During Durton Company’s first two years of operations, the company reported variable costing operating income as shown below. Production and cost data for the two years are given:

| Year 1 | Year 2 | |

| Units produced | 25,000 | 25,000 |

| Units sold | 20,000 | 30,000 |

| Year 1 | Year 2 | ||||

| Sales (at $50 per unit) | $ | 1,000,000 | $ | 1,500,000 | |

| Variable expenses: | |||||

| Variable cost of goods sold (at $20 per unit) | 400,000 | 600,000 | |||

| Variable selling and administrative costs (at $3 per unit) | 60,000 | 90,000 | |||

| Total variable expenses | 460,000 | 690,000 | |||

| Contribution margin | 540,000 | 810,000 | |||

| Fixed expenses: | |||||

| Fixed manufacturing overhead | 350,000 | 350,000 | |||

| Fixed selling and administrative | 250,000 | 250,000 | |||

| Total fixed expenses | 600,000 | 600,000 | |||

| Operating income (loss) | $ | (60,000 | ) | $ | 210,000 |

The company’s $20 unit product cost is computed as follows:

| Direct materials | $ | 8 | |

| Direct labour | 10 | ||

| Variable manufacturing overhead | 2 | ||

| Unit product cost | $ | 20 | |

Required:

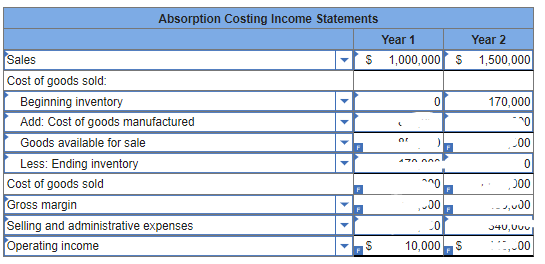

1. Prepare an absorption costing income statement for each year.

2. Reconcile the absorption costing and variable costing operating income figures for each year. (Loss amounts should be indicated by a minus sign.)

Related: (Solution) Leander Office Products Inc. produces and sells small storage

Solution – Durton Company’s first two years of operations

The unit product cost under the absorption costing approach would be computed as follows:

| Direct materials | 8 |

| Direct labour | 10 |

| Variable manufacturing overhead | 2 |

| Fixed manufacturing overhead ($350,000 ÷ 25,000 units) | 14 |

| Unit product cost | 34 |

With this figure, the absorption costing income statements can be prepared:

Please click on the Icon below to purchase the full 100% CORRECT ANSWER at only $3