Assignment 7 (Chapter 9)

Selected accounts from the financial statements for Yemellas Inc. under three different methods of accounting for its 40% interest in Wawa Ltd. are presented below. There was no acquisition differential and were no intercompany transactions.

| Equity Method | Proportionate Consolidation | Full Consolidation | |||||||

| Revenues | $ | 1,740 | $ | 4,780 | $ | 9,340 | |||

| Equity method income | 80 | ||||||||

| Expenses | 1,670 | 4,630 | 9,070 | ||||||

| Net income attributed to Yemellas | 150 | 150 | 150 | ||||||

| Net income attributed to NCI | 120 | ||||||||

| Current assets | 320 | 896 | 1,760 | ||||||

| Investment in Wawa | 800 | ||||||||

| Other assets | 590 | 2,894 | 6,350 | ||||||

| Total assets | $ | 1,710 | $ | 3,790 | $ | 8,110 | |||

| Current liabilities | $ | 190 | $ | 670 | $ | 1,390 | |||

| Long-term liabilities | 850 | 2,450 | 4,850 | ||||||

| Common shares | 100 | 100 | 100 | ||||||

| Retained earnings | 570 | 570 | 570 | ||||||

| Non-controlling interest | 0 | 0 | 1,200 | ||||||

| Total liabilities & equity | $ | 1,710 | $ | 3,790 | $ | 8,110 | |||

Required:

(a) This part of the question is not part of your Connect assignment.

(b) Calculate the return on total shareholders’ equity, current ratio and debt-to-equity ratio for each of the three financial statements. (Omit % sign in your response. Round return on equity to 1 decimal place and current ratio and debt to equity ratio to 2 decimal places.)

(c) This part of the question is not part of your Connect assignment.

(d) Calculate the current ratio for Wawa’s separate entity financial statements. (Round your answer to 1 decimal place.)

Question 2

The following information has been assembled about Casbar Corp. as at December 31, Year 5 (amounts are in thousands):

| Operating segment | Revenues | Profit | Asset | |

| A | 12,000 | 3,100 | 24,000 | |

| B | 9,600 | 2,680 | 21,000 | |

| C | 7,200 | (1,440 | 15,000 | |

| D | 3,600 | 660 | 9,000 | |

| E | 5,100 | 810 | 8,400 | |

| F | 1,800 | (270 | 3,600 | |

Required:

Determine which operating segments require separate disclosures. (Round the intermediate calculations to nearest percentage.)

Related Assignment Solution: (Solution) MOS4465 Assignment 8 (Chapter 10)

100% Correct Solution – Assignment 7 (Chapter 9)

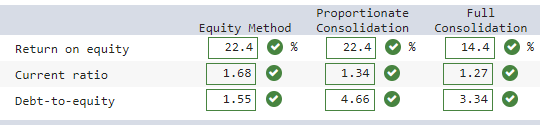

Here is the correct answer for question 1 part b

Question 1 (b) Answer Explanation

| Equity Method | Proportionate Consolidation | Full Consolidation | ||||||

| Return on equity = | Net income | $150 | = 22.4% | $150 | = 22.4% | $150 + 120 | = 14.4% | |

| Shareholders’ equity | $670 | $670 | $670 + 1,200 | |||||

| Current ratio = | Current assets | $320 | = 1.68 | $896 | = 1.34 | $1,760 | = 1.27 | |

| Current liabilities | $190 | $670 | $1,390 | |||||

| Debt-to-equity = | Total liabilities | $1,040 | = 1.55 | $3,120 | = 4.66 | $6,240 | = 3.34 | |

| Total equity | $670 | $670 | $1,870 | |||||

,,, Please click on the Icon below to purchase the full answer at only $10