MOS 3361 Assignment #2 – Chapter 18 100 Percent Correct Answers

Question 1 of 5

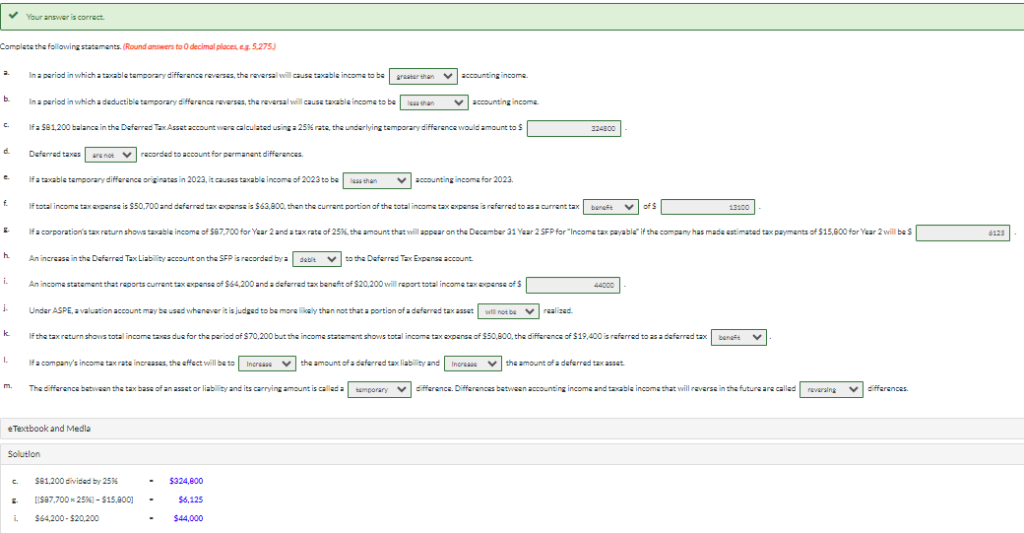

Your answer is correct.

Complete the following statements. (Round answers to 0 decimal places, e.g. 5,275.)

| a. | In a period in which a taxable temporary difference reverses, the reversal will cause taxable income to be accounting income. |

| b. | In a period in which a deductible temporary difference reverses, the reversal will cause taxable income to be accounting income. |

| c. | If a $81,200 balance in the Deferred Tax Asset account were calculated using a 25% rate, the underlying temporary difference would amount to $ . |

| d. | Deferred taxes to account for permanent differences. |

| e. | If a taxable temporary difference originates in 2023, it causes taxable income of 2023 to be accounting income for 2023. |

| f. | If total income tax expense is $50,700 and deferred tax expense is $63,800, then the current portion of the total income tax expense is referred to as a current tax of $ . |

| g. | If a corporation’s tax return shows taxable income of $87,700 for Year 2 and a tax rate of 25%, the amount that will appear on the December 31 Year 2 SFP for “Income tax payable” if the company has made estimated tax payments of $15,800 for Year 2 will be $ . |

| h. | An increase in the Deferred Tax Liability account on the SFP is recorded by a to the Deferred Tax Expense account. |

| i. | An income statement that reports current tax expense of $64,200 and a deferred tax benefit of $20,200 will report total income tax expense of $ . |

| j. | Under ASPE, a valuation account may be used whenever it is judged to be more likely than not that a portion of a deferred tax asset realized. |

| k. | If the tax return shows total income taxes due for the period of $70,200 but the income statement shows total income tax expense of $50,800, the difference of $19,400 is referred to as a deferred tax . |

| l. | If a company’s income tax rate increases, the effect will be to the amount of a deferred tax liability and answer the amount of a deferred tax asset. |

| m. | The difference between the tax base of an asset or liability and its carrying amount is called a difference. Differences between accounting income and taxable income that will reverse in the future are called differences. |

Question 2 of 5

Wildhorse Enterprises Ltd., a private company following ASPE earned accounting income before taxes of $1,730,000 for the year ended December 31, 2023.

During 2023, Wildhorse paid $220,000 for meals and entertainment expenses.

In 2020, Wildhorse’s tax accountant made a mistake when preparing the company’s income tax return. In 2023, Wildhorse paid $19,000 in penalties related to this error. These penalties were not deductible for tax purposes.

Wildhorse owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At the beginning of 2023, Wildhorse rented the building to SPK Inc. for two years at $251,000 per year. SPK paid the entire two years’ rent in advance.

Wildhorse used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $396,000. For tax purposes, Wildhorse claimed the maximum capital cost allowance of $621,000.

Wildhorse began to sell its products with a two-year warranty against manufacturing defects in 2023 to match a warranty introduced by its main competitor. In 2023, Wildhorse accrued $590,000 of warranty expenses: actual expenditures for 2023 were $281,000 with the remaining $309,000 anticipated in 2024.

In 2023, Wildhorse was subject to a 35% income tax rate. During the year, the federal government announced that tax rates would be decreased to 33% for all future years beginning January 1, 2024.

Your answer is correct.

Calculate the amount of any permanent differences for 2023.

(b)

Your answer is correct.

Calculate the amount of any temporary differences for 2023.

(c)

Your answer is correct.

Calculate taxable income and the amount of current income tax expense for 2023.

(d)

Your answer is correct.

Record current income tax for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

(e)

Your answer is correct.

Calculate the amount of any future tax asset and/or liability for 2023.

Your answer is correct.

Record future income taxes for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

Question 3 of 5

For the year ended December 31, 2023, Windsor Ltd. reported income before income taxes of $92,000.

In 2023, Windsor Ltd. paid $60,000 for rent; of this amount, $20,000 was expensed in 2023. The remaining $40,000 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 2024-2025 period. The full $60,000 was deductible for tax purposes in 2023.

The company paid $68,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes).

In 2023 Windsor Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $49,000, of which $33,000 was actual repairs for 2023 and the remaining $16,000 was estimated repairs to be completed in 2024.

Meal and entertainment expenses totalled $23,000 in 2023, only half of which were deductible for income tax purposes.

Depreciation expense for 2023 was $240,000. Capital Cost Allowance (CCA) claimed for the year was $261,000.

Windsor was subject to a 20% income tax rate for 2023. Windsor follows IFRS.

Your answer is correct.

Calculate the amount of any permanent differences for 2023.

Your answer is correct.

Calculate the amount of any temporary differences for 2023.

(c)

Your answer is correct.

Calculate taxable income and the amount of current income taxes expense for 2023.

(d)

Your answer is correct.

Record current income taxes for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

(e)

Your answer is incorrect.

Calculate the amount of any deferred tax asset and/or liability for 2023.

(f)

Your answer is partially correct.

Record deferred income taxes for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

Question 4 of 5

In 2023, Whispering Ltd., which follows IFRS, reported accounting income of $1,166,000 and the 2023 tax rate was 20%. Whispering had two timing differences for tax purposes:

CCA on the company’s tax return was $490,000. Depreciation expense on the financial statements was $297,000. These amounts relate to assets that were acquired on January 1, 2023, for $1,960,000.

Accrued warranty expense for financial statement purposes was $141,800 (accrued expenses are not deductible for tax purposes). This is the first year Whispering offers warranties.

Both of these timing differences are expected to fully reverse over the next four years, with the following enacted tax rates:

| Year | Depreciation Difference | Warranty Expense | Rate | |||

| 2024 | $59,000 | $21,000 | 20% | |||

| 2025 | 55,500 | 28,900 | 20% | |||

| 2026 | 46,000 | 41,100 | 18% | |||

| 2027 | 32,500 | 50,800 | 18% | |||

| $193,000 | $141,800 |

- Calculate income taxes payable for 2023.

- Prepare the journal entry to record current income taxes for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

- Prepare the journal entry to record deferred income taxes for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

- In 2024 the government announced a further tax rate reduction will be effective for the 2027 taxation year. The new rate will be 15%. Prepare the journal entry to adjust deferred taxes for the reduced rate. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

Related: Solution MOS 3361 Assignment #3 – Chapter 14

Question 5 of 5

Your answer is correct.

In 2023, Tamarisk Inc. reported pretax accounting income of $131,900. In 2024, the company had a pretax accounting income of $62,700. In 2025, the company had pretax losses of $215,900. The following year, the company’s pretax accounting income was $171,300. Income for tax purposes was the same as for accounting for all years. Tamarisk’s tax rate was 25% for 2023 and 2024, 28% for 2025 and 26% for 2026 and subsequent years. The tax rates were all enacted by the beginning of 2023.

Prepare the journal entries for the years 2023 to 2026 to record income taxes. Assume that Tamarisk’s policy is to carry back any tax losses first, and that at the end of 2025, the loss carryforward benefits are judged more likely than not to be realized in the future. Tamarisk follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

Solution – Correct Answers MOS 3361 Assignment #2 – Chapter 18

Question 1 of 5 – Complete the following statements

a. In a period in which a taxable temporary difference reverses, the reversal will cause taxable income to be GREATER THAN accounting income.

b. In a period in which a deductible temporary difference reverses, the reversal will cause taxable income to be LESS THAN accounting income.

c. If a $81,200 balance in the Deferred Tax Asset account were calculated using a 25% rate, the underlying temporary difference would amount to $ 324800 .

d. Deferred taxes ARE NOT to account for permanent differences.

e. If a taxable temporary difference originates in 2023, it causes taxable income of 2023 to be LESS THAN accounting income for 2023.

f. If total income tax expense is $50,700 and deferred tax expense is $63,800, then the current portion of the total income tax expense is referred to as a current tax BENEFIT of $ 13100 .

g. If a corporation’s tax return shows taxable income of $87,700 for Year 2 and a tax rate of 25%, the amount that will appear on the December 31 Year 2 SFP for “Income tax payable” if the company has made estimated tax payments of $15,800 for Year 2 will be $ 6125 .

h. An increase in the Deferred Tax Liability account on the SFP is recorded by a DEBIT to the Deferred Tax Expense account.

i. An income statement that reports current tax expense of $64,200 and a deferred tax benefit of $20,200 will report total income tax expense of $ 44000 .

j. Under ASPE, a valuation account may be used whenever it is judged to be more likely than not that a portion of a deferred tax asset WILL NOT BE realized.

k. If the tax return shows total income taxes due for the period of $70,200 but the income statement shows total income tax expense of $50,800, the difference of $19,400 is referred to as a deferred tax BENEFIT .

l. If a company’s income tax rate increases, the effect will be to INCREASE the amount of a deferred tax liability and INCREASE answer the amount of a deferred tax asset.

m. The difference between the tax base of an asset or liability and its carrying amount is called a TEMPORARY difference. Differences between accounting income and taxable income that will reverse in the future are called REVERSING differences.

Please click on the Icon below to purchase the full answer at only $10