NOA Multiple and PB Multiplier

Question 1

Correct

Mark 6.00 out of 6.00

Question text

Valuation Using Price-to-NOA Multiple

The following table provides summary data for Cerner Corporation (CERN) and its competitors, Allscripts Healthcare Solutions Inc. (MDRX) and McKesson Corporation (MCK).

| (in millions) | CERN | MDRX | MCK |

|---|---|---|---|

| Company assumed value | — | $2,063 | $21,063 |

| Equity assumed value | — | $1,607 | $19,962 |

| Net operating assets | $4,296 | $2,007 | $ 9,195 |

| Book value of equity | $4,928 | $1,551 | $ 8,094 |

| Net nonoperating obligations (assets) | $(632) | $456 | $ 1,101 |

| Common shares outstanding | 318.4 shares | 166.7 shares | 184.9 shares |

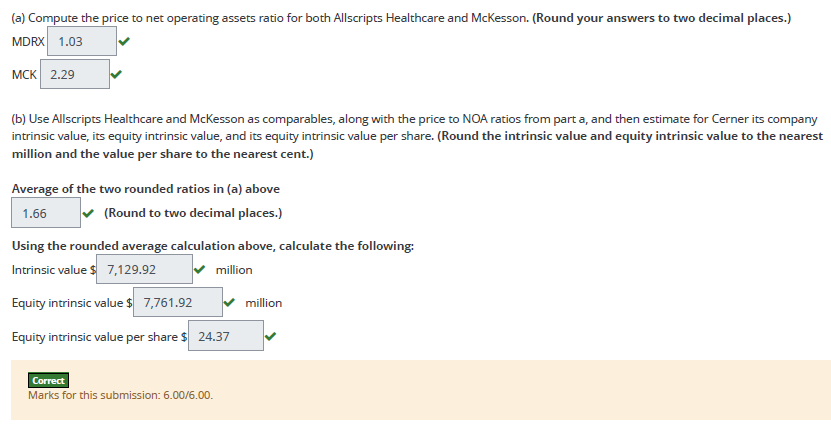

(a) Compute the price to net operating assets ratio for both Allscripts Healthcare and McKesson. (Round your answers to two decimal places.)

(b) Use Allscripts Healthcare and McKesson as comparables, along with the price to NOA ratios from part a, and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.)

Solution and Feedback

Correct

Marks for this submission: 6.00/6.00.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $15

Question 2

Correct

Mark 5.00 out of 5.00

Question text

Valuation Using the PB Multiple

The following table provides summary data for Cerner Corporation (CERN) and its competitors, Allscripts Healthcare Solutions Inc. (MDRX) and McKesson Corporation (MCK).

| (in millions) | CERN | MDRX | MCK |

|---|---|---|---|

| Company assumed value | — | $2,063 | $21,063 |

| Equity assumed value | — | $1,607 | $19,962 |

| Net operating assets | $4,296 | $2,007 | $ 9,195 |

| Book value of equity | $4,928 | $1,551 | $ 8,094 |

| Net nonoperating obligations (assets) | $(632) | $456 | $ 1,101 |

| Common shares outstanding | 318.4 shares | 166.7 shares | 184.9 shares |

(a) Compute the PB ratio for both Allscripts Healthcare and McKesson. (Round your answers to two decimal places.)

(b) Use Allscripts Healthcare and McKesson as comparables, along with the PB ratios from part a, and then estimate for Cerner its equity intrinsic value and its equity intrinsic value per share. (Round the equity intrinsic value to the nearest million and the value per share to the nearest cent.)

Feedback

Correct

Marks for this submission: 5.00/5.00.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $15

Question 3

Correct

Mark 3.00 out of 3.00

Question text

Identifying Comparables and Valuation using PB and PE

Tailored Brands Inc.’s book value of equity is $4.563 million and its forward earnings estimate per share is $1.10, or $55.7 million in total earnings. The following information is also available for TLRD and a peer group of companies (identified by ticker symbol) from the specialty retail sector.

| Ticker | Market Cap($ mil.) | PB Current | Forward PE (FY1) | EPS 5-Year Historical Growth Rate | ROE (T 4Q) | Debt-to- Equity (Prior Year) |

|---|---|---|---|---|---|---|

| TLRD | — | — | — | (0.47)% | 22.50% | 2.53 |

| GCO | 585.7 | 1.00 | 9.699 | (323.73)% | (5.86)% | 0.13 |

| ZUMZ | 789.7 | 1.95 | 14.17 | 3.28% | 13.85% | 0.00 |

| GES | 1,147.0 | 2.07 | 13.19 | (37.69)% | 1.90% | 0.56 |

| ANF | 988.2 | 1.00 | 19.69 | 9.37% | 6.35% | 0.25 |

| TLYS | 293.7 | 1.68 | 11.6 | 5.51% | 13.93% | 0.00 |

| M | 4,760.0 | 0.75 | 5.458 | (1.74)% | 16.70% | 0.74 |

(a) Identify a set of three companies from this list to use as comparables for estimating the equity intrinsic value of TLRD using the market multiples approach.

(b) Assume that you use as comparables the following set of companies: ZUMZ, TLYS, and M. Estimate TLRD’s equity intrinsic value using the PB ratio from these peer companies. (Round average PB ratio to two decimal places for your calculation. Round your answer to the nearest million.)

(c) Use the same comparables as in part b and estimate TLRD’s equity intrinsic value using the PE ratio from these peer companies. (Round average PE ratio to two decimal places for your calculation. Round your answer to the nearest million.)

Feedback

Correct

Marks for this submission: 3.00/3.00.

Question 4

Correct

Mark 1.00 out of 1.00

Question text

Determining ROE to Yield Projected PB

Alphabet Inc., formerly Google Inc. recently had a market cap of $852.83 billion, total equity of $192.19 billion, and 693.4 million shares outstanding. At about the same time, the PB of Facebook and eBay Inc. were 6.11 and 8.245, respectively. Assume that we desire a minimum 10% annual return on our investments, and that we believe Alphabet will sell at 6.0 times book value five years from now. What must Alphabet earn (ROE) on average over the next 5 years to make it a worthwhile investment? (Assume that Alphabet pays no dividends.)

Do not round until your final answer. Round final answer to one decimal place (ex: 0.2345 =23.5%).

Feedback

Correct

Marks for this submission: 1.00/1.00.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $15

Question 5

Correct

Mark 11.00 out of 11.00

Question text

Valuation Using Price-to-NOA Multiple and PB Multiple

The following table provides summary data for Target Corp. and its competitors, Kohl’s Corp. and Walmart Stores Inc.

| (in millions) | Target | Kohl’s | Wal-Mart |

|---|---|---|---|

| Company assumed value | — | $13,487 | $322,123 |

| Equity assumed value | — | $10,922 | $272,541 |

| Net operating assets | $22,640 | $8,092 | $122,082 |

| Book value of equity | $11,300 | $5,527 | $ 72,500 |

| Net nonoperating obligations (assets) | $11,340 | $2,565 | $49,582 |

| Common shares outstanding | 510.9 shares | 159.0 shares | 2,844.0 shares |

(a) Compute the price to net operating assets ratio for both Kohl’s and Wal-Mart.

Round your answers to two decimal places.

(b) Use Kohl’s and Walmart as comparables, along with the price to NOA ratios from part a, and then estimate for Target its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share.

Round company intrinsic value and equity intrinsic value to the nearest million. Round equity intrinsic value to the nearest cent.

(c) Compute the PB ratio for both Kohl’s and Wal-Mart.

Round your answers to two decimal places.

(d) Use Kohl’s and Wal-Mart as comparables, along with the PB ratios from part (c), and then estimate for Target its equity intrinsic value and its equity intrinsic value per share.

Round the equity intrinsic value to the nearest million and the value per share to the nearest cent.

Feedback

Correct

Marks for this submission: 11.00/11.00.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $15

Question 6

Correct

Mark 11.00 out of 11.00

Question text

Valuation Using Income Statement Multiples

The following table provides summary data for Target and its competitors, Kohl’s and Wal-Mart.

| (in millions) | Target | Kohl’s | Wal-Mart |

|---|---|---|---|

| Company assumed value | — | $13,487 | $322,123 |

| Equity assumed value | — | $10,922 | $272,541 |

| NOPAT | $3,260 | $980 | $8,312 |

| Net income | $2,937 | $801 | $6,670 |

| Net nonoperating obligations (assets) | $11,340 | $2,565 | $49,582 |

| Common shares outstanding | 510.9 shares | 159.0 shares | 2,844.0 shares |

(a) Compute the price to NOPAT ratio for both Kohl’s and Wal-Mart.

Round your answers to two decimal places.

(b) Use Kohl’s and Wal-Mart as comparables, along with the company value to NOPAT ratios from part (a), and then estimate for Target its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share.

Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.

(c) Compute the price to net income ratio for both Kohl’s and Wal-Mart.

Round your answers to two decimal places.

(d) Use Kohl’s and Wal-Mart as comparables, along with the equity to net income ratios from part (c), and then estimate for Target its equity intrinsic value and its equity intrinsic value per share.

Round the equity intrinsic value to the nearest million and the value per share to the nearest cent.

Feedback

Correct

Marks for this submission: 11.00/11.00.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $15