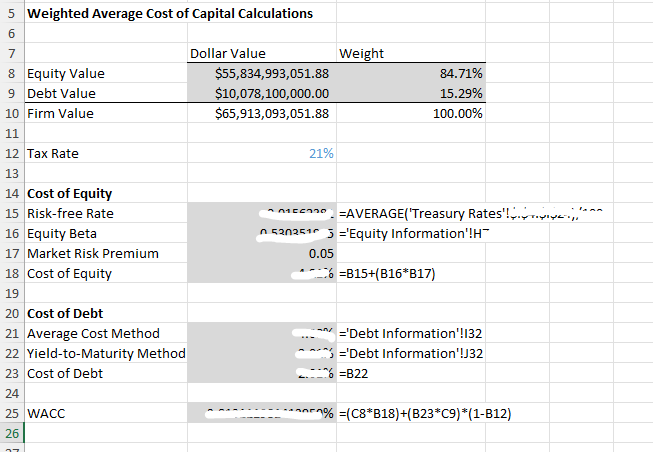

WACC for Target as of January 2020

Key assumptions

Market risk premium of 5%, tax rate of 21% The spreadsheet template includes financial data on the (1) January 2020 treasury curve, (2) Target’s income statement, (3) Target’s balance sheet, (4) Target’s recent equity returns and January 2020 market capitalization, and (5) Target’s debt structure and credit rating. a) Compute the equity beta for Target using the recent returns. b) Compute the cost of equity using CAPM. c) Compute the cost of debt, using both the average cost of the firm’s existing debt method and the yield-to-maturity method. Decide which of these methods is more appropriate for the ultimate cost of debt input to WACC. d) Compute the WACC.

Related: (Solution) MGMT 648 Applied Finance Week 1 Assignment

Solution – WACC for Target as of January 2020

In this solution, we the SLOPE function to calculate the beta of the stock,

Beta seeks to understand how a stock’s price fluctuates in response to the movement of the market.

Expected return = Risk-Free Rate + Beta (Equity Risk Premium – Risk-Free Rate)

…Please click on the Icon below to purchase the FULL ANSWER at only $10