Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December.

| On Company | Off Company | |

| Materials inventory, December 1 | $88,230.00 | $111,170.00 |

| Materials inventory, December 31 | (a) | 125,620.00 |

| Materials purchased | 224,100.00 | (a) |

| Cost of direct materials used in production | 236,460.00 | (b) |

| Direct labor | 332,630.00 | 250130 |

| Factory overhead | 103,230.00 | 124,510.00 |

| Total manufacturing costs incurred during December | (b) | 719,270.00 |

| Total manufacturing costs | 841,720.00 | 841,720.00 |

| Work in process inventory, December 1 | 169,400.00 | 267,920.00 |

| Work in process inventory, December 31 | 142,930.00 | (c) |

| Cost of goods manufactured | (c) | 712,600.00 |

| Finished goods inventory, December 1 | 149,110.00 | 124,510.00 |

| Finished goods inventory, December 31 | 156,170.00 | (d) |

| Sales | 1,300,510.00 | 1,111,700.00 |

| Cost of goods sold | (d) | 719,270.00 |

| Gross profit | (e) | (e) |

| Operating expenses | 169,400.00 | (f) |

| Net income | (f) | 246,800.00 |

Required:

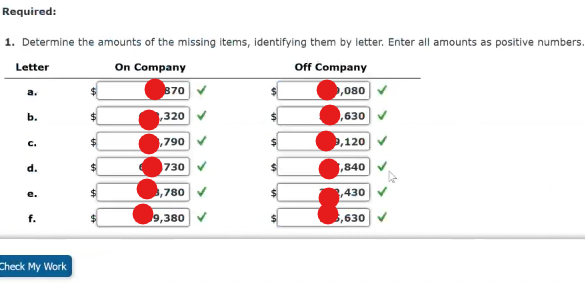

A. Determine the amounts of the missing items, identifying them by letter. Enter all amounts as positive numbers.

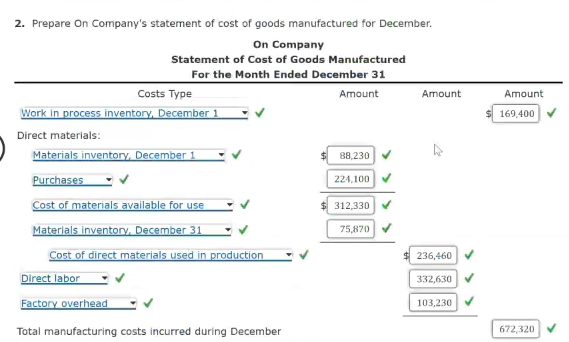

B. Prepare On Company’s statement of cost of goods manufactured for December.*

C. Prepare On Company’s income statement for December.*

Solution

We have the step by step solution. We include formulas in our excel file so that you can see where each number came from. The template can be used for your question.

…Please click on the Icon below to purchase the FULL CORRECT ANSWERS at only $5

…Please click on the Icon below to purchase the FULL CORRECT ANSWERS at only $5