Assignment 6 (Chapter 8)

Johannes Inc. acquired 80 percent of Corner Brook Ltd. common shares on January 1, Year 4, for $720,000. At that date, the fair value of the non-controlling interest was $180,000. Corner Brook’s balance sheet contained the following amounts at the time of the combination:

| Cash | $ | 60,000 | Accounts Payable | $ | 100,000 | ||

| Accounts Receivable | 130,000 | Bonds Payable | 600,000 | ||||

| Inventory | 30,000 | Common Shares ($10 par value) | 400,000 | ||||

| Construction Work in Progress | 940,000 | Retained Earnings | 500,000 | ||||

| Other Assets (net) | 440,000 | ||||||

| Total Assets | $ | 1,600,000 | Total Liabilities & Equities | $ | 1,600,000 | ||

During each of the next three years, Corner Brook reported net income of $100,000 and paid dividends of $40,000. On January 1, Year 6, Johannes sold 8,000 of the Corner Brook shares for $240,000 in cash. Johannes used the equity method in accounting for its ownership of Corner Brook.

Required:

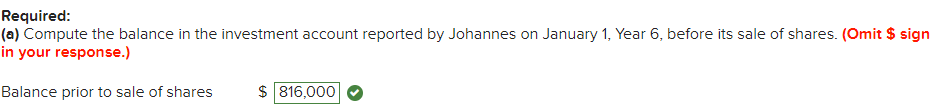

(a) Compute the balance in the investment account reported by Johannes on January 1, Year 6, before its sale of shares. (Omit $ sign in your response.)

(b) Prepare the entry recorded by Johannes when it sold the Corner Brook shares. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

(c) Calculate consolidated net income attributable to the noncontrolling interest for Year 6 and noncontrolling interest at the end of Year 6. (Omit $ sign in your response.)

Related Assignment solution: (Solution) MOS4465 Assignment 7 (Chapter 9)

100% Correct Solution with Explanation – Assignment 6 (Chapter 8)

Question 1 (a)

Correct Answer 816,000, Calculated as follows

Corner Brook has 40,000 shares outstanding: $400,000 / $10 par value per share allocated as follows:

| Parent | NCI | Total | ||||

| January 1, Year 4 | 32,000 | (80%) | 8,000 | (20%) | 40,000 | (100%) |

| Sale on Jan 1, Year 6 | (8,000 | 8,000 | ||||

| Total after sale | 24,000 | (60%) | 16,000 | (40%) | 40,000 | (100%) |

,,, Please click on the Icon below to purchase the full answer at only $10