The following information is available for Shanika Company for 20Y6:

| Inventories | 1-Jan | 31-Dec |

| Materials | $374,190 | $471,480 |

| Work in process | 673,540 | 641,210 |

| Finished goods | 647,350 | 655,360 |

| Advertising expense | $320,130 | |

| Depreciation expense-office equipment | 45,260 | |

| Depreciation expense-factory equipment | 60,820 | |

| Direct labor | 726,080 | |

| Heat, light, and power-factory | 24,050 | |

| Indirect labor | 84,870 | |

| Materials purchased | 711,930 | |

| Office salaries expense | 248,470 | |

| Property taxes-factory | 19,800 | |

| Property taxes-headquarters building | 41,020 | |

| Rent expense-factory | 33,480 | |

| Sales | 3,333,360 | |

| Sales salaries expense | 409,240 | |

| Supplies-factory | 16,500 | |

| Miscellaneous costs-factory | 10,370 |

Required:

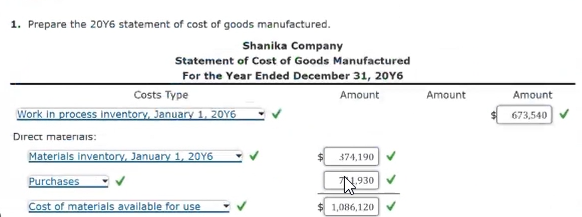

1. Prepare the 20Y6 statement of cost of goods manufactured.

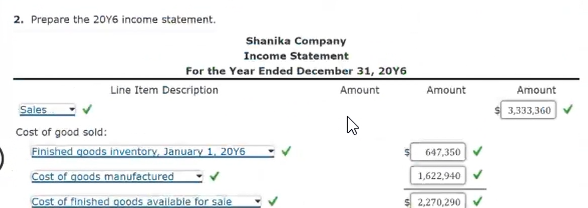

2. Prepare the 20Y6 income statement.

Solution

In the attached excel solution we solve the questions using formula. It is easy to follow and can be adopted to any set of numbers. All you need is to put in the numbers provided in your question.

…Please click on the Icon below to purchase the FULL CORRECT ANSWERS at only $5

…Please click on the Icon below to purchase the FULL CORRECT ANSWERS at only $5