WACC AND FLOTATION COSTS HOMEWORK + CORRECT ANSWERS

Question 1 – Tarrasa Mining Corporation has 11.2 million shares of common stock outstanding

Tarrasa Mining Corporation has 11.2 million shares of common stock outstanding and 205,000 5.9% semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $37 per share and has a beta of 0.8. The bonds have 12 years to maturity and sell for 91% of par. The market risk premium is 5.5%, T-bills are yielding 4%, and Tarrasa Mining’s tax rate is 30%.

What is the firm’s market value weight of equity?

What is the firm’s market value weight of debt?

What is the firm’s cost of equity?

What is the firm’s cost of debt?

If Tarrasa Mining is evaluating a new investment project that has the same risk as the firm’s typical project, what rate should the firm use to discount the project’s cash flows?

Solution

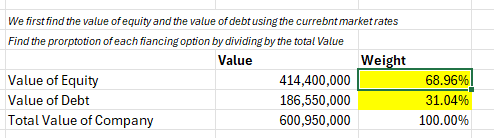

Step 1: We first find the value of equity and the value of debt using the current market rates

Step 2: Find the proportion of each financing option by dividing by the total Value

Correct Answer

What is the firm’s market value weight of equity? 68.96%

Correct Answer

What is the firm’s market value weight of debt? 31.04%

…Please click on the Icon below to purchase the FULL QUIZ ANSWERS IN EXCEL at only $10

See also: Lesson 8 Excel Project – Capital Budgeting – The Coca-Cola Company (KO)

Question – Fletcher Manufacturing has 8.3 million shares of common stock outstanding.

Fletcher Manufacturing has 8.3 million shares of common stock outstanding. The current share price is $41 and the book value per share is $7. Fletcher Manufacturing also has two bond issues outstanding. The first bond issue has a total face value of $65 million, a coupon rate of 7.5%, and sells for 99% of par. The second issue has a face value of $45 million, a coupon rate of 6.9%, and sells for 96% of par. The first issue matures in 14 years, the second in 8 years. Suppose the company’s stock has a beta of 1.4. The risk-free rate is 3.8% and the market risk premium is 7.8%. Assume that the overall cost of debt is the weighted average implied by the two outstanding debt issues. Both bonds make semi-annual payments. The tax rate is 40%

What is the firm’s market value weight of equity?

What is the firm’s market value weight of debt?

What is the firm’s cost of equity?

What is the firm’s cost of debt?

What is the firm’s WACC? (Report answer in percentage terms and round to 2 decimal places. Do not round intermediate calculations. When using previous answers, use the rounded answer as it was given in the answer box).

Solution

To solve this question, we will follow these two steps

…Please click on the Icon below to purchase the FULL QUIZ ANSWERS IN EXCEL at only $10

Question 3 – Maverick Manufacturing has a target debt-equity ratio of 0.49

Maverick Manufacturing has a target debt-equity ratio of 0.49. Its cost of equity is 12%, and its cost of debt is 8 %.

If the tax rate is 31%, what is Maverick’s WACC?

Solution

To solve this question, we will follow these two steps

…Please click on the Icon below to purchase the FULL QUIZ ANSWERS IN EXCEL at only 10

Question 4 – Garnet, Inc., has a target debt-equity ratio of 0.65. Its WACC is 11.9 %

Garnet, Inc., has a target debt-equity ratio of 0.65. Its WACC is 11.9 %, and the tax rate is 38 %

If Garnet’s cost of equity is 14%, what is its pretax cost of debt? (Report answer in percentage terms and round to 2 decimal places. Do not round intermediate calculations).

Solution

To solve this question, we will follow these two steps

…Please click on the Icon below to purchase the FULL QUIZ ANSWERS IN EXCEL at only $10

Question 5 – Garnet, Inc., has a target debt-equity ratio of 0.36. Its WACC is 11.8%,

Garnet, Inc., has a target debt-equity ratio of 0.36. Its WACC is 11.8%, and the tax rate is 38 %

If you know that the after-tax cost of debt is 6.3%, what is the cost of equity? (Report answer in percentage terms and round to 2 decimal places. Do not round intermediate calculations).

Solution

To solve this question, we will follow these two steps

…Please click on the Icon below to purchase the FULL QUIZ ANSWERS IN EXCEL at only $10

Question 6 – Gold Alliance Company needs to raise $54 million to start a new project.

Gold Alliance Company needs to raise $54 million to start a new project. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 65% common stock, 5% preferred stock, and 30% debt. Flotation costs for issuing new common stock are 8%, for new preferred stock, 5 %, and for new debt, 2 %.

What is the company’s weighted average floatation costs? (Report answer in percentage terms and round to 2 decimal places. Do not round intermediate calculations) Topic: Floatation Costs

Solution

To solve this question, we will follow these two steps

…Please click on the Icon below to purchase the FULL QUIZ ANSWERS IN EXCEL at only $10

Question 7 – Gold Alliance Company needs to raise $57 million to start a new project. The company

Gold Alliance Company needs to raise $57 million to start a new project. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 65% common stock, 5% preferred stock, and 30% debt. Flotation costs for issuing new common stock are 7%, for new preferred stock, 5 %, and for new debt, 3%.

What is the initial cost figure Gold should use when evaluating its project? (Round answer to 2 decimal places. Do not round intermediate calculations).

Solution

To solve this question, we will follow these two steps

…Please click on the Icon below to purchase the FULL QUIZ ANSWERS IN EXCEL at only $10