100% Correct MOS 4465 Assignment 2 Chapter 3 solutions

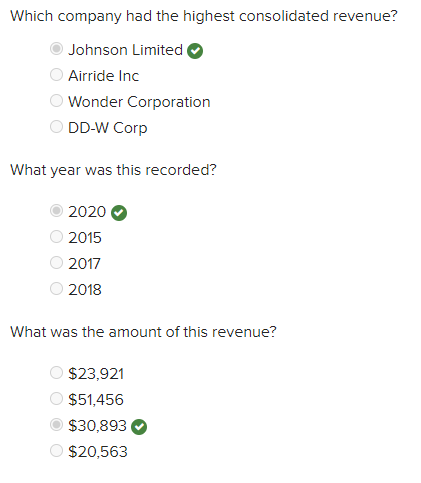

Which company had the highest consolidated revenue

This case introduces you to data analysis by allowing you to extract, visualize, and compare financial data over a span of 11 years, from 2010-2020, for six publicly traded companies whose identities have been disguised. The data is provided as an Excel file called “Ch03_CompanyData”.

For the case, assume you are an analyst conducting research into the relative performance and state of financial health of the companies.

For this question you will use PowerBI—instructions on how to create your visualization are included below. Once you have created your visualization you will refer to it to answer the included questions.

Instructions

If you do not already have Power BI, you can download a free version of Power BI desktop from Microsoft.com. After installing the application, you should be ready to import your data.

- To import your data, open the application and click get data, Import data from Excel and select the file you downloaded and click the transform button. This opens up a query window where you see a preview of your data. Ensure that the data is properly formatted paying close attention that the variable “Year” is formatted as text. Click the “Close & Apply” button on the top left corner of the screen. Once your data is imported, you should see the worksheet name under the Fields pane in the right most part of your screen. This blank canvas labelled page 1, will be the starting point of your task. You can change this label to whatever you wish. Now you are ready to perform your visualizations.

- To begin creating your visualization, create the report you want to visualize, by selecting the variables of interest – Company name, Consolidated net income and Year. This will create a Table showing the data. Next, click on the visualization of your choice on the right side of the screen. A clustered column chart yields an acceptable format. Ensure that “Company name” is in the Axis and the values are of the variables that you are interested in.

Present a visualization that shows the consolidated net income for each company for the years from 2010 – 2020. Using this visualization, answer the following questions.

Which company had the highest consolidated revenue? multiple choice

- Johnson Limited

- Airride Inc

- Wonder Corporation

- DD-W Corp

What year was this recorded? multiple choice

- 2020

- 2015

- 2017

- 2018

What was the amount of this revenue? multiple choice

- $23,921

- $51,456

- $30,893

- $20,563

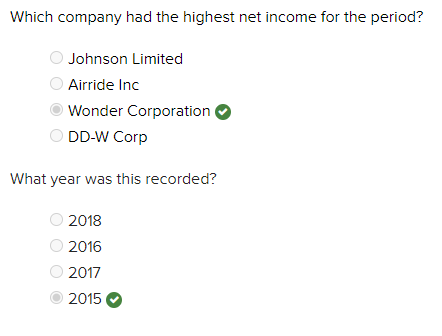

Which company had the highest net income for the period

This case introduces you to data analysis by allowing you to extract, visualize, and compare financial data over a span of 11 years, from 2010-2020, for six publicly traded companies whose identities have been disguised. The data is provided as an Excel file called “Ch03_CompanyData”.

For the case, assume you are an analyst conducting research into the relative performance and state of financial health of the companies.

For this question you will use PowerBI—instructions on how to create your visualization are included below. Once you have created your visualization you will refer to it to answer the included questions.

Instructions

If you do not already have Power BI, you can download a free version of Power BI desktop from Microsoft.com. After installing the application, you should be ready to import your data.

- To import your data, open the application and click get data, Import data from Excel and select the file you downloaded and click the transform button. This opens up a query window where you see a preview of your data. Ensure that the data is properly formatted paying close attention that the variable “Year” is formatted as text. Click the “Close & Apply” button on the top left corner of the screen. Once your data is imported, you should see the worksheet name under the Fields pane in the right most part of your screen. This blank canvas labelled page 1, will be the starting point of your task. You can change this label to whatever you wish. Now you are ready to perform your visualizations.

- To begin creating your visualization, create the report you want to visualize, by selecting the variables of interest – Company name, Consolidated net income and Year. This will create a Table showing the data. Next, click on the visualization of your choice on the right side of the screen. A clustered column chart yields an acceptable format. Ensure that “Company name” is in the Axis and the values are of the variables that you are interested in.

Present a visualization that shows the consolidated net income for each company for the years from 2010 – 2020. Using this visualization, answer the following questions.

Which company had the highest net income for the period? multiple choice

- Johnson Limited

- Airride Inc

- Wonder Corporation Correct

- DD-W Corp

What year was this recorded? multiple choice

- 2018

- 2016

- 2017

- 2015 Correct

Which companies reported only profits during the period in question

This case introduces you to data analysis by allowing you to extract, visualize, and compare financial data over a span of 11 years, from 2010-2020, for six publicly traded companies whose identities have been disguised. The data is provided as an Excel file called “Ch03_CompanyData”.

For the case, assume you are an analyst conducting research into the relative performance and state of financial health of the companies.

For this question you will use PowerBI—instructions on how to create your visualization are included below. Once you have created your visualization you will refer to it to answer the included questions.

Instructions

If you do not already have Power BI, you can download a free version of Power BI desktop from Microsoft.com. After installing the application, you should be ready to import your data.

- To import your data, open the application and click get data, Import data from Excel and select the file you downloaded and click the transform button. This opens up a query window where you see a preview of your data. Ensure that the data is properly formatted paying close attention that the variable “Year” is formatted as text. Click the “Close & Apply” button on the top left corner of the screen. Once your data is imported, you should see the worksheet name under the Fields pane in the right most part of your screen. This blank canvas labelled page 1, will be the starting point of your task. You can change this label to whatever you wish. Now you are ready to perform your visualizations.

- To begin creating your visualization, create the report you want to visualize, by selecting the variables of interest – Company name, Consolidated net income and Year. This will create a Table showing the data. Next, click on the visualization of your choice on the right side of the screen. A clustered column chart yields an acceptable format. Ensure that “Company name” is in the Axis and the values are of the variables that you are interested in.

Present a visualization that shows the consolidated net income for each company for the years from 2010 – 2020. Using this visualization, answer the following questions.

Which companies reported only profits during the period in question? Multiple Choice

- Wonder Corporation, DD-W and Skylight Inc.

- Johnson Limited and Coolridge Inc. and Airride Inc.

- Coolridge Inc., DD-W Corp., and Skylight Inc.

- DD-W Corp. and Skylight Inc. only

Which company recorded the highest loss during the period

This case introduces you to data analysis by allowing you to extract, visualize, and compare financial data over a span of 11 years, from 2010-2020, for six publicly traded companies whose identities have been disguised. The data is provided as an Excel file called “Ch03_CompanyData”.

For the case, assume you are an analyst conducting research into the relative performance and state of financial health of the companies.

For this question you will use PowerBI—instructions on how to create your visualization are included below. Once you have created your visualization you will refer to it to answer the included questions.

Instructions

If you do not already have Power BI, you can download a free version of Power BI desktop from Microsoft.com. After installing the application, you should be ready to import your data.

- To import your data, open the application and click get data, Import data from Excel and select the file you downloaded and click the transform button. This opens up a query window where you see a preview of your data. Ensure that the data is properly formatted paying close attention that the variable “Year” is formatted as text. Click the “Close & Apply” button on the top left corner of the screen. Once your data is imported, you should see the worksheet name under the Fields pane in the right most part of your screen. This blank canvas labelled page 1, will be the starting point of your task. You can change this label to whatever you wish. Now you are ready to perform your visualizations.

- To begin creating your visualization, create the report you want to visualize, by selecting the variables of interest – Company name, Consolidated net income and Year. This will create a Table showing the data. Next, click on the visualization of your choice on the right side of the screen. A clustered column chart yields an acceptable format. Ensure that “Company name” is in the Axis and the values are of the variables that you are interested in.

Present a visualization that shows the consolidated net income for each company for the years from 2010 – 2020. Using this visualization, answer the following questions.

Which company recorded the highest loss during the period? Multiple Choice

- Johnson Limited

- Airride Inc

- Wonder Corporation

- DD-W Corp

What was the amount of the highest loss reported for the period and in what year was it recorded

This case introduces you to data analysis by allowing you to extract, visualize, and compare financial data over a span of 11 years, from 2010-2020, for six publicly traded companies whose identities have been disguised. The data is provided as an Excel file called “Ch03_CompanyData”.

For the case, assume you are an analyst conducting research into the relative performance and state of financial health of the companies.

For this question you will use PowerBI—instructions on how to create your visualization are included below. Once you have created your visualization you will refer to it to answer the included questions.

Instructions

If you do not already have Power BI, you can download a free version of Power BI desktop from Microsoft.com. After installing the application, you should be ready to import your data.

- To import your data, open the application and click get data, Import data from Excel and select the file you downloaded and click the transform button. This opens up a query window where you see a preview of your data. Ensure that the data is properly formatted paying close attention that the variable “Year” is formatted as text. Click the “Close & Apply” button on the top left corner of the screen. Once your data is imported, you should see the worksheet name under the Fields pane in the right most part of your screen. This blank canvas labelled page 1, will be the starting point of your task. You can change this label to whatever you wish. Now you are ready to perform your visualizations.

- To begin creating your visualization, create the report you want to visualize, by selecting the variables of interest – Company name, Consolidated net income and Year. This will create a Table showing the data. Next, click on the visualization of your choice on the right side of the screen. A clustered column chart yields an acceptable format. Ensure that “Company name” is in the Axis and the values are of the variables that you are interested in.

Present a visualization that shows the consolidated net income for each company for the years from 2010 – 2020. Using this visualization, answer the following questions.

What was the amount of the highest loss reported for the period and in what year was it recorded? Multiple Choice

- $307; 2018

- $307; 2020

- $1,718; 2017

- $1,082; 2020

Which company showed the largest increase in net income

This case introduces you to data analysis by allowing you to extract, visualize, and compare financial data over a span of 11 years, from 2010-2020, for six publicly traded companies whose identities have been disguised. The data is provided as an Excel file called “Ch03_CompanyData”.

For the case, assume you are an analyst conducting research into the relative performance and state of financial health of the companies.

For this question you will use PowerBI—instructions on how to create your visualization are included below. Once you have created your visualization you will refer to it to answer the included questions.

Instructions

If you do not already have Power BI, you can download a free version of Power BI desktop from Microsoft.com. After installing the application, you should be ready to import your data.

- To import your data, open the application and click get data, Import data from Excel and select the file you downloaded and click the transform button. This opens up a query window where you see a preview of your data. Ensure that the data is properly formatted paying close attention that the variable “Year” is formatted as text. Click the “Close & Apply” button on the top left corner of the screen. Once your data is imported, you should see the worksheet name under the Fields pane in the right most part of your screen. This blank canvas labelled page 1, will be the starting point of your task. You can change this label to whatever you wish. Now you are ready to perform your visualizations.

- To begin creating your visualization, create the report you want to visualize, by selecting the variables of interest – Company name, Consolidated net income and Year. This will create a Table showing the data. Next, click on the visualization of your choice on the right side of the screen. A clustered column chart yields an acceptable format. Ensure that “Company name” is in the Axis and the values are of the variables that you are interested in.

Present a visualization that shows the consolidated net income for each company for the years from 2010 – 2020. Using this visualization, answer the following questions.

In 2020, which company showed the largest increase in net income? Multiple Choice

- Airride Inc.

- Coolridge Inc

- DD-W

- Skylight Inc.

Which company showed the largest decline in net income

This case introduces you to data analysis by allowing you to extract, visualize, and compare financial data over a span of 11 years, from 2010-2020, for six publicly traded companies whose identities have been disguised. The data is provided as an Excel file called “Ch03_CompanyData”.

For the case, assume you are an analyst conducting research into the relative performance and state of financial health of the companies.

For this question you will use PowerBI—instructions on how to create your visualization are included below. Once you have created your visualization you will refer to it to answer the included questions.

Instructions

If you do not already have Power BI, you can download a free version of Power BI desktop from Microsoft.com. After installing the application, you should be ready to import your data.

- To import your data, open the application and click get data, Import data from Excel and select the file you downloaded and click the transform button. This opens up a query window where you see a preview of your data. Ensure that the data is properly formatted paying close attention that the variable “Year” is formatted as text. Click the “Close & Apply” button on the top left corner of the screen. Once your data is imported, you should see the worksheet name under the Fields pane in the right most part of your screen. This blank canvas labelled page 1, will be the starting point of your task. You can change this label to whatever you wish. Now you are ready to perform your visualizations.

- To begin creating your visualization, create the report you want to visualize, by selecting the variables of interest – Company name, Consolidated net income and Year. This will create a Table showing the data. Next, click on the visualization of your choice on the right side of the screen. A clustered column chart yields an acceptable format. Ensure that “Company name” is in the Axis and the values are of the variables that you are interested in.

Present a visualization that shows the consolidated net income for each company for the years from 2010 – 2020. Using this visualization, answer the following questions.

In 2020, which company showed the largest decline in net income? Multiple Choice

- Coolridge Inc.

- Johnson Limited

- Wonder CorporationCorrect

- Skylight Inc.

The balance sheets of Abdul Co. and Lana Co. on June 30

The balance sheets of Abdul Co. and Lana Co. on June 30, Year 2, just before the transaction described below, were as follows:

| Abdul | Lana | |||

| Cash and receivables | $ | 93,000 | $ | 20,150 |

| Inventory | 60,500 | 8,150 | ||

| Plant assets (net) | 236,000 | 66,350 | ||

| $ | 389,500 | $ | 94,650 | |

| Current liabilities | $ | 65,500 | $ | 27,600 |

| Long-term debt | 94,250 | 40,100 | ||

| Common shares | 140,500 | 40,050 | ||

| Retained earnings (deficit) | 89,250 | (13,100) | ||

| $ | 389,500 | $ | 94,650 | |

On June 30, Year 2, Abdul Co. purchased all of Lana Co. assets and assumed all of Lana Co. liabilities for $58,000 in cash. The carrying amounts of Lana’s net assets were equal to fair value except for the following:

| Fair Value | |

| Inventory | $10,050 |

| Plant assets | 70,100 |

| Long-term debt | 33,800 |

Required:

(a) Prepare the journal entries for Abdul Co. and for Lana Co. to record this transaction. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

(b) Prepare balance sheets for Abdul Co. and Lana Co. at June 30, Year 2, after recording the transaction noted above. (Leave no cells blank – be certain to enter “0” wherever required. Omit $ sign in your response.)

The July 31, Year 3, balance sheets of two companies that are parties to a business combination

The July 31, Year 3, balance sheets of two companies that are parties to a business combination are as follows:

| Red Corp. | Sax Inc. | ||||||||

| Carrying Amount | Carrying Amount | Fair Value | |||||||

| Current assets | $ | 1,760,000 | $ | 436,000 | $ | 484,000 | |||

| Property, plant and equipment (net) | 1,272,000 | 856,000 | 988,000 | ||||||

| Patents | – | – | 88,000 | ||||||

| $ | 3,032,000 | $ | 1,292,000 | ||||||

| Current liabilities | $ | 1,520,000 | $ | 268,000 | 268,000 | ||||

| Long-term debt | 496,000 | 376,000 | 400,000 | ||||||

| Common shares | 880,000 | 184,000 | |||||||

| Retained earnings | 136,000 | 464,000 | |||||||

| $ | 3,032,000 | $ | 1,292,000 | ||||||

In addition to the property, plant and equipment identified above, Red Corp. attributed a value of $116,000 to Sax’s assembled workforce. They have the knowledge and skill to operate Sax’s manufacturing facility and are essential to the success of the operation. Although the eight manufacturing employees are not under any employment contracts, management of Red was willing to pay $116,000 as part of the purchase price on the belief that most or all of these employees would continue to work for the company.

Effective on August 1, Year 3, the shareholders of Sax accepted an offer from Red Corporation to purchase all of their common shares. Red’s costs for investigating and drawing up the share purchase agreement amounted to $14,000.

Required:

(a) Assume that Red made a $976,000 cash payment to the shareholders of Sax for 100% of their shares.

(i) Prepare the journal entry in the records of Red to record the share acquisition. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

(ii) Prepare the consolidated balance sheet of Red Corp. as at August 1, Year 3.

(b) Assume that Red issued 122,000 common shares, with a market value of $8 per share to the shareholders of Sax for 100% of their shares. Legal fees associated with issuing these shares amounted to $9,000 and were paid in cash. Red is identified as the acquirer.

(i) Prepare the journal entries in the records of Red to record the share acquisition and related fees. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

(ii) Prepare Red’s consolidated balance sheet as at August 1, Year 3.

(c) Assume the same facts as part (b) except that Red is a private company, uses ASPE, and chooses to use the cost method to account for its investment in Sax.

(i) Prepare the journal entries in the records of Red to record the share acquisition and related fees. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

(ii) Prepare the balance sheet of Red as at August 1, Year 3.

The financial statements for CAP Inc. and SAP Company for the year

The financial statements for CAP Inc. and SAP Company for the year ended December 31, Year 5, follow:

| CAP | SAP | |||||

| Revenues | $ | 918,000 | $ | 318,000 | ||

| Expenses | 669,000 | 209,000 | ||||

| Profit | $ | 249,000 | $ | 109,000 | ||

| Retained earnings, 1/1/Year 5 | $ | 809,000 | $ | 218,000 | ||

| Profit | 249,000 | 109,000 | ||||

| Dividends paid | 99,000 | 0 | ||||

| Retained earnings, 12/31/Year 5 | $ | 959,000 | $ | 327,000 | ||

| Equipment (net) | $ | 709,000 | $ | 609,000 | ||

| Patented technology (net) | 909,000 | 318,000 | ||||

| Receivables and inventory | 409,000 | 179,000 | ||||

| Cash | 89,000 | 119,000 | ||||

| Total assets | $ | 2,116,000 | $ | 1,225,000 | ||

| Ordinary shares | $ | 548,000 | $ | 479,000 | ||

| Retained earnings | 959,000 | 327,000 | ||||

| Liabilities | 609,000 | 419,000 | ||||

| Total equities and liabilities | $ | 2,116,000 | $ | 1,225,000 | ||

On December 31, Year 5, after the above figures were prepared, CAP issued $309,000 in debt and 13,800 new shares to the owners of SAP to purchase all of the outstanding shares of that company. CAP shares had a fair value of $49 per share.

CAP also paid $34,500 to a broker for arranging the transaction. In addition, CAP paid $49,000 in stock issuance costs. SAP’s equipment was actually worth $737,000 but its patented technology was valued at only $279,000.

Required:

What are the balances for the following accounts on the Year 5 consolidated financial statements? (Omit $ sign in your response.)

| (a) | Profit | |

| (b) | Retained earnings, 12/31/Year 5 | |

| (c) | Equipment | |

| (d) | Patented technology | |

| (e) | Goodwill | |

| (f) | Ordinary shares | |

| (g) | Liabilities | |

Solution

Which company had the highest consolidated revenue? multiple choice

- Johnson Limited

- Airride Inc

- Wonder Corporation

- DD-W Corp

Correct Answer – Johnson Limited

What year was this recorded? multiple choice

- 2020

- 2015

- 2017

- 2018

Correct Answer – 2020

What was the amount of this revenue? multiple choice

- $23,921

- $51,456

- $30,893

- $20,563

Correct Answer – $30,893

Please click on the Icon below to purchase the full answer at only $10