Crane Water Co. is a leading producer of greenhouse

Crane Water Co. is a leading producer of greenhouse irrigation systems. Currently, the company manufactures the timer unit used in each of its systems. Based on an annual production of 40,500 timers, the company has calculated the following unit costs.

| Cost Type | Amount ($) |

|---|

| Direct Materials | 11 |

| Direct Labor | 6 |

| Variable Manufacturing Overhead | 3 |

| Direct Fixed Manufacturing Overhead | 8 | 30% salaries, 70% depreciation |

| Allocated Fixed Manufacturing Overhead | 10 |

| Total Unit Cost | 38 |

Clifton Clocks has offered to provide the timer units to Crane at a price of $36 per unit. If Crane accepts the offer, the current timer unit supervisory and clerical staff will be laid off.

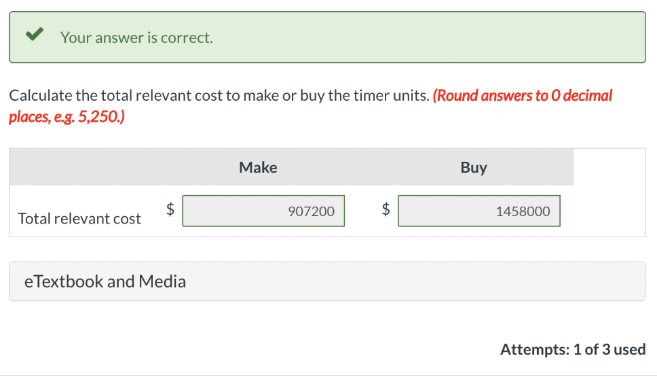

a1. Calculate the total relevant cost to make or buy the timer units. (Round answers to 0 decimal places, e.g. 5,250.)

a2. Assuming that Crane Water has no other use for either the facilities or the equipment currently used to manufacture the timer units, should the company accept Clifton’s offer?

b1. Assume that if Crane Water accepts Clifton’s offer, the company can use the freed-up manufacturing facilities to manufacture a new line of growing lights. The company estimates it can sell 94,550 of the new lights each year at a price of $10. Variable costs of the lights are expected to be $7 per unit. The timer unit supervisory and clerical staff would be transferred to this new product line. Calculate the total relevant cost to make the timer units and the net cost if they accept Clifton’s offer.

Solution

Relevant costs are those costs and revenues that differ across alternatives. Irrelevant costs do not differ between alternatives. When making decisions, we only consider the relevant costs.

For Crane Water Co.’s decision of whether to make or buy timer units, the relevant costs are those that will change if the company chooses to buy the units from Clifton Clocks instead of manufacturing them in-house. These include:

- Direct Materials ($11 per unit): This cost will be eliminated if Crane stops making the timers.

- Direct Labor ($6 per unit): This cost will also be eliminated if Crane buys the timers.

- Variable Manufacturing Overhead ($3 per unit): This cost is directly tied to production and will be saved if production stops.

…Please click on the Icon below to purchase the FULL ANSWER at only $1.99