ElectronPlus manufactures and sells a unique electronic part. Operating results for the first three years of activity were as follows (absorption costing basis):

| Year 1 | Year 2 | Year 3 | |

| Sales | 1,049,000 | 839,200 | 1,072,000 |

| Cost of goods sold: | |||

| Beginning inventory | 0 | 0 | 270,000 |

| Add: cost of goods manufactured | 811,000 | 840,000 | 764,000 |

| Goods available for sale | 811,000 | 840,000 | 1,034,000 |

| Less: ending inventory | 0 | 270,000 | 173,000 |

| Cost of goods sold | 811,000 | 570,000 | 861,000 |

| Gross margin | 238,000 | 269,200 | 211,000 |

| Selling and administrative expenses | 173,000 | 74,200 | 214,000 |

| Operating income (loss) | 65,000 | 195,000 | (3,000) |

Sales dropped by 20% during year 2 due to the entry of several foreign competitors into the market. ElectronPlus had expected sales to remain constant at 51,000 units for the year; production was set at 61,000 units in order to build a buffer against unexpected spurts in demand. By the start of year 3, management could see that spurts in demand were unlikely and that the inventory was excessive. To work off the excessive inventories, ElectronPlus cut back production during year 3, as shown below:

| Year 1 | Year 2 | Year 3 | |

| Production in units | 51,000 | 61,000 | 41,000 |

| Sales in units | 51,000 | 41,000 | 51,000 |

Additional information about the company follows:

a. The company’s plant is highly automated. Variable manufacturing costs (direct materials, direct labour, and variable manufacturing overhead) total only $4 per unit, and fixed manufacturing overhead costs total $648,000 per year.

b. Fixed manufacturing overhead costs are applied to units of product on the basis of each year’s planned production. (That is, a new fixed overhead rate is computed each year).

c. Variable selling and administrative expenses are $2 per unit sold. Fixed selling and administrative expenses total $69,200 per year.

d. The company uses a FIFO inventory flow assumption.

The management of ElectronPlus can’t understand why profits tripled during year 2 when sales dropped by 20%, and why a loss was incurred during year 3 when sales recovered to previous levels.

Required:

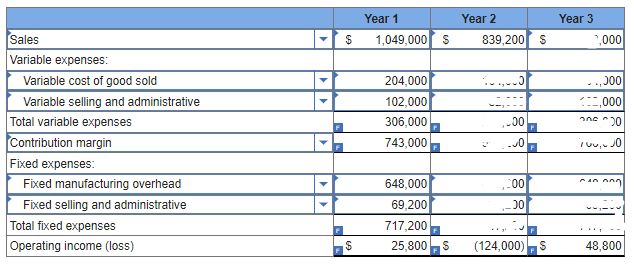

1. Prepare a contribution format income statement for each year using variable costing.

2. Refer to the absorption costing income statements above.

a. Compute the unit product cost in each year under absorption costing. (Show how much of this cost is variable and how much is fixed.) (Round your answer to 2 decimal places.)

b. Reconcile the variable costing and absorption costing operating income figures for each year. (Losses and deductible amounts should be indicated by a minus sign. Do not leave any empty spaces; input a 0 wherever it is required. Round your intermediate calculations to 2 decimals and round your final answer to the nearest whole dollar.)

3. This part of the question is not part of your Connect assignment.

4. This part of the question is not part of your Connect assignment.

5-a. This part of the question is not part of your Connect assignment.

5-b. If lean production had been in use during year 2 and year 3, what would the company’s operating income (or loss) have been in each year under absorption costing? (Loss amounts should be indicated by a minus sign.)

Related: (Solution) Haas Company manufactures and sells one product

Solution – ElectronPlus manufactures and sells a unique electronic part

To create a contribution format income statement using variable costing, we must first separate variable costs from fixed costs and compute the contribution margin.

The contribution format income statement follows the structure: Sales−Variable Costs=Contribution Margin

Contribution Margin−Fixed Costs=Operating Income (Loss)

Key Information:

- Variable Manufacturing Cost per Unit = $4 (includes direct materials, direct labor, and variable manufacturing overhead)

- Fixed Manufacturing Overhead = $648,000 per year

- Variable Selling and Administrative Expenses = $2 per unit sold

- Fixed Selling and Administrative Expenses = $69,200 per year

Now, we will prepare a contribution format income statement for each year (Year 1, Year 2, and Year 3).

Year 1:

- Sales: = 51,000 units×$52 = $1,049,000

- Variable Costs:

- Variable manufacturing costs: 51,000 units×$4=$204,00051,000 Variable selling and administrative expenses: 51,000 units×$2=$102,000

- Contribution Margin: Sales−Variable Costs = $1,049,000−$306,000=$743,000

- Fixed Costs:

- Fixed manufacturing overhead = $648,000Fixed selling and administrative expenses = $69,200

- Operating Income: Contribution Margin−Fixed Costs=$743,000−$717,200=$25,800

Please click on the Icon below to purchase the full 100% CORRECT ANSWER at only $3