Jose LaGuardia mortgage loan

Question 1

Jose LaGuardia takes out a $200,000 mortgage loan from the Bears Credit Union. The terms are 15 years, 9 percent, and annual payments. The credit union decides to sell the loan at the end of Year 4 in a 12 percent market.

- What is the loan balance at the end of year 4?

- What amount will the credit union realize, assuming no prepayment is expected on the loan? (1 point)

- What is the dollar and percent discount for the loan in part b? (1 point)

- Assuming prepayment at the end of year 10 and sale of the loan at the end of year 4, at what price is the loan likely to sell? (2 points)

- Irena James buys the loan at the end of year 4 for $140,000. Assuming that it is not prepaid, what yield (IRR) should she realize?

- Irena James buys the loan at the end of year 4 for $140,000. Assuming that it will be prepaid at the end of year 10, what yield (IRR) should be realized?

Question 2

How many months does it take to amortize a loan with an outstanding loan balance of $135,895, monthly payments of $1,245, and an interest rate of 10 percent?

Question 3

What is the outstanding loan balance at the end of year 15 on a 30-year, $750,000 loan at 8 percent with monthly amortization?

Related – (Solution) Equity multiple for Cash Flow at Stabilization

Solution

Question 1: Jose LaGuardia Mortgage Loan

Given:

- Loan Amount: $200,000

- Interest Rate: 9% annually

- Term: 15 years

- Annual Payments

a) Loan Balance at the End of Year 4

Step 1: Calculate Annual Payment

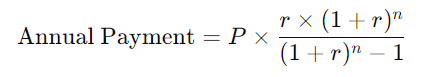

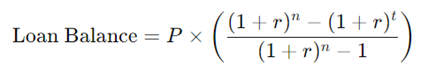

Formula:

P = 200,000 (loan amount)

R = 0.09 (annual interest rate)

N = 15 years

Substituting the values:

Step 2: Calculate Loan Balance at End of Year 4

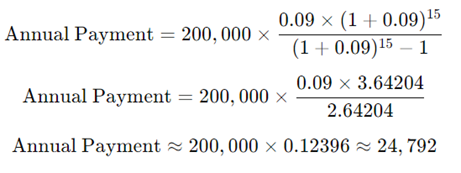

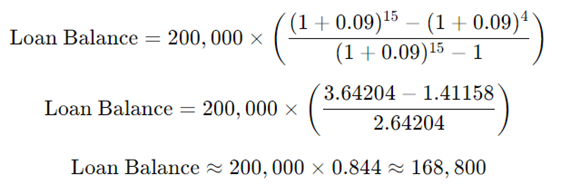

Formula:

P = 200,000

r = 0.09

n=15

t=4

Substituting the values:

Correct Answer: $168,800

… Please click on the Icon below to purchase the full answer at only $10