MGMT 502-001 – Financial Accounting and Analysis Exam 1

Q1. A $16 credit to Revenue was posted as a $160 credit. By what amount is the Revenue account in error?

Multiple Choice

- $144 understated.

- $160 understated.

- $160 overstated.

- $144 overstated.

- $16 understated.

Q2. Doc’s Ribhouse had beginning equity of $53,500; net income of $23,000. The company has no other transactions impacting equity. Calculate the ending equity.

Multiple Choice

- $30,500.

- $(5,500).

- $76,500.

- $5,500.

- $101,500.

Q3. On December 1, Milton Company borrowed $330,000, at 9% annual interest, from the Tennessee National Bank. Interest is paid when the loan matures one year from the issue date. What is the adjusting entry for accruing interest that Milton would need to make on December 31, the calendar year-end?

Multiple Choice

- Debit Interest Expense, $2,475; credit Interest Payable, $2,475.

- Debit Interest Expense, $4,950; credit Interest Payable, $4,950.

- Debit Interest Payable, $2,475; credit Interest Expense, $2,475.

- Debit Interest Expense, $29,700; credit Interest Payable, $29,700.

- Debit Interest Expense, $2,475; credit Cash, $2,475.

Q4. Accrued expenses at the end of one accounting period result in cash payments in a future period.

True or false

Q.5 Identify the item below that would cause the trial balance to not balance?

Multiple Choice

- The cash payment of a $990 account payable was posted as a debit to Accounts Payable and a debit to Cash for $990.

- A $170 cash receipt for the performance of a service was not recorded at all.

- The purchase of office supplies on account for $3,255 was erroneously recorded in the journal as $2,355 debit to Office Supplies and $2,355 credit to Accounts Payable.

- The purchase of office equipment for $1,800 was posted as a debit to Office Supplies and a credit to Cash for $1,800.

- A $1,240 collection of an account receivable was erroneously posted as a debit to Accounts Receivable and a credit to Cash.

Q6. On November 1, Jasper Company loaned another company $240,000 at a 9% interest rate. The note receivable plus interest will not be collected until March 1 of the following year. The company’s annual accounting period ends on December 31. The amount of interest revenue that should be reported in the first year is:

Multiple Choice

- $8,100.

- $3,600.

- $19,900.

- $6,775.

- $0.

Q7. Saddleback Company paid off $46,000 of its accounts payable in cash. What would be the effects of this transaction on the accounting equation?

Multiple Choice

- Liabilities decrease $46,000; equity increases $46,000.

- Assets decrease $46,000; liabilities increase $46,000.

- Assets decrease $46,000; equity decreases $46,000.

- Assets increase $46,000; equity increases $46,000.

- Assets decrease $46,000; liabilities decrease $46,000.

Q8. Unearned revenue is a liability that is recorded when customers pay in advance for products or services.

True or False

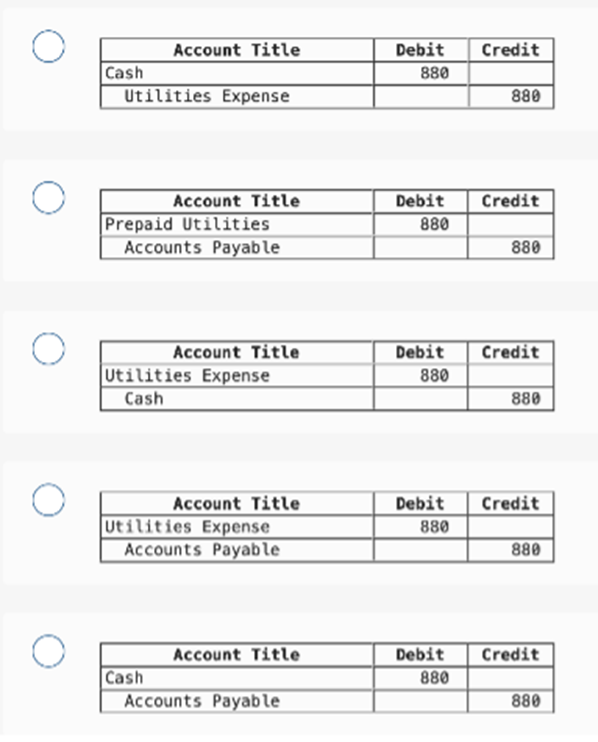

Q9. Jose Consulting paid $880 cash for utilities for the current month. Determine the general journal entry that Jose Consulting will make to record this transaction.

Multiple Choice

Q10. At the beginning of the year, Sigma Company’s balance sheet reported Total Assets of $348,000 and Total Liabilities of $26,900 and Common stock of $107,600. During the year, the company reported total revenues of $413,000 and expenses of $319,500. Also, dividends during the year totaled $82,000. Assuming no other changes to Retained earnings, the balance in the Retained earnings account at the end of the year would be:

Multiple Choice

- $219,000.

- $222,000.

- $304,000.

- $353,500.

- $225,000.

Q11. Identify which error will cause the trial balance to be out of balance.

Multiple Choice

- A $135 cash receipt from a customer in payment of her account posted as a $135 debit to Cash and a $135 credit to Cash.

- An $1,400 prepayment from a customer for services to be rendered in the future was posted as an $1,400 debit to Unearned Revenue and an $1,400 credit to Cash.

- A $220 cash receipt from a customer in payment of her account posted as a $220 debit to Cash and a $22 credit to Accounts Receivable.

- A $86 cash purchase of office supplies posted as a $86 debit to Office Equipment and a $86 credit to Cash.

- A $320 cash salary payment posted as a $320 debit to Cash and a $320 credit to Salaries Expense.

Q12. Expenses decrease equity

True or False

Q13. A company’s Office Supplies account shows a beginning balance of $700 and an ending balance of $600. If office supplies expense for the year is $3,600, what amount of office supplies was purchased during the period?

Multiple Choice

- $3,500.

- $4,300.

- $3,700.

- $3,000.

- $4,200

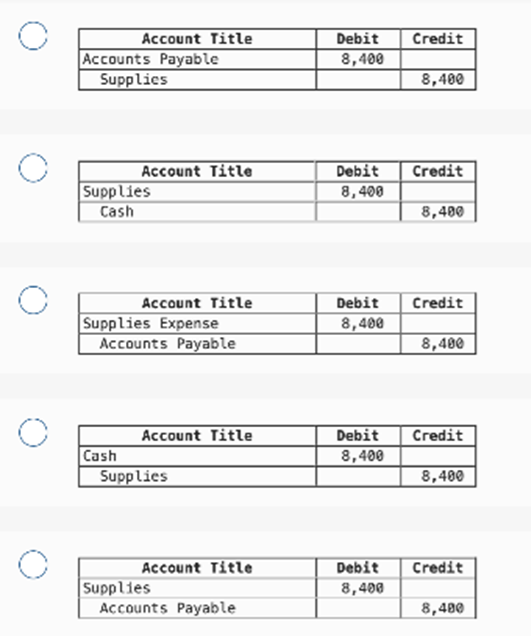

Q14. Specter Consulting purchased $8,400 of supplies and paid cash immediately. Which of the following general journal entries will Specter Consulting make to record this transaction?

Multiple Choice

.

Q15. Determine the net income of a company for which the following information is available for the month of September.

Service revenue $ 316,000

Rent expense 56,000

Utilities expense 4,000

Salaries expense 89,000

Multiple Choice

- $279,000.

- $260,000.

- $465,000,

- $171,000.

- $167,000.

Q16. At year-end, a trial balance showed total credits exceeding total debits by $5,400. This difference could have been caused by:

Multiple Choice

- A net income of $5,400.

- An error in the general journal where a $5,400 increase in Accounts Payable was mistakenly recorded as a decrease in Accounts Payable.

- The balance of $6,040 in the Office Equipment account being mistakenly entered on the trial balance as a debit of $640.

- The balance of $54,000 in Accounts Payable being mistakenly entered in the trial balance as $5,400.

- An error in the general journal where a $5,400 increase in Accounts Receivable was recorded as an increase in Cash.

Q17. Maintenance expense incurred increase Equity

True or False.

Q18. Any debit entry always increases an account

True or False.

Q19. The accounting equation can be restated as: Assets + Liabilities = Equity.

True or False

Q20. If a company purchases equipment costing $3,700 on credit, the effect on the accounting equation would be:

Multiple Choice

- Assets increase $3,700 and liabilities increase $3,700.

- One asset increases $3,700 and another asset decreases $3,700.

- Equity increases $3,700 and liabilities decrease $3,700.

- Assets increase $3,700 and liabilities decrease $3,700.

- Equity decreases $3,700 and liabilities increase $3,700.

Q21. Financing activities on the statement of cash flows include long-term borrowing and repaying of cash from lenders.

True or False

Solution

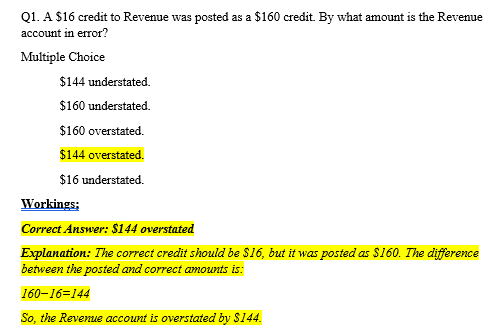

Q1: A $16 credit to Revenue was posted as a $160 credit. By what amount is the Revenue account in error?

Correct Answer: $144 overstated

Explanation: The correct entry was supposed to be a credit of $16, but $160 was credited instead. The difference between the correct amount and the wrong amount is:160−16=144160 – 16 = 144160−16=144

This means the Revenue account was overstated by $144.

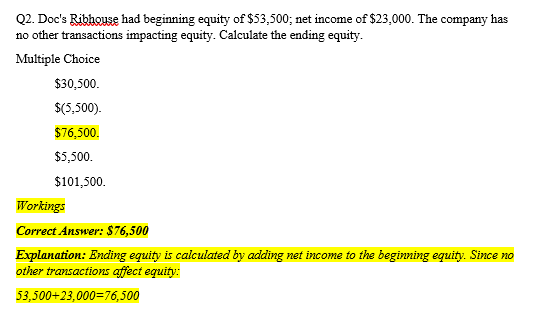

Q2: Doc’s Ribhouse had beginning equity of $53,500; net income of $23,000. The company has no other transactions impacting equity. Calculate the ending equity.

Correct Answer: $76,500

Explanation: The ending equity is calculated by adding the net income to the beginning equity. Since no other transactions affect equity:53,500+23,000=76,50053,500 + 23,000 = 76,50053,500+23,000=76,500

So, the ending equity is $76,500.

Please click on the Icon below to purchase the full answer at only $10