HSA525 WEEK 7 EXERCISES

Assignment Exercise 15–1: Budgeting – Case Study: Metropolis Health System

Select an organization: either from the Case Studies in Chapters 27–28 or from one of the Mini-Case Studies in Chapters 29–31.

Required

1. Using the organization selected, create a budget for the next fiscal year. Set out the details of all assumptions you needed in order to build this budget.

2. Use the “Checklist for Building a Budget” (Exhibit 15–2) and critique your own budget.

Solution – Assignment Exercise 15–1: Budgeting

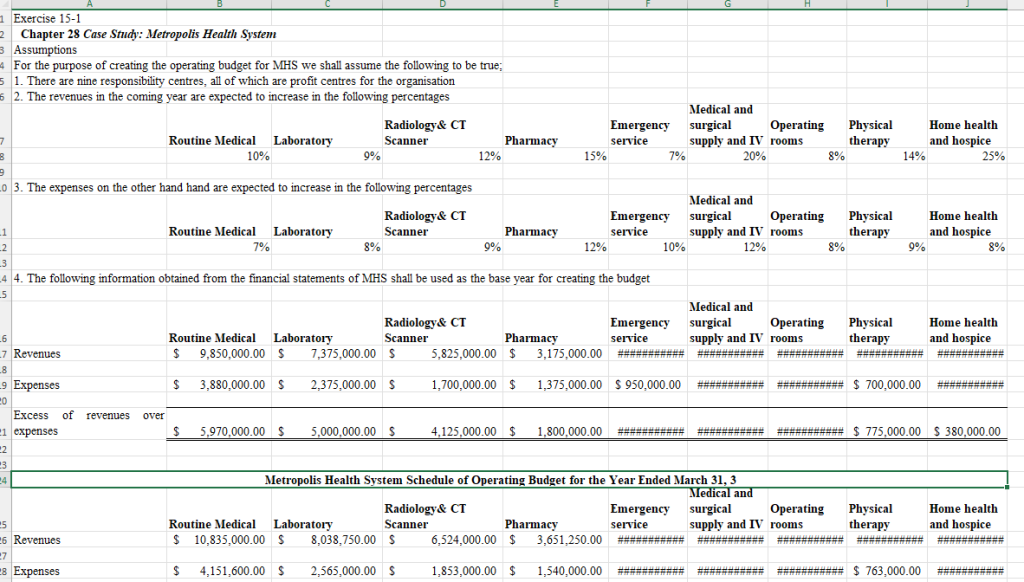

Chapter 28 Case Study: Metropolis Health System

Assumptions

For the purpose of creating the operating budget for MHS we shall assume the following to be true;

- There are nine responsibility centres, all of which are profit centres for the organisation

- The revenues in the coming year are expected to increase in the following percentages

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

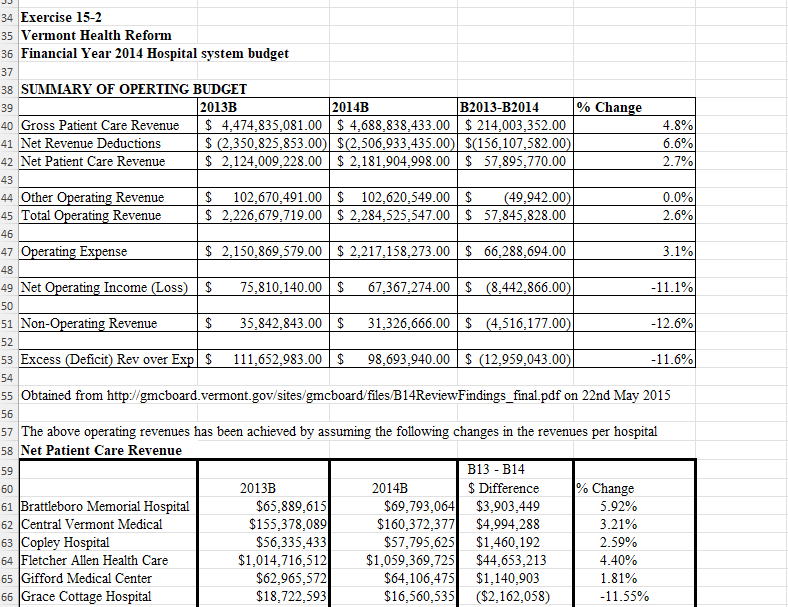

Assignment Exercise 15–2: Budgeting

Find an existing budget from a published source. Detail should be extensive enough to present a challenge.

Required

1. Using the existing budget, create a new budget for the next fiscal year. Set out the details of all the assumptions you needed in order to build this budget.

2. Use the “Checklist for Building a Budget” (Exhibit 15–2) and critique your own effort.

3. Use the “Checklist for Reviewing a Budget” (Exhibit 15–3) and critique the existing budget.

Solution – Assignment Exercise 15–2: Budgeting

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Assignment Exercise 15–3: Transactions Outside the Operating Budget

Review Figure 15–2 and the accompanying text.

Metropolis Health System (MHS) has received a wellness grant from the charitable arm of an area electronics company. The grant will run for 24 months, beginning at the first of the next fiscal year. Two therapists and two registered nurses will each be spending half of their time working on the wellness grant. All four individuals are full-time employees of MHS. The electronics company has only recently begun to operate the charitable organization that awarded the grant. While they have gained all the legal approvals necessary, they have not yet provided the manuals and instructions for grant transactions that MHS usually receives when grants are awarded. Consequently, guidance about separate accounting is not yet forthcoming from the grantor.

Required

How would you handle this issue on the MHS operating budget for next year?

Solution – Assignment Exercise 15–3: Transactions Outside the Operating Budget

A grant requires to be trated as a separate accounting entity at any given time. This is regardless of whether directives have or have not been received from the danating organisation regarding how the grant is to be used. In this case therefore the grant should be accounted for differently despite lack of manuals and instructions on the grant transactions.

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

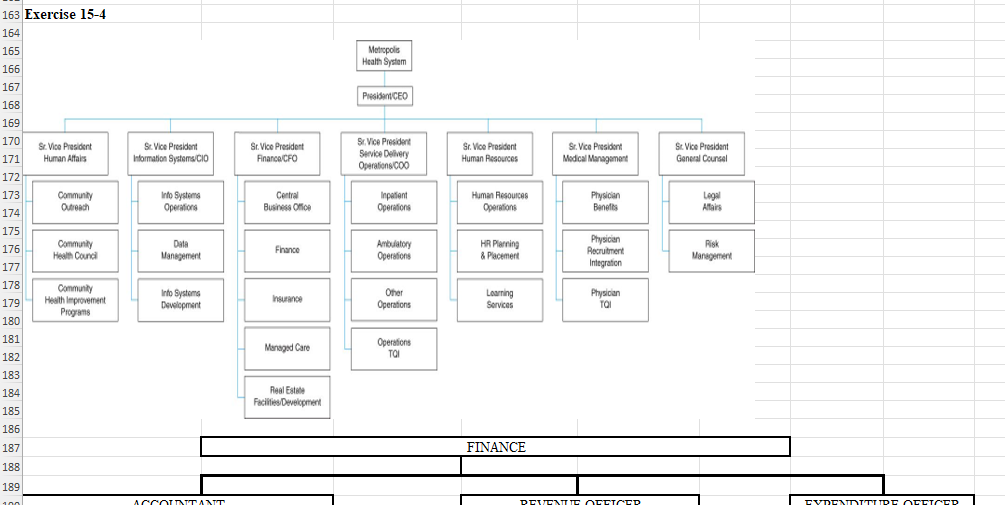

Assignment Exercise 15–4: Identified Versus Allocated Costs in Budgeting

Review Figure 15–3 and the accompanying text.

Metropolis Health System is preparing for a significant upgrade in both hardware and software for its information systems. As part of the project, the Chief of Information Operations (CIO) has indicated that the Information Systems (IS) department can change the format of the MHS operating budgets and related reports before the operating budget is constructed for the coming fiscal year. The Chief Financial Officer (CFO) has long wanted to modify what costs are identified and what costs are allocated (along with the method of allocation). This is a golden opportunity to do so. To gain ammunition for the change, the CFO is preparing to conduct a survey. The survey will obtain a variety of suggestions for potential changes in allocation methods for the new operating budget report formats. You have been selected as one of the employees who will be surveyed.

Required

You may choose your role for this assignment, as follows:

Refer to the “MHS Executive-Level Organization Chart” (Figure 28–2 in the MHS Case Study). (1) Either (a) choose any type of patient service that would be under the direction of the Senior Vice President of Service Delivery Operations or (b) choose any other function shown on the organization chart. (Your function could be a whole department or a division or unit of that department. For example, you might choose Community Outreach or Human Resources Operations or the Emergency department, etc.) (2) Make up your own organization chart for other employee levels within the function you have chosen. (3) Now make up another chart that indicates the operating budget costs you think would be mostly identifiable for the department or unit or division you have chosen and what other operating budget costs you think would be mostly allocated to it. (You may use Figure 15–3 as a rough guide, but do not let it limit your imagination. Model the detail on your “identifiable versus allocated costs” chart after a real department if you so choose.) Use MHS hospital statistics shown in Exhibit 28–8 of the MHS Case Study as a basis for allocation if these statistics are helpful. If they are not, make a note of what other statistics you would like to have.

Note: As an alternative approach, you may choose a function from the “Nursing Practice and Administration Organization Chart” as shown in Figure 28–1 of the MHS Case Study instead of choosing from the Executive-Level Organization Chart.

Solution – Assignment Exercise 15–4: Identified Versus Allocated Costs in Budgeting

…Please click on the Icon below to purchase the FULL SOLUTION PACKAGE at only $10

Assignment Exercise 16–1: Capital Expenditure Proposals

Ted Jones, the Surgery Unit Director, is about to choose his strategy for creating a capital expenditure funding proposal for the coming year. Ted’s unit needs more room. The Surgery Unit is running at over 90% capacity. In addition, a prominent cardiology surgeon on staff at the hospital wants to create a new cardiac surgery program that would require extensive funding for more space and for new state-of-the-art equipment. The surgeon has been campaigning with the hospital board members.

Required

What should Ted decide to ask for? How should he go about crafting a strategy to justify his request, given the hospital’s new scoring system?

Solution – Assignment Exercise 16–1: Capital Expenditure Proposals

Capital Expenditures require careful analysis on their viability mainly because they involve a large sum of money and also once started started they cannot be stopped without incurring losses. This case is not different, and Ted needs to