Module 3 Assignment

Question 1

Question text

Compute, Disaggregate, and Interpret RNOA of Competitors

Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements.

| $ millions | HAL | SLB |

|---|---|---|

| Total revenue | $23,995 | $32,815 |

| Pretax net nonoperating expense | 653 | 426 |

| Net income | 1,657 | 2,177 |

| Average operating assets | 23,361 | 67,836 |

| Average operating liabilities | 5,888 | 16,499 |

| Marginal tax rate | 22% | 19% |

| Return on equity | 18.56% | 5.86% |

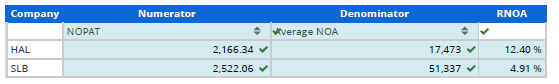

a. Compute return on net operating assets (RNOA) for each company.

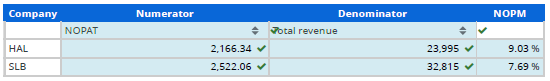

b. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for each company.

Solution

a. Compute return on net operating assets (RNOA) for each company.

b. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for each company.

..Please click on the Icon below to purchase the FULL ANSWER at only $10

Question 2

Correct

Mark 2.00 out of 2.00

Question text – Compute NOPAT

The income statement for TJX Companies follows.

| THE TJX COMPANIES, INC. Consolidated Statements of Income | |

|---|---|

| Fiscal Year Ended ($ thousands) | February 2, 2019 |

| Net sales | $38,972,934 |

| Cost of sales, including buying and occupancy costs | 27,831,177 |

| Selling, general and administrative expenses | 6,923,564 |

| Pension settlement charge | 36,122 |

| Interest expense, net | 8,860 |

| Income before provision for income taxes | 4,173,211 |

| Provision for income taxes | 1,113,413 |

| Net income | $3,059,798 |

Assume that the combined federal and state statutory tax rate is 22%.

a. Compute NOPAT using the formula: NOPAT = Net income + NNE.

b. Compute NOPAT using the formula: NOPAT = NOPBT − Tax on operating profit.

..Please click on the Icon below to purchase the FULL ANSWER at only $10

Question 3

Correct

Mark 11.00 out of 11.00

Question text

Analysis and Interpretation of Profitability

Balance sheets and income statements for 3M Company follow.

| 3M COMPANY | ||

|---|---|---|

| Consolidated Statements of Income | ||

| For Years ended December 31 ($ millions) | 2018 | 2017 |

| Net sales | $32,765 | $31,657 |

| Operating expenses | ||

| Cost of sales | 16,682 | 16,055 |

| Selling, general and administrative expenses | 7,602 | 6,626 |

| Research, development and related expenses | 1,821 | 1,870 |

| Gain on sale of businesses | (547) | (586) |

| Total operating expenses | 25,558 | 23,965 |

| Operating income | 7,207 | 7,692 |

| Other expense, net* | 207 | 144 |

| Income before income taxes | 7,000 | 7,548 |

| Provision for income taxes | 1,637 | 2,679 |

| Net income including noncontrolling interest | 5,363 | 4,869 |

| Less: Net income attributable to noncontrolling interest | 14 | 11 |

| Net income attributable to 3M | $5,349 | $4,858 |

| *Interest expense, gross | $350 | $322 |

| 3M COMPANY | ||

|---|---|---|

| Consolidated Balance Sheets | ||

| At December 31 ($ millions, except per share amount) | 2018 | 2017 |

| Current Assets | ||

| Cash and cash equivalents | $2,853 | $3,053 |

| Marketable securities | 380 | 1,076 |

| Accounts receivable | 5,020 | 4,911 |

| Total inventories | 4,366 | 4,034 |

| Prepaids | 741 | 937 |

| Other current assets | 349 | 266 |

| Total current assets | 13,709 | 14,277 |

| Property, plant and equipment-net | 8,738 | 8,866 |

| Goodwill | 10,051 | 10,513 |

| Intangible assets-net | 2,657 | 2,936 |

| Other assets | 1,345 | 1,395 |

| Total assets | $36,500 | $37,987 |

| Current liabilities | ||

| Short-term borrowings and current portion of long-term debt | $1,211 | $1,853 |

| Accounts payable | 2,266 | 1,945 |

| Accrued payroll | 749 | 870 |

| Accrued income taxes | 243 | 310 |

| Other current liabilities | 2,775 | 2,709 |

| Total current liabilities | 7,244 | 7,687 |

| Long-term debt | 13,411 | 12,096 |

| Pension and postretirement benefits | 2,987 | 3,620 |

| Other liabilities | 3,010 | 2,962 |

| Total liabilities | 26,652 | 26,365 |

| 3M Company shareholders’ equity | ||

| Common stock, par value | 9 | 9 |

| Additional paid-in capital | 5,643 | 5,352 |

| Retained earnings | 40,636 | 39,115 |

| Treasury stock | (29,626) | (25,887) |

| Accumulated other comprehensive income (loss) | (6,866) | (7,026) |

| Total 3M Company shareholders’ equity | 9,796 | 11,563 |

| Noncontrolling interest | 52 | 59 |

| Total equity | 9,848 | 11,622 |

| Total liabilities and equity | $36,500 | $37,987 |

| Combined federal and state statutory tax rate | 22% | |

a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%.

b. Compute net operating assets (NOA) for 2018 and 2017.

c. Compute and disaggregate 3M’s RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM × NOAT.

***RNOA may be different from first RNOA calculation due to rounding

d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity

e. Compute return on equity (ROE) for 2018.

f. What is the nonoperating return component of ROE for 2018?

..Please click on the Icon below to purchase the FULL ANSWER at only $10

Related: (Solved) Module 4 Assignment Compute profitability measures RNOA

Question 4

Correct

Mark 11.00 out of 11.00

Question text – Analysis and Interpretation of Profitability

Balance sheets and income statements for Costco Wholesale Corporation follow.

| Costco Wholesale Corporation | |

|---|---|

| Consolidated Statements of Earnings | |

| For Fiscal Years Ended ($ millions) | September 2, 2018 |

| Total revenue | $141,576 |

| Operating expenses | |

| Merchandise costs | 123,152 |

| Selling, general and administrative | 13,876 |

| Preopening expenses | 68 |

| Operating Income | 4,480 |

| Other (income) expense | |

| Interest expense | 159 |

| Interest income and other, net | (121) |

| Income before income taxes | 4,442 |

| Provision for income taxes | 1,263 |

| Net income including noncontrolling interests | 3,179 |

| Net income attributable to noncontrolling interests | (45) |

| Net income attributable to Costco | $3,134 |

| Costco Wholesale Corporation | ||

|---|---|---|

| Consolidated Balance Sheets | ||

| ($ millions, except par value and share data) | September 2, 2018 | September 3, 2017 |

| Current assets | ||

| Cash and cash equivalents | $6,055 | $4,546 |

| Short-term investments | 1,204 | 1,233 |

| Receivables, net | 1,669 | 1,432 |

| Merchandise inventories | 11,040 | 9,834 |

| Other current assets | 321 | 272 |

| Total current assets | 20,289 | 17,317 |

| Net property and equipment | 19,681 | 18,161 |

| Other assets | 860 | 869 |

| Total assets | $40,830 | $36,347 |

| Current liabilities | ||

| Accounts payable | $11,237 | $9,608 |

| Accrued salaries and benefits | 2,994 | 2,703 |

| Accrued member rewards | 1,057 | 961 |

| Deferred membership fees | 1,624 | 1,498 |

| Other current liabilities | 3,014 | 2,725 |

| Total current liabilities | 19,926 | 17,495 |

| Long-term debt | 6,487 | 6,573 |

| Other liabilities | 1,314 | 1,200 |

| Total liabilities | 27,727 | 25,268 |

| Equity | ||

| Preferred stock, $0.01 par value: | 0 | 0 |

| Common stock, $0.01 par value: | 4 | 4 |

| Additional paid-in-capital | 6,107 | 5,800 |

| Accumulated other comprehensive loss | (1,199) | (1,014) |

| Retained earnings | 7,887 | 5,988 |

| Total Costco stockholders’ equity | 12,799 | 10,778 |

| Noncontrolling interests | 304 | 301 |

| Total equity | 13,103 | 11,079 |

| Total liabilities and equity | $40,830 | $36,347 |

| Combined federal and state statutory tax rate | 22% | |

(a) Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%.

| NOPAT | |

|---|---|

| Answer 1 |

(b) Compute net operating assets (NOA) for 2018 and 2017.

| Year | NOA | |

|---|---|---|

| 2018 | Answer 2 | |

| 2017 | Answer 3 |

(c) Compute Costco’s RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018.

(d) Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity.

(e) Compute return on equity (ROE) for 2018.

(f) Infer the nonoperating return component of ROE for 2018.

..Please click on the Icon below to purchase the FULL ANSWER at only $10

Question 5

Correct

Mark 13.00 out of 13.00

Question text – Direct Computation of Nonoperating Return

Balance sheets and income statements for 3M Company follow.

| 3M COMPANY | ||

|---|---|---|

| Consolidated Statements of Income | ||

| For Years ended December 31 ($ millions) | 2018 | 2017 |

| Net sales | $32,765 | $31,657 |

| Operating expenses | ||

| Cost of sales | 16,682 | 16,055 |

| Selling, general and administrative expenses | 7,602 | 6,626 |

| Research, development and related expenses | 1,821 | 1,870 |

| Gain on sale of businesses | (547) | (586) |

| Total operating expenses | 25,558 | 23,965 |

| Operating income | 7,207 | 7,692 |

| Other expense, net* | 207 | 144 |

| Income before income taxes | 7,000 | 7,548 |

| Provision for income taxes | 1,637 | 2,679 |

| Net income including noncontrolling interest | 5,363 | 4,869 |

| Less: Net income attributable to noncontrolling interest | 14 | 11 |

| Net income attributable to 3M | $5,349 | $4,858 |

| *Interest expense, gross | $350 | $322 |

| 3M COMPANY | ||

|---|---|---|

| Consolidated Balance Sheets | ||

| At December 31 ($ millions, except per share amount) | 2018 | 2017 |

| Current Assets | ||

| Cash and cash equivalents | $2,853 | $3,053 |

| Marketable securities | 380 | 1,076 |

| Accounts receivable | 5,020 | 4,911 |

| Total inventories | 4,366 | 4,034 |

| Prepaids | 741 | 937 |

| Other current assets | 349 | 266 |

| Total current assets | 13,709 | 14,277 |

| Property, plant and equipment-net | 8,738 | 8,866 |

| Goodwill | 10,051 | 10,513 |

| Intangible assets-net | 2,657 | 2,936 |

| Other assets | 1,345 | 1,395 |

| Total assets | $36,500 | $37,987 |

| Current liabilities | ||

| Short-term borrowings and current portion of long-term debt | $1,211 | $1,853 |

| Accounts payable | 2,266 | 1,945 |

| Accrued payroll | 749 | 870 |

| Accrued income taxes | 243 | 310 |

| Other current liabilities | 2,775 | 2,709 |

| Total current liabilities | 7,244 | 7,687 |

| Long-term debt | 13,411 | 12,096 |

| Pension and postretirement benefits | 2,987 | 3,620 |

| Other liabilities | 3,010 | 2,962 |

| Total liabilities | 26,652 | 26,365 |

| 3M Company shareholders’ equity | ||

| Common stock, par value | 9 | 9 |

| Additional paid-in capital | 5,643 | 5,352 |

| Retained earnings | 40,636 | 39,115 |

| Treasury stock | (29,626) | (25,887) |

| Accumulated other comprehensive income (loss) | (6,866) | (7,026) |

| Total 3M Company shareholders’ equity | 9,796 | 11,563 |

| Noncontrolling interest | 52 | 59 |

| Total equity | 9,848 | 11,622 |

| Total liabilities and equity | $36,500 | $37,987 |

| Combined federal and state statutory tax rate | 22.00% | |

| ROE | 50.09% | |

| RNOA | 25.89% | |

a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume a tax rate of 22%.

b. Compute net nonoperating obligations (NNO).

c. Compute financial leverage (FLEV).

d. Compute NNEP and Spread.

e. Compute the noncontrolling interest ratio (NCI ratio).

f. Confirm the relation: ROE = [RNOA + (FLEV × Spread)] × NCI ratio.

***ROE may be different due to rounding