MOS 3361 Assignment #1 – Chapter 13

Question 1 of 6

Your answer is correct.

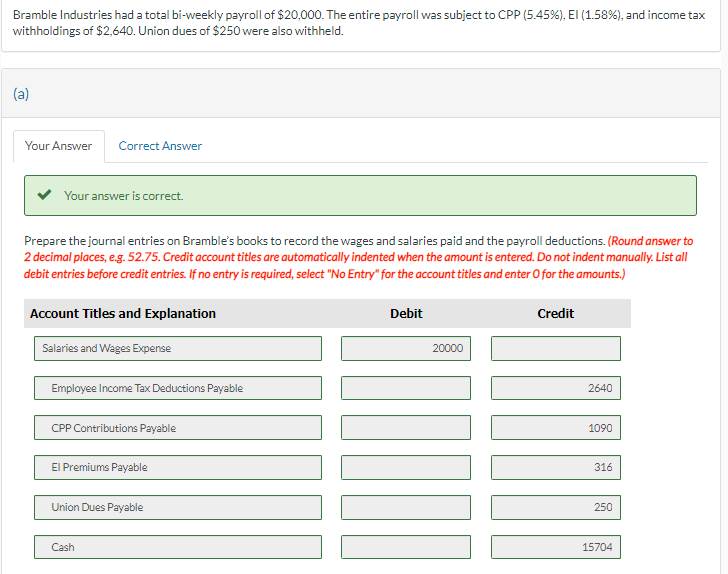

Bramble Industries had a total bi-weekly payroll of $20,000. The entire payroll was subject to CPP (5.45%), EI (1.58%), and income tax withholdings of $2,640. Union dues of $250 were also withheld.

Prepare the journal entries on Bramble’s books to record the wages and salaries paid and the payroll deductions. (Round answer to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

Prepare the journal entries on Bramble’s books to record the employer payroll contributions. (Round answer to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

Prepare the journal entries on Bramble’s books to record the remittance to the Receiver General for Canada for the above-described payroll. (Round answer to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

Question 2 of 6

Your answer is correct.

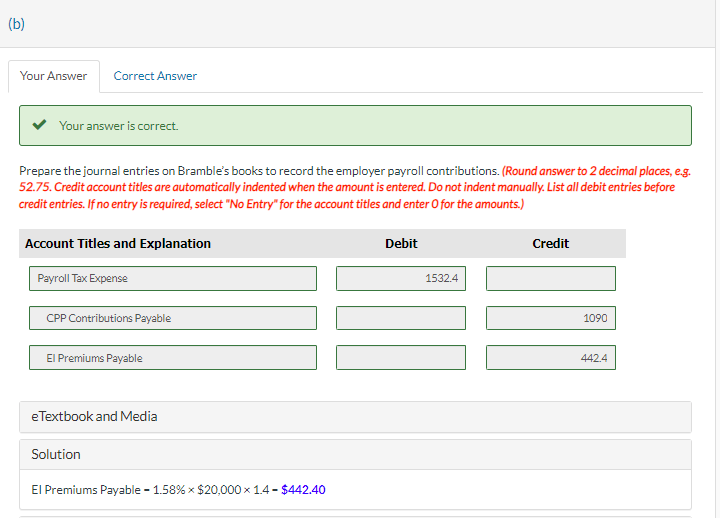

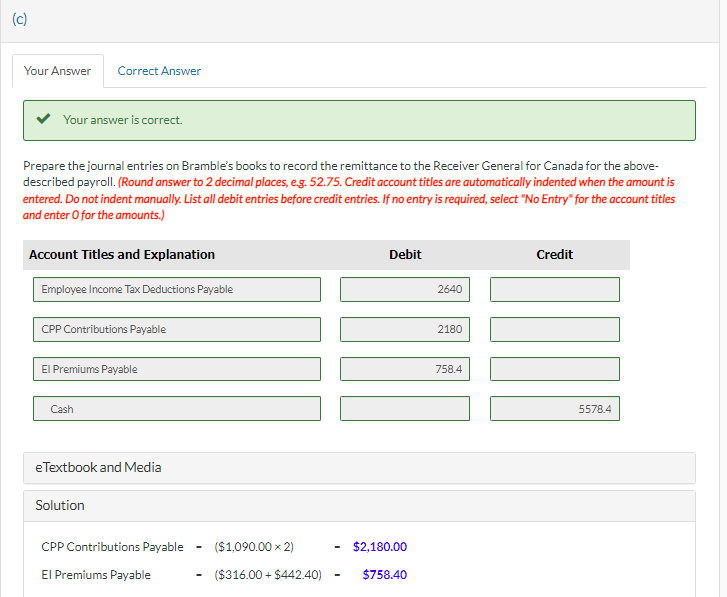

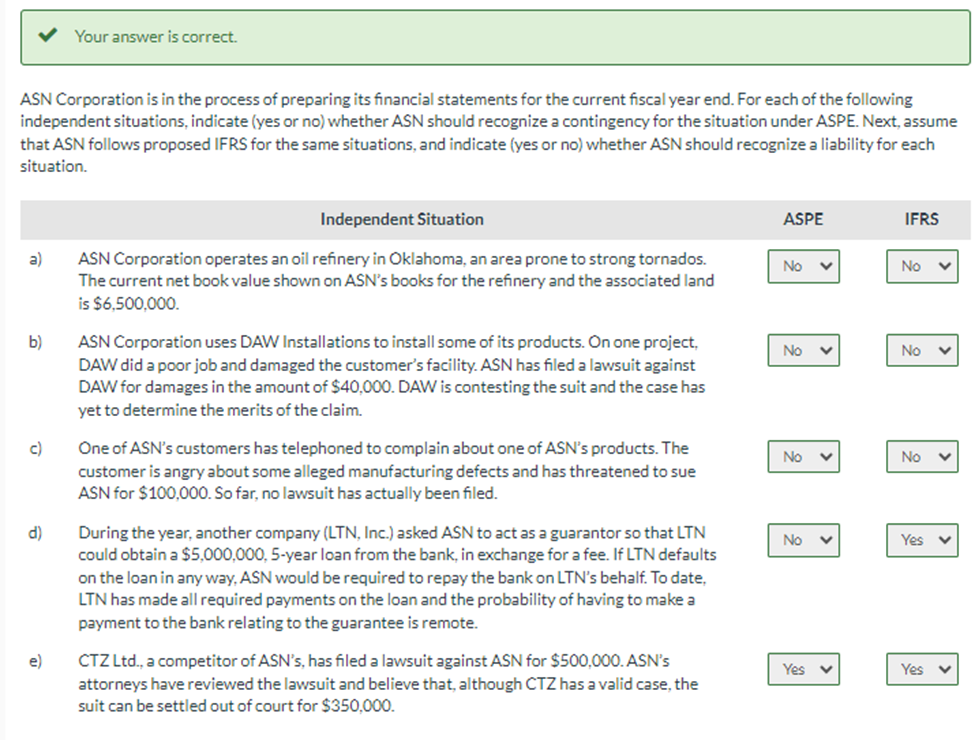

ASN Corporation is in the process of preparing its financial statements for the current fiscal year end. For each of the following independent situations, indicate (yes or no) whether ASN should recognize a contingency for the situation under ASPE. Next, assume that ASN follows proposed IFRS for the same situations, and indicate (yes or no) whether ASN should recognize a liability for each situation.

| Independent Situation | ASPE | IFRS | |

| a | ASN Corporation operates an oil refinery in Oklahoma, an area prone to strong tornados. The current net book value shown on ASN’s books for the refinery and the associated land is $6,500,000. | ||

| b | ASN Corporation uses DAW Installations to install some of its products. On one project, DAW did a poor job and damaged the customer’s facility. ASN has filed a lawsuit against DAW for damages in the amount of $40,000. DAW is contesting the suit and the case has yet to determine the merits of the claim. | ||

| c | One of ASN’s customers has telephoned to complain about one of ASN’s products. The customer is angry about some alleged manufacturing defects and has threatened to sue ASN for $100,000. So far, no lawsuit has actually been filed. | ||

| d | During the year, another company (LTN, Inc.) asked ASN to act as a guarantor so that LTN could obtain a $5,000,000, 5-year loan from the bank, in exchange for a fee. If LTN defaults on the loan in any way, ASN would be required to repay the bank on LTN’s behalf. To date, LTN has made all required payments on the loan and the probability of having to make a payment to the bank relating to the guarantee is remote. | ||

| e | CTZ Ltd., a competitor of ASN’s, has filed a lawsuit against ASN for $500,000. ASN’s attorneys have reviewed the lawsuit and believe that, although CTZ has a valid case, the suit can be settled out of court for $350,000. |

Question 3 of 6

CAL Corporation began operations January 1, 2022. Given the below information for CAL Corporation, calculate the following ratios and identify for each whether or not there has been a year-over-year improvement or deterioration:

| CAL Corporation | ||||

| Balance Sheet | ||||

| 2024 | 2023 | |||

| Cash | $19,000 | $13,000 | ||

| Accounts Receivable | 29,100 | 20,000 | ||

| Inventory | 14,800 | 11,000 | ||

| Total Current Assets | 62,900 | 44,000 | ||

| Property, Plant & Equipment | 82,000 | 69,000 | ||

| Total Assets | $144,900 | $113,000 | ||

| Accounts Payable | $22,000 | $11,000 | ||

| Unearned Revenue | 15,000 | 11,000 | ||

| Note Payable (due 2026) | 55,000 | 55,000 | ||

| Total Liabilities | 92,000 | 77,000 | ||

| Common Shares | 22,000 | 22,000 | ||

| Retained Earnings | 30,900 | 14,000 | ||

| Shareholders’ Equity | 52,900 | 36,000 | ||

| Total Liabilities & Equity | $144,900 | $113,000 | ||

Your answer is correct.

| Current ratio. (Round answers to 1 decimal place, e.g. 6.2.) The current ratio has . |

| There has been a year-over-year . |

Your answer is correct.

| Acid-test ratio. (Round answers to 1 decimal place, e.g. 6.2.) The acid-test ratio has select an |

| There has been a year-over-year |

Your answer is correct.

| Days payables outstanding assuming COGS of $162,000 and $79,000 for the years 2024 and 2023, respectively. Accounts payable on January 1, 2023 totalled $11,000. (Use 365 days for calculation. Round answers to 0 decimal places, e.g. 62.) The ratio has |

| There has been a year-over-year im |

Question 4 of 6

DJN Corp. manufactures a wide range of equipment. The company’s biggest seller is the Whatchamacallit, which sells for $4,570 each. Starting in 2023 each Whatchamacallit now carries with it a two-year warranty against manufacturing defects. In addition to this warranty, customers can purchase an optional extended warranty for $1,520 extra that extends the Whatchamacallit’s warranty an additional two years. From experience with similar products, DJN Corp. has determined that each Whatchamacallit sold will average $1,010 in replacement parts (ignore labour costs for repairs). In 2023, the company sells 680 Whatchamacallits; 200 of these customers decide to purchase the optional extended warranty. Assume the revenue is earned evenly over the two-year contract. Also in 2023, the company incurred $165,000 in total repair costs (replacement parts out of inventory).

Your answer is correct.

Prepare the journal entry to record the sale of the Whatchamacallits and the extended warranties (sales would take place throughout the year; prepare only one entry at December 31, 2023 for the total sales). Ignore any cost of goods sold entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

(b)

Your answer is correct.

Prepare the 2023 journal entries related to the assurance-type warranties using the expense approach. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

(c)

Your answer is correct.

Assuming that the extended warranty period begins January 1, 2025 for all customers who purchased the extended warranty, prepare the journal entries at December 31, 2025 for the extended warranty. Assume that $134,000 in warranty costs were incurred in 2025. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

Question 5 of 6

Flounder’s Steelers Inc. (FSI) is a steel manufacturing company located in Ontario. On November 1, 2021, FSI acquired land on which it constructed a facility for steel manufacturing purposes. Since its manufacturing process produces excessive waste, the government of Ontario has imposed a requirement for FSI to clean up property. As part of its agreement with the province of Ontario, FSI is allowed to operate on this site for only 15 years after which time FSI estimates it will need to incur $2,300,000 to clean up the site. Flounder went ahead with the construction of the building and recognized the asset retirement obligation at that time.

The company’s discount rate is 5% and FSI reports under IFRS with a December 31 year-end.

Your answer is correct.

What adjusting journal entry should FSI have made to initially recognize the ARO under IFRS? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 0.52750 and round final answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

(b)

Your answer is correct.

What are the journal entries FSI should have recorded at its 2021 year-end? (Round answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

Question 6 of 6

Your answer is correct.

Described below are certain transactions of Blue Corporation Ltd.

Click here to view the factor table.

Click here to view the factor table.

Prepare the journal entries related to the event or transaction described. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)

a. On April 1, the corporation bought a truck for $52,000 paying $5,500 in cash and signing a 1-year, 8% note for the balance of the purchase price. The purchase is subject to PST at the rate of 8% and GST at the rate of 5%.

b. On May 1, the corporation borrowed cash from National Bank by signing a $80,500 zero-interest-bearing note due 1 year from May 1. Use tables from Appendix A, Excel or a financial calculator to calculate the amount of cash received assuming a 4% interest rate applies.

c. On August 1, the board of directors declared a $310,000 cash dividend that was payable on September 10 to shareholders of record on August 31. Record the declaration and payment of the dividend.

d. On November 1, the corporation received $22,800 from a tenant for three months rent beginning November 1.

e. On December 31, the cash sales for the month totaled $791,000, which includes the 8% PST and 5% GST that must be remitted to by the fifteenth day of the following month. (Ignore any cost of goods sold entry)

f. Prepare the December 31 adjusting entry for the 8% note and the payment of the note at maturity of April 1.

g. Prepare the December 31 adjusting entry for the 4% zero note and the payment of the note at maturity on May 1. Record the payment as two entries.

h. Prepare the December 31 adjusting entry concerning the rent payment from the tenant.

i. Prepare the remittance of the provincial sales tax for the December sales.

Related: (Solution) MOS 3361 Assignment #2 – Chapter 18

Solution MOS 3361 Assignment #1 – Chapter 13

Question 1 of 6

a.

CPP Contributions Payable = 5.45% x $20,000 = 1,090

EI Premiums Payable = 1.58% x $20,000 = $316

b.

c.

Question 2 of 6

Your answer is correct.

ASN Corporation is in the process of preparing its financial statements for the current fiscal year end. For each of the following independent situations, indicate (yes or no) whether ASN should recognize a contingency for the situation under ASPE. Next, assume that ASN follows proposed IFRS for the same situations, and indicate (yes or no) whether ASN should recognize a liability for each situation.

Answer with Explanation

ASPE: No. IFRS: No. Although the possibility of losing the facility to a tornado exists, the likelihood of the event cannot be determined with any accuracy. Also, no event has actually occurred to create an obligation (liability). Under proposed IFRS rules, no unconditional obligation exists, therefore no liability exists.

ASPE: No. IFRS: No. No accrual, since gain contingencies are never recorded until receipt is virtually assured. Since the other company is contesting the claim and no determination has been made on the merits of the case, no recognition should be made at this time.

ASPE: No. IFRS: No. Again, no event has occurred. Although the customer is threatening legal action, until a suit is actually filed, no event has taken place, and no unconditional liability exists.

ASPE: No. IFRS: Yes. The event that has taken place is the guarantee of the loan. Under ASPE, an accrual may not be required; however, note disclosure should be made for the remaining fair value of the loan. Under IFRS, the guarantee should be recognized at higher of 1. the best estimate of the payment that would be needed to settle the obligation at the reporting date and 2. any unamortized premium received as a fee for the guarantee (balance of unearned revenue).

ASPE: Yes. IFRS: Yes. Regardless whether the suit is settled in or out of court, it is highly likely that ASN will have to pay something. Under ASPE, a contingency should be recognized for the likely outcome ($350,000), and under IFRS a liability should be recognized for the same amount. Note disclosure should be made for the full amount of the lawsuit under both ASPE and IFRS.

… Please click on the Icon below to purchase the full answer at only $10