Johnston Company (JC) sells two types of bicycles with details as follows for 2022. Required: 1. Calculate the budgeted contribution margin for each model. 2. Calculate the following variances:

| Plan | Mountain | Road |

| Expected total industry unit sales | 96,000 | 170,000 |

| Budgeted JC unit sales | 8,400 | 34,000 |

| Budgeted selling price per unit | 1,200 | 1,600 |

| Budgeted variable costs per unit | 968 | 1,258 |

| Actuals | ||

| Actual total industry unit sales | 120,000 | 200,000 |

| Actual JC unit sales | 12,000 | 36,000 |

| Actual selling price per unit | 1,240 | 1,575 |

| Actual variable cost per unit | 1,000 | 1,275 |

Related: (Solution) The Yardman Company produces electric weed trimmers

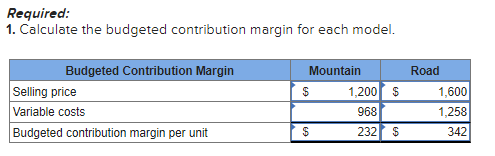

Solution – Budgeted Contribution Margin

Here’s the step-by-step solution:

1. Calculation

The contribution margin is calculated using the formula:

Contribution Margin = Selling Price per Unit − Variable Cost per Unit

We’ll calculate this for both Mountain and Road bikes.

Mountain Bike (Contribution Margin)

Budgeted Selling Price per Unit = $1,200

Budgeted Variable Costs per Unit=$968

Using the formula: Contribution Margin (Mountain) = 1,200−968=$232 per unit

Road Bike (Contribution Margin)

Budgeted Selling Price per Unit=$1,600

Budgeted Variable Costs per Unit=$1,258

Using the formula: Contribution Margin (Road)=1,600 − 1,258 = $342 per unit

| Mountain | Road | |

| Selling price | $1,200 | $1,600 |

| Variable costs | 968 | 1,258 |

| Budgeted contribution margin per unit | $232 | $342 |

Please click on the Icon below to purchase the full 100% CORRECT ANSWER at only $3