MOS 3361 Assignment #3 – Chapter 14

Question 1 of 6

Tamarisk Ltd. issued a $1,094,000, 10-year bond dated January 1, 2023. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company’s year-end was December 31, and Tamarisk followed IFRS. Using 1. factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ORDINARY ANNUITY OF 1. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places e.g. 58,971.)

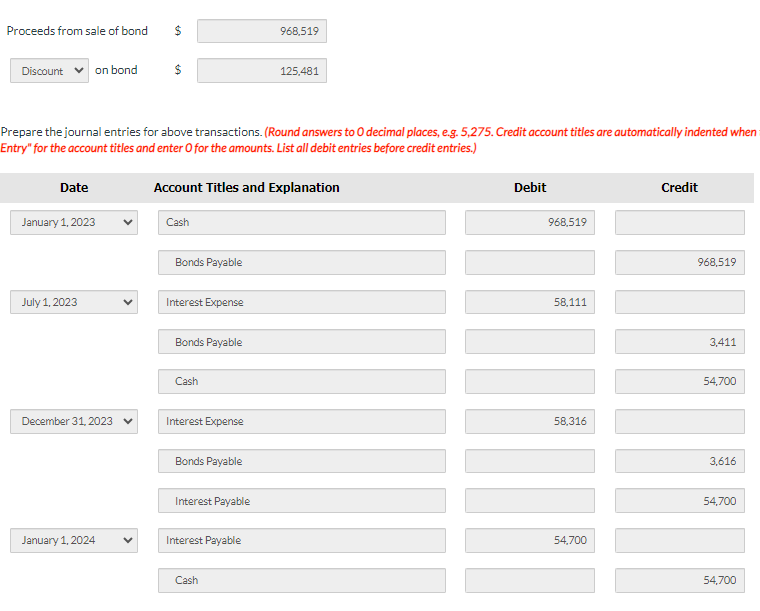

Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)

Question 2 of 6

Your answer is correct.

Kingbird Ltd. issued a $1,120,000, 10-year bond dated January 1, 2023. The bond was sold at 97. Interest was payable at the rate of 11% on the bond on January 1 and July 1 each year. The company’s year-end was December 31, and Kingbird followed ASPE, and chose to use the straight-line amortization method. Prepare the journal entries for the given dates. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

Question 3 of 6

On July 1, 2023, AWM Limited issued bonds with a face value of $1,060,000 due in 20 years, paying interest at a face rate of 6% on January 1 and July 1 each year. The bonds were issued to yield 8%. The company’s year-end was September 30. The company used the effective interest method of amortization.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ORDINARY ANNUITY OF 1.

(a) Using 1. factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the premium or discount on the bonds. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.)

(b) Prepare a partial Bond Premium/Discount Amortization Schedule for AWM Limited. Only prepare the entries in the schedule for July 1, 2023, January 1, 2024, and July 1, 2024. (Round answers to 0 decimal places, e.g. 5,275.)

(c) Prepare the journal entry to record the issue of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List debit entry before credit entry.)

(d) Prepare the year-end accrual entry for AWM Limited at September 30, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.)

(e) Prepare the journal entry on January 1, 2024 when AWM makes the first payment of interest on the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.)

Question 4 of 6

On January 1, 2023, DJN Corporation issued 13% bonds with a par value of $5,210,000, due in 10 years. The company incurred $174,000 in costs associated with the issuance of the bonds, which were capitalized. The bonds were issued at 102, and paid interest on January 1 and July 1 each year. DJN’s year-end was March 31. The company followed ASPE and chose to use the straight-line method of amortization for bond discounts or premiums.

Your answer is correct.

Prepare the journal entry to record the issue of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

Your answer is correct.

Prepare the entries required on March 31, 2023 to accrue interest and record any amortization required. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. List all debit entries before credit entries.)

Question 5 of 6

On May 1, 2020, JMM Ltd. issued a series of bonds in order to raise money for some upcoming projects. The bonds had a face value of $5,816,000 and matured in 10 years. Interest was payable at a face rate of 5% each April 30 and October 31. The bonds were issued to yield 6.00%.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

Your answer is correct.

Using 1. factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places e.g. 58,971.)

Prepare a bond discount/premium amortization table. (Round answers to 0 decimal places, e.g. 5,275.)

(c) In the years that followed, JMM encountered a number of highly profitable years, resulting in a surplus of cash. On August 1, 2025, the company repurchased and retired the entire bond issue at 114, plus accrued interest.

Calculate the amount of the gain or loss on early redemption of the bonds. (Round answer to 0 decimal places, e.g. 5,275.)

(d) Prepare a journal entry to accrue interest to the date of the redemption and the journal entry to record the redemption of the bonds plus accrued interest on August 1, 2025. (Round answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)

Question 6 of 6

Your answer is correct.

At December 31, 2023, Pronghorn Corporation has the following account balances:

| Bonds payable, due January 1, 2033 | $1,945,000 | |

| Interest payable | 73,000 |

Show how the above accounts should be presented on the December 31, 2023, statement of financial position, including the proper classifications.

Solution MOS 3361 Assignment #3 – Chapter 14

Question 1 of 6 – Tamarisk Ltd. issued a $1,094,000, 10-year bond dated January 1, 2023

1. Using factor tables:

| Face Value of the Bond | $1,094,000 | |

| Present value of $1,094,000 in 10 years at 12% | $341,114 | |

| Present value of $54,700 payments for 20 periods at 6% | 627,405 | |

| Proceeds from sale of bond | 968,519 | |

| Discount on bond | $125,481 |

2. Using a financial calculator:

| PV | $? | Yields $968,519 |

| I | 6% | |

| N | 20 | |

| PMT | $(54,700) | |

| FV | $(1,094,000) | |

| Type | 0 |

3. Using Excel: = PV(rate,nper,pmt,fv,type)

| Rate | 0.06 |

| Nper | 20 |

| PMT | (54,700) |

| FV | (1,094,000) |

| Type | 0 |

Result: $968,519.0619 Rounded $968,519

| July 1, 2023 | Interest Expense | = | ($968,519 × 12% × 6/12) | = | $58,111 |

| December 31, 2023 | Interest Payable | = | ($1,094,000 × 10% × 6/12) | = | $54,700 |

| December 31, 2023 | Interest Expense | = | [($968,519 + $3,411) × 12% × 6/12] | = | $58,316 |

Please click on the Icon below to purchase the full answer at only $10