Assignment 5 (Chapters 6 & 7)

Paper Corp. purchased 70% of the outstanding shares of Sand Ltd. on January 1, Year 2, at a cost of $84,000. Paper has always used the equity method to account for its investments. On January 1, Year 2, Sand had common shares of $50,000 and retained earnings of $30,000, and fair values were equal to carrying amounts for all its net assets, except inventory (fair value was $9,000 less than carrying amount) and equipment (fair value was $24,000 greater than carrying amount). The equipment, which is used for research, had an estimated remaining life of six years on January 1, Year 2.

The following are the financial statements of Paper Corp. and its subsidiary Sand Ltd. as at December 31, Year 5:

| BALANCE SHEETS | |||||

| At December 31, Year 5 | |||||

| Paper | Sand | ||||

| Cash | $ | – | $ | 10,000 | |

| Accounts receivable | 36,000 | 25,000 | |||

| Note receivable | – | 45,000 | |||

| Inventory | 66,000 | 44,000 | |||

| Equipment (net) | 220,000 | 76,000 | |||

| Land | 155,000 | 30,000 | |||

| Investment in Sand | 110,250 | – | |||

| $ | 587,250 | $ | 230,000 | ||

| Bank indebtedness | $ | 90,000 | $ | – | |

| Accounts payable | 50,000 | 60,000 | |||

| Notes payable | 45,000 | – | |||

| Common shares | 150,000 | 50,000 | |||

| Retained earnings | 252,250 | 120,000 | |||

| $ | 587,250 | $ | 230,000 | ||

| INCOME STATEMENTS | |||||

| For the year ended December 31, Year 5 | |||||

| Paper | Sand | ||||

| Sales | $ | 798,000 | $ | 300,000 | |

| Management fee revenue | 24,000 | – | |||

| Equity method income from Sand | 1,050 | – | |||

| Interest income | – | 3,600 | |||

| Gain on sale of land | – | 25,000 | |||

| 823,050 | 328,600 | ||||

| Cost of sales | 480,000 | 200,000 | |||

| Research and development expenses | 40,000 | 12,000 | |||

| Interest expense | 10,000 | – | |||

| Miscellaneous expenses | 106,000 | 31,600 | |||

| Income taxes | 80,000 | 34,000 | |||

| 716,000 | 277,600 | ||||

| Net income | $ | 107,050 | $ | 51,000 | |

Additional Information

- During Year 5, Sand made a cash payment of $2,000 per month to Paper for management fees, which is included in Sand’s Miscellaneous expenses.

- During Year 5, Paper made intercompany sales of $100,000 to Sand. The December 31, Year 5, inventory of Sand contained goods purchased from Paper amounting to $30,000. These sales had a gross profit of 35%.

- On April 1, Year 5, Paper acquired land from Sand for $45,000. This land had been recorded on Sand’s books at a carrying amount of $20,000. Paper paid for the land by signing a $45,000 note payable to Sand, bearing yearly interest at 8%. Interest for Year 5 was paid by Paper in cash on December 31, Year 5. This land was still being held by Paper on December 31, Year 5.

- The value of consolidated goodwill remained unchanged from January 1, Year 2, to July Year 5. On July 1, Year 5, a valuation was performed, indicating that the recoverable amount of consolidated goodwill was $3,500.

- During the year ended December 31, Year 5, Paper paid dividends of $80,000 and Sand paid dividends of $20,000.

- Sand and Paper pay taxes at a 40% rate. Assume that none of the gains or losses were capital gains or losses.

Required:

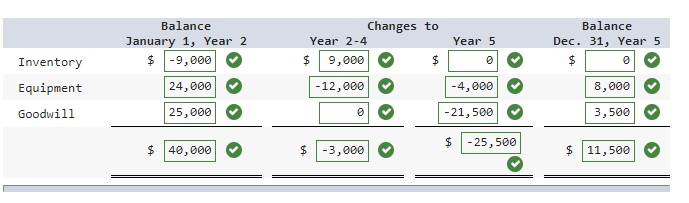

(a) Prepare, in good form, a calculation of goodwill and any undepleted acquisition differential as of December 31, Year 5. (Negative amounts should be indicated by a minus sign. Leave no cells blank – be certain to enter “0” wherever required. Omit $ sign in your response.)

(b) Prepare Paper’s consolidated income statement for the year ended December 31, Year 5, with expenses classified by function.

(c) Calculate the following balances that would appear on Paper’s consolidated balance sheet as at December 31, Year 5: (Leave no cells blank – be certain to enter “0” wherever required. Omit $ sign in your response.)

(i) Inventory

(ii) Land

(iii) Notes payable

(iv) Non-controlling interest

(v) Common shares

(d) Assume that an independent business valuator valued the non-controlling interest at $30,000 at the date of acquisition. Calculate goodwill impairment loss and profit attributable to non-controlling interest for the year ended December 31, Year 5. (Omit $ sign in your response.)

Question 2

Pure Company purchased 70% of the ordinary shares of Gold Company on January 1, Year 6, for $486,400 when the latter company’s accumulated depreciation, ordinary shares, and retained earnings were $76,900, $500,000, and $43,000, respectively. Noncontrolling interest was valued at $198,000 by an independent business valuator at the date of acquisition. On this date, an appraisal of the assets of Gold disclosed the following differences:

| Carrying amount | Fair value | |||||

| Land | $ | 170,000 | $ | 229,000 | ||

| Plant and equipment | 719,000 | 793,000 | ||||

| Inventory | 151,000 | 133,000 | ||||

The plant and equipment had an estimated life of 20 years on this date.

The statements of financial position of Pure and Gold, prepared on December 31, Year 11, follow:

| Pure | Gold | |||||||

| Land | $ | 116,000 | $ | 170,000 | ||||

| Plant and equipment | 644,000 | 964,000 | ||||||

| Less accumulated depreciation | (173,000 | ) | (202,000 | ) | ||||

| Patent (net of amortization) | 41,500 | |||||||

| Investment in Gold Co. shares (equity method) | 486,400 | |||||||

| Investment in Gold Co. bonds | 218,000 | |||||||

| Inventory | 244,000 | 191,000 | ||||||

| Accounts receivable | 234,150 | 182,000 | ||||||

| Cash | 51,670 | 60,200 | ||||||

| $ | 1,862,720 | $ | 1,365,200 | |||||

| Ordinary shares | $ | 750,000 | $ | 500,000 | ||||

| Retained earnings | 1,054,740 | 277,700 | ||||||

| Bonds payable (due Year 20) | 382,000 | |||||||

| Accounts payable | 57,980 | 205,500 | ||||||

| $ | 1,862,720 | $ | 1,365,200 | |||||

Additional Information

- Goodwill impairment tests have resulted in impairment losses totalling 60% of the goodwill at the date of acquisition.

- On January 1, Year 1, Gold issued $400,000 of 8 1/2% bonds at 90, maturing in 20 years (on December 31, Year 20).

- On January 1, Year 11, Pure acquired $200,000 of Gold’s bonds on the open market at a cost of $220,000.

- On July 1, Year 8, Gold sold a patent to Pure for $73,000. The patent had a carrying amount on Gold’s books of $52,000 on this date and an estimated remaining life of seven years.

- Pure uses tax allocation (40% rate) and allocates bond gains between affiliates when it consolidates Gold.

- Pure uses the cost method to account for its investment in Gold Company and the straight-line method to account for the amortization of bond premiums and discounts.

Required:

Prepare a consolidated statement of financial position as at December 31, Year 11. (Amounts to be deducted should be indicated with a minus sign.)

See Related Assignment: (Solution) MOS4465 Assignment 6 (Chapter 8)

100% Correct Solution with Explanation – Assignment 5 (Chapters 6 & 7)

Question 1

| Cost of 70% investment, January 1, Year 2 | 84,000 | ||

| Implied value of 100% investment | 120,000 | ||

| Common shares | 50,000 | ||

| Retained earnings | 30,000 | ||

| Total shareholders’ equity | 80,000 | ||

| Acquisition differential | 40,000 | ||

| Allocation: | |||

| Inventory | 9,000 | ||

| Equipment | 24,000 | 15,000 | |

| Goodwill as at January 1, Year 2 | 25,000 | ||

,,, Please click on the Icon below to purchase the full answer at only $10