Excel Analytics Excel Analytics Ozuna Company uses job-order costing

Excel Analytics 02-02 (Static) Job-Order Costing; Plantwide Predetermined Overhead Rates [LO2-1, LO2- 2, LO2-3]

Ozuna Company uses a job-order costing system with a plantwide predetermined overhead rate based on direct labor- hours. For job costing purposes, it uses an average direct labor wage rate of $20 per hour. The company has been struggling financially; accordingly, it has asked you to conduct a job profitability study beginning with a thorough critique of its existing cost system. To keep the scope of your project manageable, you have chosen a subset of 12 jobs from the many jobs completed by the company during the year. Your goal is to complete the table shown below and comment on the insights that it provides:

- Refer to the workbook titled “ExcelAnalytics_JobOrderCosting_Plantwide Predetermined Overhead Rates_Template”

Navigate to the “Estimated MOH” tab of this workbook.

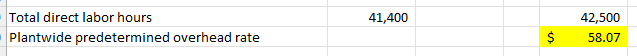

a. Within the “Estimated MOH” tab, create a formula in cell E40 that calculates a plantwide predetermined overhead rate this year. b. What is the plantwide predetermined overhead rate for this year?

The plantwide predetermined overhead rate is $ 58.07

…Please click on the Icon below to purchase the FULL ANSWER at only $10

- Refer to the workbook titled “ExcelAnalytics_JobOrderCosting_Plantwide Predeterned Overhead Rates_Template” Navigate to the “Job Profitability” tab of this workbook.

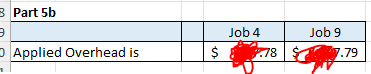

a. Using formulas that refer to your answers from requirements 1-4, calculate the direct materials, direct labor, and applied overhead cost for each of the 12 jobs. (Hint: Use VLOOKUP to reference values from the pivot tables you created in requirements 1 and 2.) b. What is the amount of applied overhead for Jobs 4 and 9?

Save your work in Excel, then enter your answer to requirement 5b below.

The applied overhead is

What is the amount of applied overhead for Jobs 4 and 9?

…Please click on the Icon below to purchase the FULL ANSWER at only $10

- Refer to the workbook titled “ExcelAnalytics_JobOrderCosting_Plantwide Predetermined Overhead Rates_Template”

Navigate to the “Job Profitability” tab of this workbook.

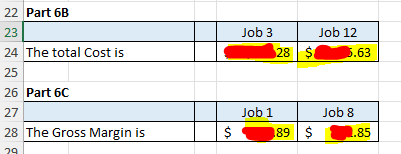

a. Within the “Job Profitability” tab, create formulas that compute the total job cost and gross margin for each of the 12 jobs. b. What is the total cost of Jobs 3 and 12?

c. What is the gross margin Jobs 1 and 8?

What is the total cost of Jobs 3 and 12?

…Please click on the Icon below to purchase the FULL ANSWER at only $10

- Refer to the workbook titled “ExcelAnalytics_JobOrderCosting Plantwide Predetermined Overhead Rates_Template”

Navigate to the “Waterfall Chart” tab of this workbook.

a. According to the chart, which jobs have the highest and lowest gross margins?

The job with the highest gross margin is job number The job with the lowest gross margin is job number

b. According to the chart, which of the following statements are true (you may select more than one answer).

The eight most profitable jobs produced a gross margin slightly above $4,000.

A total of four jobs decreased the company’s overall gross margin.

Jobs 8 and 2 both decreased the total gross margin.

The company’s total gross margin for the 12 jobs included in the chart is less than $2,500

- Refer to the workbook titled “ExcelAnalytics_JobOrderCosting Plantwide Predetermined Overhead Rates_Template”

Navigate to the “Combo Chart” tab of this workbook.

a. According to the chart, which jobs have the lowest and highest labor intensity percentages?

The job with the lowest labor intensity percentage is

The job with the highest labor intensity percentage is

b. According to the chart, which of the following statements are true regarding the company’s existing cost system (you may select more than one correct answer)?

The 12 jobs depicted in the combo chart suggest that gross margin and labor intensity percentage tend to have an inverse relationship.

The 12 jobs depicted in the combo chart suggest that gross margin and labor intensity percentage tend to move in tandem because they are correlated with one another.

The existing cost system is most likely undercosting labor intensive products.

The existing cost system is most likely overcosting labor intensive products.

…Please click on the Icon below to purchase the FULL ANSWER at only $10