MGMT 648: APPLIED FINANCE Clarkson Lumber Assignment 1

Clarkson Lumber Company

Each team is to prepare a written analysis of the case (maximum of 2 pages text). You may also include any additional charts, figures, or spreadsheet excerpts as appropriate. You need to upload two files to Canvas by the start of class: (1) your written analysis in PDF form and (2) your underlying Excel model. I will primarily rely on the written analysis (PDF) for grading, so please make sure that your assumptions and workings are clear.

The purpose of this case is to ascertain why the Clarkson Lumber Company is so strapped for cash even though it has a strong record of profitability – and to help determine the difference between profits and cash requirements. Also, we need to help determine Mr. Clarkson’s loan requirements given his financial conditions – and when he can repay the loan. Finally, we will explore the wisdom of rapidly expanding a business despite heavy financial pressure. Overall, this case is an excellent treatment of elementary financial analysis, financial statement forecasting, and management of working capital.

Key questions and concepts that your team should address:

- Why has Clarkson Lumber Company borrowed increasing amounts despite its consistent profitability?

- How has Mr. Clarkson met the financing needs of the company during the period 1993 through 1995? Has the financial strength of Clarkson Lumber improved or deteriorated?

- How attractive is it to take the trade discount?

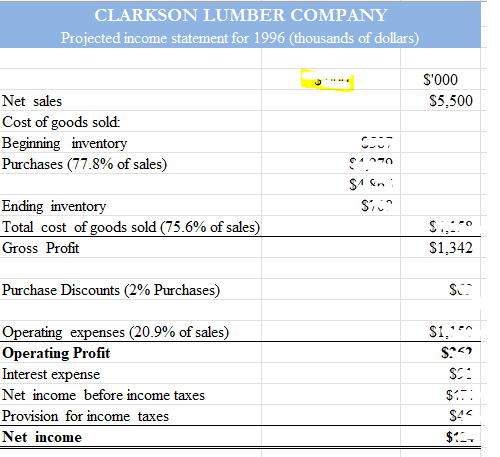

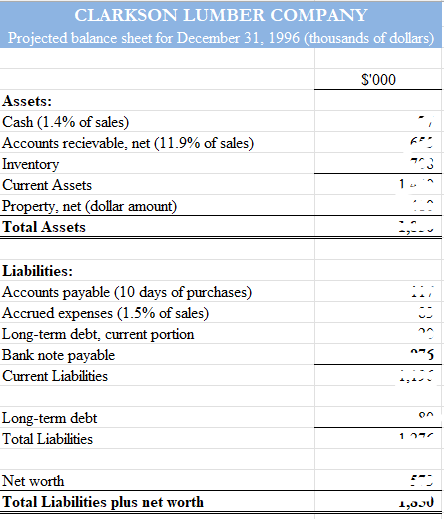

- Do you agree with Mr. Clarkson’s estimate of the company’s loan requirements? How much will he need to finance the expected expansion in sales to $5.5 million in 1996 and take all the trade discounts?

- What is the “plug” in your financial model? Why did you choose this variable as the plug? Describe in a few sentences and/ or equations how you implemented the plug.

- As Mr. Clarkson’s financial advisor, would you urge him to go ahead with, or to reconsider, his anticipated expansion and his plan for additional debt financing? As the banker, would you approve Mr. Clarkson’s loan request, and, if so, what condition would you put on the loan?

Spreadsheet Model

As part of your case report, build a spreadsheet model that summarizes all of the relevant financial information. Your spreadsheet model should be well-organized, clear, and concise. In your pro-forma spreadsheet, you can combine ‘Notes payable, Trade’ and ‘Accounts Payable’ into one item. This item should reflect the amount payable to suppliers after taking all trade discounts in Question 4, above.

Related: (Solution) MGMT 648 Applied Finance Week 1 Assignment

Solution

Why has Clarkson Lumber Company borrowed increasing amounts despite its consistent profitability?

Clarkson Lumber has borrowed increasing amounts primarily due to its rapid growth, which has required additional working capital to support higher sales volumes. While the company has been consistently profitable, with after-tax net income increasing from $60,000 in 1993 to $77,000 in 1995, this profitability hasn’t translated into sufficient cash flow to fund its expansion. The increase in accounts receivable (from $306,000 in 1993 to $606,000 in 1995) and inventory (from $337,000 in 1993 to $587,000 in 1995) has tied up cash that could otherwise be used to reduce borrowing. Additionally, Mr. Clarkson bought out his partner in 1994, which further strained cash flow by adding debt to finance the buyout. Thus, despite profitability, the increasing working capital needs have outpaced internal cash generation, necessitating external financing.

How has Mr. Clarkson met the financing needs of the company during the period 1993 through 1995? Has the financial strength of Clarkson Lumber improved or deteriorated?

From 1993 to 1995, Mr. Clarkson met the company’s financing needs through a combination of increased bank borrowing and extended trade credit. Bank loans rose from $60,000 in 1994 to $390,000 by the end of 1995. Additionally, Clarkson extended payment terms with suppliers, taking advantage of trade credit rather than paying within the discount period, as seen in the rise of accounts payable from $213,000 in 1993 to $376,000 in 1995.

Financial strength has deteriorated during this period. Key indicators of financial health, such as the debt-to-equity ratio, have worsened. In 1993, total liabilities were $415,000 against a net worth of $504,000, resulting in a debt-to-equity ratio of 0.82. By 1995, liabilities had grown to $1.188 million against net worth of $449,000, pushing the debt-to-equity ratio to 2.65. This increased leverage indicates heightened financial risk, as the company has become more dependent on debt to finance its operations…..Please click on the Icon below to purchase the full answer at only $10 both Excel File and Word Document