Exercise 8–1: FIFO and LIFO Inventory (Study the FIFO and LIFO explanations in the chapter).

a1. Use the format in Exhibit 8–1 below to compute the ending FIFO inventory and the cost of goods sold, assuming $90,000 in sales; beginning inventory 500 units @ $50; purchases of 400 units @ $50; 100 units @ $65; 400 units @ $80.

a2. Also compute the cost of goods sold percentage of sales.

b1. Use the format in Exhibit 8–2 below to compute the ending LIFO inventory and the cost of goods sold, using same assumptions.

b2. Also compute the cost of goods sold percentage of sales.

c. Comment on the difference in outcomes.

Solution – FIFO and LIFO Inventory

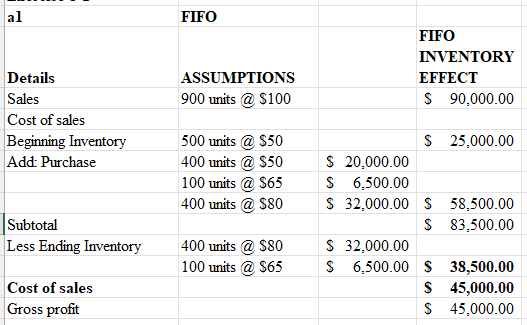

To calculate the ending FIFO inventory and the cost of goods sold we use the following table. This has been calculated in excel.

| Exercise 8-1 | |||

| a1 | FIFO | ||

| Details | ASSUMPTIONS | FIFO INVENTORY EFFECT | |

| Sales | 900 units @ $100 | $ 90,000.00 | |

| Cost of sales | |||

| Beginning Inventory | 500 units @ $50 | $ 25,000.00 | |

| Add: Purchase | 400 units @ $50 | $ 20,000.00 | |

| 100 units @ $65 | $ 6,500.00 | ||

| 400 units @ $80 | $ 32,000.00 | $ 58,500.00 | |

| Subtotal | $ 83,500.00 | ||

| Less Ending Inventory | 400 units @ $80 | $ 32,000.00 | |

| 100 units @ $65 | $ 6,500.00 | $ 38,500.00 | |

| Cost of sales | $ 45,000.00 | ||

| Gross profit | $ 45,000.00 | ||

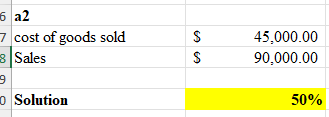

| a2 | |||

| cost of goods sold | $ 45,000.00 | ||

| Sales | $ 90,000.00 | ||

| Solution | 50% |

…Please click on the Icon below to purchase the FULL ANSWER FOR FIFO and LIFO Inventory at only $10

Assignment Exercise 8–2: Inventory Turnover

Study the “Calculating Inventory Turnover” portion of the chapter closely, whereby the cost of goods sold divided by the average inventory equals the inventory turnover.

Compute two inventory turnover calculations as follows:

1. Use the LIFO information in the previous assignment to first compute the average inventory and then to compute the inventory turnover.

2. Use the FIFO information in the previous assignment to first compute the average inventory and then to compute the inventory turnover.

…Please click on the Icon below to purchase the FULL ANSWER at only $10

Assignment Exercise 8–3: Depreciation Concept

Assume that MHS purchased two additional pieces of equipment on April 1 (the first day of its fiscal year), as follows:

1. The laboratory equipment cost $300,000 and has an expected life of = years. The salvage value is 5% of cost. No equipment was traded in on this purchase.

2. The radiology equipment cost $800,000 and has an expected life of 7 years. The salvage value is 10% of cost. No equipment was traded in on this purchase.

For both pieces of equipment:

1. Compute the straight-line depreciation.

2. Compute the double-declining balance depreciation.

*Assignment Exercise 9–1: FTEs to Annualize Staffing

The Metropolis Health System managers are also working on their budgets for next year. Each manager must annualize his or her staffing plan, and thus must convert staff net paid days worked to a factor. Each manager has the MHS worksheet, which shows 9 holidays, 7 sick days, 15 vacation days, and 3 education days, equaling 34 paid days per year not worked.

The Laboratory is fully staffed 7 days per week and the 34 paid days per year not worked is applicable for the lab. The Medical Records department is also fully staffed 7 days per week. However, Medical Records is an outsourced department so the employee benefits are somewhat different. The Medical Records employees receive 9 holidays plus 21 personal leave days, which can be used for any purpose.

1. Compute net paid days worked for a full-time employee in the Laboratory and in Medical Records.

2. Convert net paid days worked to a factor for the Laboratory and for Medical Records so these MHS managers can annualize their staffing plans.

…Please click on the Icon below to purchase the FULL ANSWER at only $10

Assignment Exercise 9–2: FTEs to Fill a Position

Metropolis Health System (MHS) uses a basic work week of 40 hours throughout the system. Thus, one full-time employee works 40 hours per week. MHS also uses a standard 24-hour scheduling system of three 8-hour shifts. The Director of Nursing needs to compute the staffing requirements to fill the Operating Room (OR) positions. Since MHS is a trauma center, the OR is staffed 24 hours a day, 7 days a week. At present, staffing is identical for all 7 days of the week, although the Director of Nursing is questioning the efficiency of this method.

The Operating Room department is staffed with two nursing supervisors on the day shift and one nursing supervisor apiece on the evening and night shifts. There are two technicians on the day shift, two technicians on the evening shift, and one technician on the night shift. There are three RNs on the day shift, two RNs on the evening shift, and one RN plus one LPN on the night shift. In addition, there is one aide plus one clerical worker on the day shift only.

1. Set up a staffing requirements worksheet, using the format in Exhibit 9–4 above.

2. Compute the number of FTEs required to fill the Operating Room staffing positions.