Module 11 Assignment – Analyzing Forecasting and Interpreting

Question 1

Correct

Mark 12.00 out of 12.00

Question text

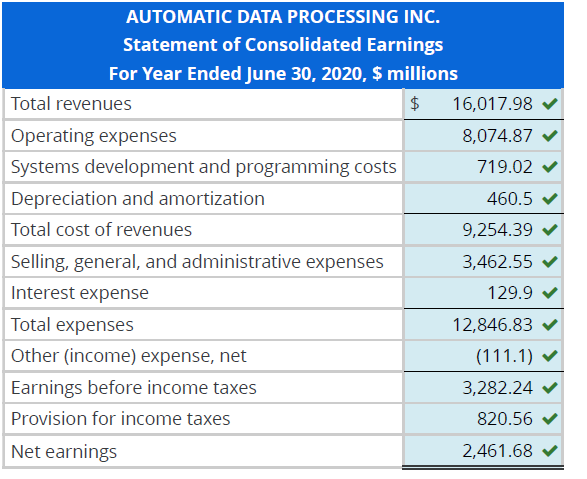

Forecasting an Income Statement

ADP reports the following income statement.

| AUTOMATIC DATA PROCESSING INC. | |

|---|---|

| Statement of Consolidated Earnings | |

| For Year Ended June 30, 2019, $ millions | |

| Total revenues | $14,175.0 |

| Operating expenses | 7,146.0 |

| Systems development and programming costs | 636.0 |

| Depreciation and amortization | 304.4 |

| Total cost of revenues | 8,086.4 |

| Selling, general, and administrative expenses | 3,064.0 |

| Interest expense | 130.0 |

| Total expenses | 11,280.4 |

| Other (income) expense, net | (111.0) |

| Earnings before income taxes | 3,005.6 |

| Provision for income taxes | 713.0 |

| Net earnings | $2,292.6 |

Forecast ADP’s 2020 income statement assuming the following income statement relations. All percentages (other than total revenue growth and provision for income taxes) are based on historic percent of total revenues. Dollar figures are in millions

| Assumptions | |

|---|---|

| Total revenues growth | 13.00% |

| Depreciation and amortization | $460.5 |

| Interest expense | No change |

| Other (income) expense, net | No change |

| Income tax rate | 25.00% |

Note: Complete the entire question in Excel using the following template: Excel Template. Format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

Solution

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Question 2 – Analyzing Forecasting and Interpreting

Question text

Analyzing, Forecasting, and Interpreting Both Income Statement and Balance Sheet

Following are the income statement and balance sheet of Seagate Technology for fiscal 2019.

Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places.

| SEGATE TECHNOLOGY PLC | |

|---|---|

| Consolidated Statement of Income | |

| For Year Ended June 28, 2019, $ millions | |

| Revenue | $10,390 |

| Cost of revenue | 7,458 |

| Product development | 991 |

| Marketing and administrative | 453 |

| Amortization of intangibles | 23 |

| Restructuring and other, net | (22) |

| Total operating expenses | 8,903 |

| Income from operations | 1,487 |

| Interest income | 84 |

| Interest expense | (224) |

| Other, net | 25 |

| Other expense, net | (115) |

| Income before income taxes | 1,372 |

| (Benefit) provision for income taxes | (640) |

| Net income | $2,012 |

| SEAGATE TECHNOLOGY PLC Consolidated Balance Sheet | |

|---|---|

| Consolidated Balance Sheet | |

| $ millions | June 28, 2019 |

| Current assets | |

| Cash and cash equivalents | $2,220 |

| Accounts receivable, net | 989 |

| Inventories | 970 |

| Other current assets | 184 |

| Total current assets | 4,363 |

| Property, equipment and leasehold improvements, net | 1,869 |

| Goodwill | 1,237 |

| Other intangible assets, net | 111 |

| Deferred income taxes | 1,114 |

| Other assets, net | 191 |

| Total assets | $8,885 |

| Current liabilities | |

| Accounts payable | $1,420 |

| Accrued employee compensation | 169 |

| Accrued warranty | 91 |

| Accrued expenses | 552 |

| Total current liabilities | 2,232 |

| Long-term accrued warranty | 104 |

| Long-term accrued income taxes . | 4 |

| Other noncurrent liabilities | 130 |

| Long-term debt, less current portion | 4,253 |

| Total liabilities | 6,723 |

| Shareholders’ equity | |

| Ordinary shares— par value $0.0001, 2.6 billion shares authorized, 1,340,697,595 and | |

| 1,354,218,154 shares issued and outstanding, respectively | 0 |

| Additional paid-in capital | 6,545 |

| Accumulated other comprehensive loss | (34) |

| Accumulated deficit | (4,349) |

| Total shareholders’ equity | 2,162 |

| Total liabilities and shareholders’ equity | $8,885 |

Forecast Seagate Technology’s 2020 income statement using the following forecast assumptions, which are expressed as a percentage of revenue unless otherwise indicated.

Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with _two decimal places_.

Note: Use negative signs with answers, when appropriate.

Forecast Seagate Technology’s 2020 balance sheet using the following forecast assumptions, which are expressed as a percentage of revenue unless otherwise indicated.

Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with _two decimal places_.

Note: Use negative signs with answers, when appropriate.

RELATED: (Solution) Module 12 Assignment – Cost of Capital Measures

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Question 3

Question text

Forecast the Statement of Cash Flows

Following are the income statement and balance sheet of Seagate Technology.

| SEAGATE TECHNOLOGY PLC Consolidated Statement of Income ($ millions) For Year Ended | June 2020 Forecasted | June 2019 Actual |

|---|---|---|

| Revenue | 10,910 | 10,390 |

| Cost of revenue | 7,833 | 7,458 |

| Product development | 1,036 | 991 |

| Marketing and administrative | 480 | 453 |

| Amortization of intangibles | 23 | 23 |

| Restructuring and other, net | 0 | (22) |

| Total operating expenses | 9,372 | 8,903 |

| Income from operations | 1,538 | 1,487 |

| Interest income | 84 | 84 |

| Interest expense | (224) | (224) |

| Other, net | 25 | 25 |

| Other expense, net | (115) | (115) |

| Income before income taxes | 1,423 | 1,372 |

| (Benefit) provision for income taxes | 299 | (640) |

| Net income | 1,124 | 2,012 |

| SEAGATE TECHNOLOGY PLCBalance Sheet ($ millions) | June 2020 Forecasted | June 2019 Actual |

|---|---|---|

| Current assets | ||

| Cash and cash equivalents | 2,935 | 2,220 |

| Accounts receivable, net | 1,036 | 989 |

| Inventories | 1,015 | 970 |

| Other current assets | 196 | 184 |

| Total current assets | 5,182 | 4,363 |

| Property, equipment and leasehold improvements, net | 1,971 | 1,869 |

| Goodwill | 1,237 | 1,237 |

| Other intangible assets, net | 88 | 111 |

| Deferred income taxes | 1,167 | 1,114 |

| Other assets, net | 196 | 191 |

| Total assets | 9,841 | 8,885 |

| Current liabilities | ||

| Accounts payable | 1,495 | $1,420 |

| Accrued employee compensation | 175 | 169 |

| Accrued warranty | 98 | 91 |

| Accrued expenses | 578 | 552 |

| Total current liabilities | 2,346 | 2,232 |

| Long-term accrued warranty | 109 | 104 |

| Long-term accrued income taxes . | 4 | 4 |

| Other noncurrent liabilities | 142 | 130 |

| Long-term debt, less current portion | 4,253 | 4,253 |

| Total liabilities | 6,854 | 6,723 |

| Shareholders’ equity | ||

| Ordinary shares— par value $0.0001, 2.6 billion shares authorized, 1,340,697,595 and | ||

| and1,354,218,154 shares issued and outstanding, respectively | 0 | 0 |

| Additional paid-in capital | 6,644 | 6,545 |

| Accumulated other comprehensive loss | (34) | (34) |

| Accumulated deficit | (3,623) | (4,349) |

| Total shareholders’ equity | 2,987 | 2,162 |

| Total liabilities and shareholders’ equity | 9,841 | 8,885 |

| CAPEX (Increase in gross Property and equipment)/Revenue | 5.8% |

| Depreciation expense | $633 |

| Dividends | $398 |

Refer to the Seagate Technology (STX) financial information above. Prepare a forecast of its FY2020 statement of cash flows.

Round all answers to the nearest whole number. Use negative signs with answers, when appropriate.

Question 4 – Analyzing Forecasting and Interpreting

Question text

Forecast Income Statement and Balance Sheet

Following are the income statement and balance sheet for Medtronic PLC.

Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places.

Use the following assumptions to prepare a forecast of the company’s income statement for fiscal year 2020.

Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with _two decimal places_.

Note: Use negative signs with answers, when appropriate.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Question 5 – Analyzing Forecasting and Interpreting

Question text

Forecast the Statement of Cash Flows

Following are the income statement and balance sheet for Medtronic PLC.

Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places.

| Medtronic PLC | |

|---|---|

| Consolidated Statement of Income | |

| $ millions, For Fiscal Year Ended | April 26, 2019 |

| Net sales | $30,557 |

| Costs and expenses | |

| Cost of products sold | 9,155 |

| Research and development expense | 2,330 |

| Selling, general, and administrative expense | 10,418 |

| Amortization of intangible assets | 1,764 |

| Restructuring charges, net | 198 |

| Certain litigation charges, net | 166 |

| Other operating expense, net | 258 |

| Operating profit | 6,268 |

| Other nonoperating income, net | (373) |

| Interest expense | 1,444 |

| Income before income taxes | 5,197 |

| Income tax provision | 547 |

| Net income | 4,650 |

| Net income loss attributable to noncontrolling interests | (19) |

| Net income attributable to Medtronic | $4,631 |

| Medtronic PLC | |

|---|---|

| Consolidated Balance Sheet | |

| $ millions | April 26, 2019 |

| Current assets | |

| Cash and cash equivalents | $4,393 |

| Investments | 5,455 |

| Accounts receivable, net | 6,222 |

| Inventories, net | 3,753 |

| Other current assets | 2,144 |

| Total current assets | 21,967 |

| Property, plant, and equipment, net | 4,675 |

| Goodwill | 39,959 |

| Other intangible assets, net | 20,560 |

| Tax assets | 1,519 |

| Other assets | 1,014 |

| Total assets | $89,694 |

| Current liabilities | |

| Current debt obligations | $838 |

| Accounts payable | 1,953 |

| Accrued compensation | 2,189 |

| Accrued income taxes | 567 |

| Other accrued expenses | 2,925 |

| Total current liabilities | 8,472 |

| Long-term debt | 24,486 |

| Accrued compensation and retirement benefits | 1,651 |

| Accrued income taxes | 2,838 |

| Deferred tax liabilities | 1,278 |

| Other liabilities | 757 |

| Total liabilities | 39,482 |

| Shareholders’ equity | |

| Ordinary shares | 0 |

| Additional paid-in capital | 26,532 |

| Retained earnings | 26,270 |

| Accumulated other comprehensive loss | (2,711) |

| Total shareholders’ equity | 50,091 |

| Noncontrolling interests | 121 |

| Total equity | 50,212 |

| Total liabilities and equity | $89,694 |

Prepare a forecast of the FY2020 statement of cash flows using the provided financial information and following assumptions.

Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with _two decimal places_.

Note: Use negative signs with answers, when appropriate.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Question 6 – Analyzing Forecasting and Interpreting

Question text

Projecting NOPAT and NOA Using Parsimonious Forecasting Method

Following are Logitech’s sales, net operating profit after tax (NOPAT), and net operating assets (NOA) for its fiscal year ended March 31, 2019 ($ thousands).

Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places.

| Financial information | |

|---|---|

| Net sales | $2,788,322 |

| Net operating profit after tax (NOPAT) | 211,362 |

| Net operating assets (NOA) | 571,823 |

Use the parsimonious method to forecast Logitech’s sales, NOPAT, and NOA for fiscal years ended March 31, 2020 through 2023 using the following assumptions.

Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with _two decimal places_.

Note: When completing the question in Excel, refer directly to the cells containing these assumptions, i.e., don’t type the NOPM number when making a calculation, refer to the cell.

Note: Use negative signs with answers, when appropriate.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10