Average operating assets | $250000 | $300000 | |

| Margin | 4% | ||

| Turnover | 2 | ||

| Return on investment | 7% | ||

Financial data for Bridger Inc. for last year are as follows:

| BRIDGER INC. Balance Sheet | ||||||

| Ending Balance | Beginning Balance | |||||

| Assets | ||||||

| Cash | $ | 151,000 | $ | 146,000 | ||

| Accounts receivable | 450,000 | 310,000 | ||||

| Inventory | 460,000 | 510,000 | ||||

| Plant and equipment, net | 639,000 | 654,000 | ||||

| Investment in Brier Company | 460,000 | 430,000 | ||||

| Land (undeveloped) | 280,000 | 280,000 | ||||

| Total assets | $ | 2,440,000 | $ | 2,330,000 | ||

| Liabilities and shareholders’ equity | ||||||

| Accounts payable | $ | 200,000 | $ | 230,000 | ||

| Long-term debt | 1,000,000 | 1,000,000 | ||||

| Shareholders’ equity | 1,240,000 | 1,100,000 | ||||

| Total liabilities and shareholders’ equity | $ | 2,440,000 | $ | 2,330,000 | ||

| BRIDGER INC. Income Statement | ||||||

| Sales | $ | 4,150,000 | ||||

| Operating expenses | 3,569,000 | |||||

| Operating income | 581,000 | |||||

| Interest and taxes: | ||||||

| Interest expense | $ | 121,000 | ||||

| Tax expense | 201,000 | 322,000 | ||||

| Net income | $ | 259,000 | ||||

The company paid dividends of $120,000 last year. The “Investment in Brier Company” on the balance sheet represents an investment in the common shares of another company.

Required:

1.Compute the company’s margin, turnover, and ROI for last year. (Round your intermediate calculations and final answers to 2 decimal places.)

2. The board of directors of Bridger Inc. has set a minimum required return of 18%. What was the company’s residual income last year?

Question 4

There is often more than one way to improve a performance measure. Unfortunately, some of the actions taken by managers to make their performance look better may actually harm the organization. For example, suppose the marketing department is held responsible only for increasing the performance measure “total revenues.” Increases in total revenues may be achieved by working harder and smarter, but they can also usually be achieved by simply cutting prices. The increase in volume from cutting prices almost always results in greater total revenues; however, it does not always lead to greater total profits. Those who design performance measurement systems need to keep in mind that managers who are under pressure to perform may take actions to improve performance measures that have negative consequences elsewhere.

Required:

For each of the following situations, describe actions that managers might take to show improvement in the performance measure but which do not actually lead to improvement in the organization’s overall performance.

1. Concerned with the slow rate at which new products are brought to market, top management of a consumer electronics company introduces a new performance measure—speed-to-market. The research and development department is given responsibility for this performance measure, which measures the average amount of time a product is in development before it is released to the market for sale.

2. The CEO of an airline company is dissatisfied with the amount of time that her ground crews are taking to unload luggage from airplanes. To solve the problem, she decides to measure the average elapsed time from when an airplane parks at the gate to when all pieces of luggage are unloaded from the airplane. For each month that an airport’s ground crew can lower its “average elapsed time” relative to the prior month, the CEO pays a lump-sum bonus to be split equally among members of the crew.

3. A manufacturing company has been plagued by the chronic failure to ship orders to customers by the promised date. To solve this problem, the production manager has been given the responsibility of increasing the percentage of orders shipped on time. When a customer calls in an order, the production manager and the customer agree to a delivery date. If the order is not completed by that date, it is counted as a late shipment.

Question 5

In Cases 1 to 3 below, assume that Division A has a product that can be sold either to Division B of the same company or to outside customers. The managers of both divisions are evaluated based on their own division’s ROI. The managers are free to decide if they will participate in any internal transfers. All transfer prices are negotiated. Treat each case independently:

| Case | ||||||||||||

| 1 | 2 | 3 | 4 | |||||||||

| Division A: | ||||||||||||

| Capacity in units | 50,000 | 300,000 | 100,000 | 200,000 | ||||||||

| Number of units now being sold to outside customers | 50,000 | 300,000 | 75,000 | 200,000 | ||||||||

| Selling price per unit to outside customers | $ | 100 | $ | 40 | $ | 60 | $ | 45 | ||||

| Variable costs per unit | $ | 63 | $ | 19 | $ | 35 | $ | 30 | ||||

| Fixed costs per unit (based on capacity) | $ | 25 | $ | 8 | $ | 17 | $ | 6 | ||||

| Division B: | ||||||||||||

| Number of units needed annually | 10,000 | 70,000 | 20,000 | 60,000 | ||||||||

| Purchase price now being paid to an outside supplier | $ | 92 | $ | 39 | $ | 60 | * | — | ||||

*Before any purchase discount.

Required:

1. Refer to Case 1. A study has indicated that Division A can avoid $5 per unit in variable costs on any sales to Division B.

a. What is the minimum transfer price for Division A?

b. What is the maximum transfer price for Division B?

c. Will the managers agree to a transfer?multiple choice 1

- Yes

- No

2. Refer to Case 2. Assume that Division A can avoid $4 per unit in variable costs on any sales to Division B.

a-1. What is the minimum transfer price for Division A?

a-2. What is the maximum transfer price for Division B?

a-3. It is assumed that managers are co-operative and understand their own business. Would you expect any disagreement between the two divisional managers over what the transfer price should be?multiple choice 2

- Yes

- No

b. Assume that Division A offers to sell 70,000 units to Division B for $38 per unit and that Division B refuses this price. What will be the loss in potential profits for the company as a whole?

3. Refer to Case 3. Assume that Division B is now receiving a 5% price discount from the outside supplier.

a-1. What is the minimum transfer price for Division A?

a-2. What is the range of transfer price the manager’s of both divisions should agree?

a-3. It is assumed that managers are co-operative and understand their own business. Will the managers agree to a transfer?multiple choice 3

- Yes

- No

b. Assume that Division B offers to purchase 20,000 units from Division A at $52 per unit. If Division A accepts this price, would you expect its ROI to increase, decrease, or remain unchanged?

4. Refer to Case 4. Assume that Division B wants Division A to provide it with 60,000 units of a different product from the one that Division A is now producing. The new product would require $25 per unit in variable costs and would require that Division A cut back production of its present product by 30,000 units annually. What is the lowest acceptable transfer price from Division A’s perspective? (Round your intermediate and final answers to 2 decimal places.)

Hrubec Products Inc. operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs associated with a tonne of pulp follow:

| Selling price | $ | 70 | ||

| Expenses: | ||||

| Variable | $ | 42 | ||

| Fixed (based on a capacity of 50,000 tonnes per year) | 18 | 60 | ||

| Operating income | $ | 10 | ||

Hrubec Products has just acquired a small company that manufactures paper cartons. Hrubec plans to treat its newly acquired Carton Division as a profit centre. The manager of the Carton Division is currently purchasing 5,000 tonnes of pulp per year from a supplier at a cost of $63 per tonne. Hrubec’s president is anxious for the Carton Division to begin purchasing its pulp from the Pulp Division if the managers of the two divisions can negotiate an acceptable transfer price.

Required:

For (1) and (2) below, assume the Pulp Division can sell all of its pulp to outside customers for $70 per tonne.

1. What is the Pulp Division’s lowest acceptable transfer price? What is the Carton Division’s highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 5,000 tonnes of pulp next year?

2. If the Pulp Division meets the price that the Carton Division is currently paying to its supplier and sells 5,000 tonnes of pulp to the Carton Division each year, what will be the effect on the profits of the Pulp Division, the Carton Division, and the company as a whole?

For (3)–(6) below, assume that the Pulp Division is currently selling only 30,000 tonnes of pulp each year to outside customers at the stated $70 price.

3. What is the Pulp Division’s lowest acceptable transfer price? What is the Carton Division’s highest acceptable transfer price? What is the range of acceptable transfer prices (if any) between the two divisions? Are the managers of the Carton and Pulp Divisions likely to voluntarily agree to a transfer price for 5,000 tonnes of pulp next year?

4-a. Suppose the Carton Division’s outside supplier drops its price to only $59 per tonne. Should the Pulp Division meet this price?

4-b. If the Pulp Division does not meet the $59 price, what will be the effect on the profits of the company as a whole?

5. Refer to (4) above. If the Pulp Division refuses to meet the $59 price, should the Carton Division be required to purchase from the Pulp Division at a higher price for the good of the company as a whole?

6. Refer to (4) above. Assume that due to inflexible management policies, the Carton Division is required to purchase 5,000 tonnes of pulp each year from the Pulp Division at $70 per tonne. What will be the effect on the profits of the company as a whole?

Question 7

“I can’t understand what’s happening here,” said Mike Holt, president of Severson Products Inc.

“We always seem to bid too high on jobs that require a lot of labour time in the Finishing Department, and we always seem to get every job we bid on that requires a lot of machine time in the Milling Department. Yet we don’t seem to be making much money on those Milling Department jobs. I wonder if the problem is in our overhead rates.”

Severson Products manufactures high-quality wood products to customers’ specifications. Some jobs take a large amount of machine work in the Milling Department, and other jobs take a large amount of hand-finishing work in the Finishing Department. In addition to the Milling and Finishing Departments, the company has three service departments. The costs of these service departments are allocated to other departments in the order listed below. For each service department, use the most appropriate allocation base:

| Total Labour-Hours | Square Metres of Space Occupied | Number of Employees | Machine-Hours | Labour- Hours | |||||||||||

| Cafeteria | 16,000 | 12,000 | 25 | ||||||||||||

| Custodial Services | 9,000 | 3,000 | 40 | ||||||||||||

| Machinery Maintenance | 15,000 | 10,000 | 60 | ||||||||||||

| Milling | 30,000 | 40,000 | 100 | 160,000 | 20,000 | ||||||||||

| Finishing | 100,000 | 20,000 | 300 | 40,000 | 70,000 | ||||||||||

| 170,000 | 85,000 | 525 | 200,000 | 90,000 | |||||||||||

Budgeted overhead costs in each department for the current year are as follows:

| Cafeteria | $ | 320,000 | * |

| Custodial Services | 65,400 | ||

| Machinery Maintenance | 93,600 | ||

| Milling | 416,000 | ||

| Finishing | 166,000 | ||

| Total budgeted cost | $ | 1,061,000 | |

*This represents the amount of cost subsidized by the company.

The company has always allocated service department costs to the operating departments (Milling and Finishing) using the direct method of allocation, because of its simplicity.

Required:

1.Allocate service department costs to operating departments by the step-down method. Then compute predetermined overhead rates in the operating departments for the current year, using machine-hours as the allocation base in the Milling Department and direct labour-hours as the allocation base in the Finishing Department. (Round “Predetermined overhead rate” answers to 2 decimal places. Negative amounts should be indicated by a minus sign.)

2. Repeat (requirement 1) above, this time using the direct method. Again compute predetermined overhead rates in the Milling and Finishing departments. (Round “Predetermined overhead rate” answers to 2 decimal places. Negative amounts should be indicated by a minus sign.)

3. Assume that during the current year the company bids on a job that requires machine and labour time as follows:

| Machine-Hours | Direct Labour-Hours | |||||

| Milling Department | 2,000 | 1,600 | ||||

| Finishing Department | 800 | 13,000 | ||||

| Total hours | 2,800 | 14,600 | ||||

3-a. Determine the amount of overhead that would be assigned to the job if the company used the overhead rates developed in (requirement 1) above. Then determine the amount of overhead that would be assigned to the job if the company used the overhead rates developed in (requirement 2) above. (Round the predetermined overhead rates to 2 decimal places.)

Solution

Question 1 Answer

Prepare a new segmented contribution format income statement for May.

Question 2 Answer

Please click on the Icon below to purchase the full answer at only $10