Assignment 9 (Chapter 11)

On December 31, Year 1, Precision Manufacturing Inc. (PMI) of Edmonton purchased 100% of the outstanding ordinary shares of Sandora Corp. of Flint, Michigan.

Sandora’s comparative statement of financial position and Year 2 income statement are as follows:

| STATEMENT OF FINANCIAL POSITION | ||||||

| At December 31 | ||||||

| Year 2 | Year 1 | |||||

| Plant and equipment (net) | US$ | 6,790,000 | US$ | 7,490,000 | ||

| Inventory | 5,890,000 | 6,490,000 | ||||

| Accounts receivable | 6,290,000 | 4,890,000 | ||||

| Cash | 970,000 | 1,090,000 | ||||

| US$ | 19,940,000 | US$ | 19,960,000 | |||

| Ordinary shares | US$ | 5,190,000 | US$ | 5,190,000 | ||

| Retained earnings | 7,670,000 | 7,190,000 | ||||

| Bonds payable—due Dec. 31, Year 6 | 4,990,000 | 4,990,000 | ||||

| Current liabilities | 2,090,000 | 2,590,000 | ||||

| US$ | 19,940,000 | US$ | 19,960,000 | |||

| INCOME STATEMENT | |||

| For the year ended December 31, Year 2 | |||

| Sales | 49,000,000 | ||

| Cost of purchases | 38,220,000 | ||

| Change in inventory | 600,000 | ||

| Depreciation expense | 700,000 | ||

| Other expenses | 6,270,000 | ||

| 45,790,000 | |||

| Profit | US$ | 3,210,000 | |

Additional Information

- Exchange rates

| Dec. 31, Year 1 | US$1 | = | C$1.10 |

| Sep. 30, Year 2 | US$1 | = | C$1.07 |

| Dec. 31, Year 2 | US$1 | = | C$1.05 |

| Average for Year 2 | US$1 | = | C$1.08 |

- Sandora declared and paid dividends on September 30, Year 2.

- The inventories on hand on December 31, Year 2, were purchased when the exchange rate was US$1 = C$1.06.

Required:

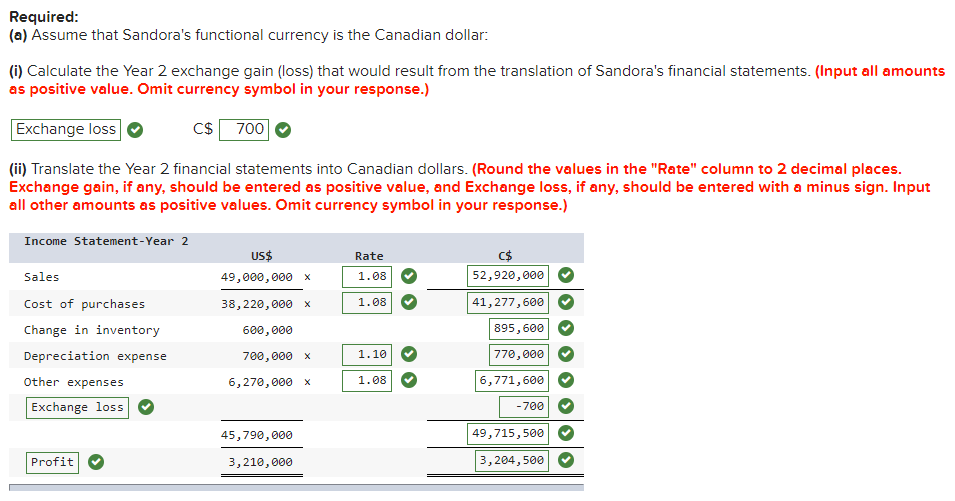

(a) Assume that Sandora’s functional currency is the Canadian dollar:

(i) Calculate the Year 2 exchange gain (loss) that would result from the translation of Sandora’s financial statements. (Input all amounts as positive value. Omit currency symbol in your response.)

(ii) Translate the Year 2 financial statements into Canadian dollars. (Round the values in the “Rate” column to 2 decimal places. Exchange gain, if any, should be entered as positive value, and Exchange loss, if any, should be entered with a minus sign. Input all other amounts as positive values. Omit currency symbol in your response.)

(b) Assume that Sandora’s functional currency is the U.S. dollar:

(i) Calculate the Year 2 exchange gain (loss) that would result from the translation of Sandora’s financial statements and would be reported in other comprehensive income. (Input all amounts as positive value. Omit currency symbol in your response.)

(ii) Translate the Year 2 financial statements into Canadian dollars. (Round the values in the “Rate” column to 2 decimal places. Loss amounts should be indicated with a minus sign. Input all other amounts as positive values. Omit currency symbol in your response.)

(c) Which functional currency would Sandora prefer to use if it wants to show the following?

(i) The strongest solvency position for the company.

multiple choice 1

- Functional currency is Canadian dollar.

- Functional currency is U.S. dollar and accumulated foreign exchange adjustments (AFEA) are included in equity.

- Functional currency is U.S. dollar and accumulated foreign exchange adjustments (AFEA) are excluded from equity.

(ii) The best return on shareholders’ equity.

multiple choice 2

- Functional currency is Canadian dollar.

- Functional currency is U.S. dollar and other comprehensive income (OCI) is included in income.

- Functional currency is U.S. dollar and other comprehensive income (OCI) is excluded income.

Related Assignment Solution: (Solution) Mos4465 Assignment 10 (Chapter 12)

Solution – Assignment 9 (Chapter 11)

Workings – Calculation of Year 2 exchange gain (loss) that would result from the translation of Sandora’s financial statements.

Sandora’s functional currency is the Canadian dollar i.e. Sandora is an integrated foreign subsidiary

| Retained earnings Dec. 31, Year 1 | 7,190,000 |

| Profit – Year 2 | 3,210,000 |

| 10,400,000 | |

| Retained earnings Dec. 31, Year 2 | 7,670,000 |

| Dividends Year 2 | 2,730,000 |

| Net monetary position | |||

| US$ | C$ | ||

| Balance Jan 1, Year 2 (US$4,890,000 + | |||

| US$1,090,000 − US$4,990,000 − US$2,590,000) | (1,600,000 | 1.10 | (1,760,000 |

| Changes − Year 2 | |||

| Sales | 49,000,000 | 1.08 | 52,920,000 |

| Purchases | (38,220,000 | 1.08 | (41,277,600 |

| Other expenses | (6,270,000 | 1.08 | (6,771,600 |

| Dividends | (2,730,000 | 1.07 | (2,921,100 |

| Calculated monetary position | 180,000 | 189,700 | |

| Actual monetary position (US$6,290,000 + | |||

| US$970,000 − US$4,990,000 − US$2,090,000) | 180,000 | 1.05 | 189,000 |

| Exchange gain − Year 2 | (700 |

,,, Please click on the Icon below to purchase the full answer at only $10