100% Correct MOS4465 Assignment 1 Chapter 1 & 2

Questions – MOS4465 Assignment 1 Chapter 1 & 2

Convert Moosomin’s financial statements for both Year 6 and Year 7 into common-sized financial statements

Selected financial information (in 000s) from the financial statements of Moosomin Ltd. for Years 6 and 7 is as follows:

| Year 6 | Year 7 | |||

| Sales revenue | $ | 1,470 | $ | 1,570 |

| Cost of goods sold | 770 | 905 | ||

| Other expenses | 440 | 325 | ||

| Net income | 260 | 340 | ||

| Current assets | 530 | 570 | ||

| Total assets | 1,720 | 1,810 | ||

| Total liabilities | 1,170 | 1,080 | ||

| Shareholders’ equity | 550 | 730 | ||

Required:

(a) Convert Moosomin’s financial statements for both Year 6 and Year 7 into common-sized financial statements using (Input all amounts as positive values. Round the final answers to the nearest whole percent. Omit % sign in your response.)

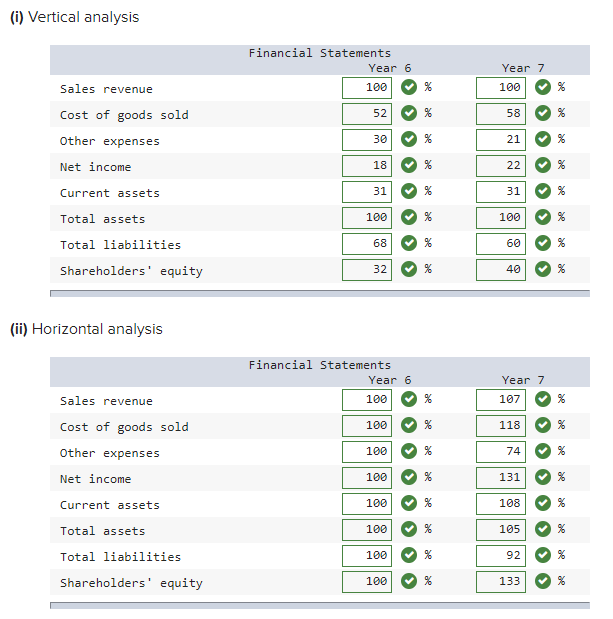

(i) Vertical analysis

(ii) Horizontal analysis

(b) Identify three financial statement items (other than net income) that seem to be the most peculiar relative to expectations. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)

check all that apply

- Sales revenue

- Cost of goods sold

- Other expenses

- Current assets

- Total assets

- Total liabilities

- Shareholders’ equity

Fast Ltd. is a public company that prepares its consolidated financial statements

Fast Ltd. is a public company that prepares its consolidated financial statements in accordance with IFRS. Its net income in Year 2 was $205,000, and shareholders’ equity at December 31, Year 2, was $1,850,000.

Mr. Lombardi, the major shareholder, has made an offer to buy out the other shareholders, delist the company, and take it private. Thereafter, the company will report under ASPE. You have identified the following two areas in which Fast’s accounting principles differ between IFRS and ASPE.

- Fast incurred research and development costs of $505,000 in Year 1. Thirty percent of these costs were related to development activities that met the criteria for capitalization as an intangible asset. The newly developed product was brought to market in January, Year 2 and is expected to generate sales revenue for 10 years.

- Fast acquired equipment at the beginning of Year 1 at a cost of $110,000. The equipment has a five-year life with no expected residual value and is depreciated on a straight-line basis. At December 31, Year 1, Fast compiled the following information related to this equipment:

| Expected future cash flows from use of the equipment | $ | 90,000 |

| Present value of expected future cash flows from use of the equipment | 80,000 | |

| Net realizable value | 77,000 | |

Required:

(a) Determine the amount at which Fast should report each of the following on its balance sheet at December 31, Year 2, using (1) IFRS and (2) ASPE. Ignore the possibility of any additional impairment or reversal of impairment loss at the end of Year 2. Assume that Fast wants to minimize net income. (Leave no cells blank – be certain to enter “0” wherever required. Omit $ sign in your response.)

(i) Research and development

(ii) Equipment

(b) Prepare a reconciliation of net income for Year 2 and shareholders’ equity at December 31, Year 2, under IFRS to an ASPE basis. (Omit $ sign in your response.)

Pender Corp. paid $285,000 for a 30% interest in Saltspring Limited

Pender Corp. paid $285,000 for a 30% interest in Saltspring Limited on January 1, Year 6. During Year 6, Saltspring paid dividends of $110,000 and reported profit as follows:

| Profit before discontinued operations | $339,000 | ||

| Discontinued operations loss (net of tax) | (33,000) | ||

| Profit | $306,000 | ||

Pender’s profit for Year 6 is calculated on $990,000 in sales, expenses of $110,000, income tax expense of $352,000, and its investment income from Saltspring. Both companies have an income tax rate of 40%.

Required:

(a) Assume that Pender reports its investment using the equity method.

(i) Prepare all journal entries necessary to account for Pender’s investment for Year 6. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

ii) Determine the correct balance in Pender’s investment account at December 31, Year 6. (Omit $ sign in your response.)

(iii) Prepare an income statement for Pender for Year 6. (Negative amounts and deductibles should be indicated by a minus sign. Omit $ sign in your response.)

b) Assume that Pender uses the cost method.

(i) Prepare all journal entries necessary to account for Pender’s investment for Year 6. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

(ii) Determine the correct balance in Pender’s investment account at December 31, Year 6. (Omit $ sign in your response.)Balance in Pender’s investment account $ 318,000 Numeric Response 11.Edit Unavailable. 318,000 incorrect.

(iii) Prepare an income statement for Pender for Year 6. (Negative amounts and deductibles should be indicated by a minus sign. Omit $ sign in your response.)

(c-1) Compute return on investment under the cost method and return on investment under the equity method. (Round your answers to 2 decimal place. Omit % sign in your response.)

(c-2) Which reporting method would Pender want to use if its bias is to report the highest possible return on investment to users of its financial statements? multiple choice

- Cost method

- Equity method Correct

Her Company purchased 26,000 common shares (20%) of Him Inc.

Her Company purchased 26,000 common shares (20%) of Him Inc. on January 1, Year 4, for $442,000. Additional information on Him for the three years ending December 31, Year 6, is as follows:

| Year | Net Income | Dividends Paid | Market Value per Share at December 31 |

| Year 4 | $260,000 | $195,000 | $18 |

| Year 5 | 292,500 | 208,000 | 20 |

| Year 6 | 312,000 | 227,500 | 23 |

On December 31, Year 6, Her sold its investment in Him for $598,000.

Required:

(a) Compute the balance in the investment account at the end of Year 5, assuming that the investment is classified as (Omit $ sign in your response.)

(i) FVTPL

(ii) Investment in associate

(iii) FVTOCI

(b) Calculate how much income will be reported in net income and other comprehensive income in each of Years 4, 5, and 6, and in total for the three years assuming that the investment is classified as (Leave no cells blank – be certain to enter “0” wherever required. Omit $ sign in your response.)

(i) FVTPL

| Year 4 | Year 5 | Year 6 | Total | ||||

| Dividend income | |||||||

| Unrealized gains | |||||||

| Gain on sale | |||||||

| Net income | |||||||

| Total OCI | |||||||

(ii) Investment in associate

| Year 4 | Year 5 | Year 6 | Total | ||||

| Equity income | |||||||

| Gain on sale | |||||||

| Net income | |||||||

| Total OCI | |||||||

(iii) FVTOCI

| Year 4 | Year 5 | Year 6 | Total | ||||

| Dividend income | |||||||

| Gain on sale | |||||||

| Net income | |||||||

| Other comprehensive income | |||||||

| Unrealized gain | |||||||

| Gain on sale | |||||||

| Total other comprehensive income | |||||||

| Comprehensive income | |||||||

Related: (Solution) MOS4465 Assignment 2 Chapter 3

Solutions – MOS4465 Assignment 1 Chapter 1 & 2

Convert Moosomin’s financial statements for both Year 6 and Year 7 into common-sized financial statements

Selected financial information (in 000s) from the financial statements of Moosomin Ltd. for Years 6 and 7 is as follows:

| Year 6 | Year 7 | |||

| Sales revenue | $ | 1,470 | $ | 1,570 |

| Cost of goods sold | 770 | 905 | ||

| Other expenses | 440 | 325 | ||

| Net income | 260 | 340 | ||

| Current assets | 530 | 570 | ||

| Total assets | 1,720 | 1,810 | ||

| Total liabilities | 1,170 | 1,080 | ||

| Shareholders’ equity | 550 | 730 | ||

Required:

(a) Convert Moosomin’s financial statements for both Year 6 and Year 7 into common-sized financial statements using (Input all amounts as positive values. Round the final answers to the nearest whole percent. Omit % sign in your response.)

Correct Answer

Vertical Analysis of Income Statement

- To show each line item as a percentage of Total Revenue or Sales.

- Calculation: Percentage=(Line Item/Total Revenue)×100

- Use: It helps assess the relative size of each expense and profit component within a single period.

Horizontal Analysis of Income Statement

- Purpose: To compare figures across different periods.

- Calculation:

- Percentage Change = (Current Period Amount−Previous Period Amount/Previous Period Amount) × 100

- Use: Tracks growth or decline in income, expenses, and profit over time.

| Vertical analysis | Horizontal analysis | |||||||

| Year 6 | Year 7 | Year 6 | Year 7 | Year 6 | Year 7 | |||

| Sales revenue | 1,470 | 1,570 | 100% | 100% | 100% | 107% | ||

| Cost of goods sold | 770 | 905 | 52% | 58% | 100% | 118% | ||

| Other expenses | 440 | 325 | 30% | 21% | 100% | 74% | ||

| Net income | 260 | 340 | 18% | 22% | 100% | 131% | ||

| Current assets | 530 | 570 | 36% | 36% | 100% | 108% | ||

| Total assets | 1,720 | 1,810 | 117% | 115% | 100% | 105% | ||

| Total liabilities | 1,170 | 1,080 | 80% | 69% | 100% | 92% | ||

| Shareholders’ equity | 550 | 730 | 37% | 46% | 100% | 133% | ||

(b) Identify three financial statement items (other than net income) that seem to be the most peculiar relative to expectations.

Correct Answer – Other Expenses, Total Liabilities, Shareholders’ Equity

Explanation

The three financial statement items that seem most peculiar relative to expectations are:

- Other expenses declined when revenue increased and now represent only 21% of sales compared to 30% of sales in Year 6.

- Total liabilities declined by 8% even though sales increased by 7% and now represent only 60% of total assets compared to 68% in Year 6.

- Shareholders’ equity increased by 33% even though sales only increased by 7% and now represent 40% of total assets compared to only 32% in Year 6.

Please click on the Icon below to purchase the full answer at only $10