Cost of Acquisition Questions

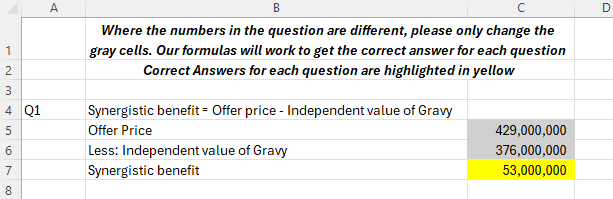

Question 1 – Biscuits Inc. has offered $429 million cash for all of the common stock in Gravy Corporation

Biscuits Inc. has offered $429 million cash for all of the common stock in Gravy Corporation. Based on recent market information, Gravy is worth $376 million as an independent operation.

If the merger makes econòmic sense for Biscuits, what is the minimum estimated value of the synergistic benefits from the merger? (Round answer to the nearest whole number)

Topic: Gains from Acquisition

Solution

Synergistic benefit = Offer price – Independent value of Gravy

Correct Answer = 53,000,000

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 2 – Penn Corp. is analyzing the possible acquisition of Teller Company.

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total after-tax annual cash flows by $1.7 million indefinitely. The current market value of Teller is $46 million, and the market value of Penn is $88 million. The appropriate discount rate for the incremental cash flows is 10%. Penn is trying to decide whether it should offer 40% of its stock or $67 million in cash to Teller’s shareholders.

What is the cost associated with the cash offer? (Round answer to the nearest whole number)

Topic: Cost of Acquisition

Solution

The Cost associated with cash offer is amount of the cash offer amount

Correct Answer = 67,000,000

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 3 – What is the cost associated with the equity offer?

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total after-tax annual cash flows by $2.1 million indefinitely. The current market value of Teller is $48 million, and the market value of Penn is $83 million. The appropriate discount rate for the incremental cash flows is 10%. Penn is trying to decide whether it should offer 40% of its stock or $64 million in cash to Teller’s shareholders.

What is the cost associated with the equity offer? (Round answer to the nearest whole number)

Topic: Cost of Acquisition

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 4 – What is the NPV using the cash offer?

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total after-tax annual cash flows by $1.3 million indefinitely. The current market value of Teller is $46 million, and the market value of Penn is $87 million. The appropriate discount rate for the incremental cash flows is 10%. Penn is trying to decide whether it should offer 40% of its stock or $62 million in cash to Teller’s shareholders.

What is the NPV using the cash offer? (Round answer to the nearest whole number)

Topic: Cost of Acquisition

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 5 – What is the NPV using the equity offer? Topic: Cost of Acquisition

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total after-tax annual cash flows by $2.4 million indefinitely. The current market value of Teller is $41 million, and the market value of Penn is $86 million. The appropriate discount rate for the incremental cash flows is 10%. Penn is trying to decide whether it should offer 40% of its stock or $61 million in cash to Teller’s shareholders.

What is the NPV using the equity offer? (Round answer to the nearest whole number)

Topic: Cost of Acquisition

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 6 – Bidding firm (Firm B) has 5,219 shares outstanding that are currently selling at $44 per share

Bidding firm (Firm B) has 5,219 shares outstanding that are currently selling at $44 per share. Target firm (Firm T) has 1,436 shares outstanding that are currently selling at $16 per share. Assume that both firms have no debt outstanding. Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $8,771.

If Firm T is willing to be acquired for $21 per share in cash, what is the NPV of the merger? (Round answer to 2 decimal places. Do not round intermediate calculations) Topic: Cost of Acquisition

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 7 – what will be the price per share of the merged firm?

Bidding firm (Firm B) has 5,740 shares outstanding that are currently selling at $46 per share. Target firm (Firm T) has 1,872 shares outstanding that are currently selling at $17 per share. Assume that both firms have no debt outstanding. Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $8,364.

If firm T is willing to be acquired for $21 per share in cash, what will be the price per share of the merged firm? (Round answer to 2 decimal places. Do not round intermediate calculations) Topic: Cost of Acquisition

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 8 – If firm T is willing to be acquired for $21 per share in cash, what is the merger premium?

Bidding firm (Firm B) has 5,875 shares outstanding that are currently selling at $43 per share. Target firm (Firm T) has 1,563 shares outstanding that are currently selling at $15 per share. Assume that both firms have no debt outstanding. Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $8,899.

If firm T is willing to be acquired for $21 per share in cash, what is the merger premium? (Round answer to 2 decimal places. Do not round intermediate calculations)

Topic: Cost of Acquisition

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 9 – If B offers three of its shares for every five of T’s shares, what will be the price per share of the merged firm?

Bidding firm (Firm B) has 5,659 shares outstanding that are currently selling at $47 per share. Target firm (Firm T) has 1,731 shares outstanding that are currently selling at $17 per share. Assume that both firms have no debt outstanding. Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $8,827.

Suppose Firm T is agreeable to a merger by an exchange of stock. If B offers three of its shares for every five of T’s shares, what will be the price per share of the merged firm? (Round answer to 2 decimal places. Do not round intermediate calculations)

Topic: Cost of Acquisition

…Please click on the Icon below to purchase the FULL ANSWER WITH FORMULAS IN EXCEL at only $10

Question 10 – If B offers three of its shares for every five of T’s shares, what is the NPV of the merger?

Bidding firm (Firm B) has 5,704 shares outstanding that are currently selling at $42 per share. Target firm (Firm T) has 1,649 shares outstanding that are currently selling at $19 per share. Assume that both firms have no debt outstanding. Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $8,614.

Suppose Firm T is agreeable to a merger by an exchange of stock. If B offers three of its shares for every five of T’s shares, what is the NPV of the merger? (Round answer to 2 decimal places. Do not round intermediate calculations)

Topic: Cost of Acquisition