Mini Case – Pharma Industries

Part A: Bonds

Pharma Industries has an outstanding $1,000 par value bond with an 8% coupon rate.

The bond has 12 years remaining to its maturity date.

Required:

- If interest is paid annually, find the value of the bond when the required rate of return is 7% and 10%. Indicate which bond is selling at a discount and premium. ( 2Marks)

Correct Answer 1079.43 at 7%

- Using the 10% required return, find the bond’s value when the interest is paid semiannually. ( 2Marks)

- Explain the difference between semiannual and annual interest payments. ( 1 Mark )

Part B: Stocks

The dividend the Pharma Industry paid in the current year was $1.80 per share. The required rate of return on its common share is 12%. Estimate the value of common stock under each of the following assumptions about the dividend:

Required:

- Dividends are expected to grow at an annual rate of 0% (2 Marks)

- Dividends are expected to grow at a constant annual rate of 5% to infinity. (3 Marks)

- Dividends are expected to grow at an annual rate of 5% for the next 3 years, followed by a constant growth rate of 4% in year 4 to infinity. (7 Marks)

- How is this information useful in making investment decisions? (2 Marks)

Related: (Solved) Mini Case – Super Hardware Canada (SHC)

Solution – Mini Case 2 Pharma Industries

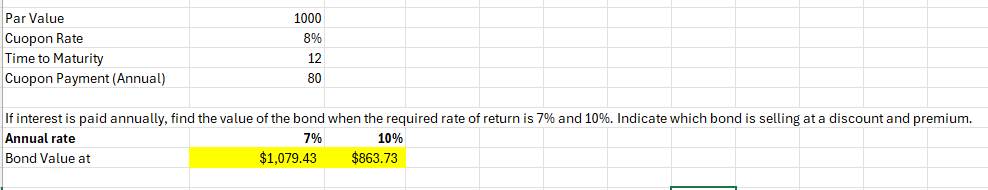

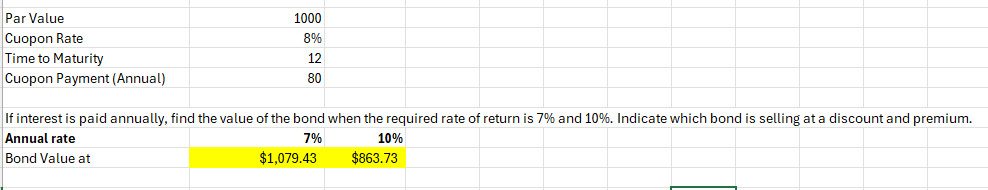

Bond Information:

- Par Value: $1,000

- Coupon Rate: 8%

- Time to Maturity: 12 years

- Coupon Payment (Annual): 1,000×0.08=80

(a) Bond Value at Required Rates of Return 7% and 10% (Interest Paid Annually)

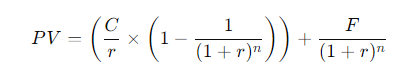

The bond value can be calculated using the following formula:

We can also use Excel Present Value formula, = PV(rate, nper,pmt,fv,type)

…Please click on the Icon below to purchase the FULL ANSWER at only $5