100% Correct MOS3330 Homework 12, 13 solutions

Questions

PA 12-4 (Algo) Bruno Fruscalzo decided to start a small…

Bruno Fruscalzo decided to start a small production facility in Sydney to sell gelato to the local restaurants. His local milk supplier charges $0.50 per kilogram of milk plus a $20 delivery fee (the $20 fee is independent of the amount ordered). Bruno’s holding cost is $0.03 per kilogram per month. He needs 9,750 kilograms of milk per month.

- Suppose Bruno orders 9,000 kilograms each time. What is his average inventory (in kilograms)?

- Suppose Bruno orders 8,000 kilograms each time. How many orders does he place with his supplier each year? Note: Round your answer to 1 decimal place.

- How many kilograms should Bruno order from his supplier with each order to minimize the sum of the ordering and holding costs?

- If Bruno’s storage vessel can hold only 3,250 kilograms of milk, what would be Bruno’s annual ordering and holding costs if he orders this amount?

- If Bruno’s storage vessel can hold only 6,000 kilograms of milk, what would be Bruno’s annual ordering and holding costs if he orders this amount?

- Bruno’s supplier’s truck can carry 20,000 kilograms of milk. The supplier does not want to deliver to more than three customers with each truck. Thus, the supplier requires a minimum order quantity of 6,500 kilograms. If Bruno orders the minimum amount, what would be the sum of his annual ordering and holding costs? Assume he has a storage vessel large enough to hold 6,500 kilograms.

- Bruno’s supplier offers a 3 percent discount when a customer orders a full truck, which is 20,000 kilograms. Assume Bruno can store that quantity and the product will not spoil. If Bruno orders a full truck, what would be the annual inventory holding and ordering cost incurred per kilogram of milk?Note: Round your answer to 3 decimal places.

Correct Answer – PA 12-4 (Algo) Bruno Fruscalzo decided to start a small

Q1 Answer – 4,500 kilograms.

Average inventory = 9,000 ÷ 2 = 4,500.

Q2 Answer – 14.6 orders

Annual orders = (9,750 per month × 12) ÷ 8,000 per order = 14.6 orders

PA 12-3 (Algo) Joe Birra needs to purchase malt for his…

Joe Birra needs to purchase malt for his microbrewery production. His supplier charges $40 per delivery (no matter how much is delivered) and $1.25 per gallon. Joe’s annual holding cost per unit is 30 percent of the price per gallon. Joe uses 200 gallons of malt per week.

- Suppose Joe orders 125 gallons each time. What is his average inventory (in gallon)?

- Suppose Joe orders 1,000 gallons each time. How many orders does he place with his supplier each year? Note: Round your answer to 2 decimal places.

- How many gallons should Joe order from his supplier with each order to minimize the sum of the ordering and holding costs?

- Suppose Joe orders 3,000 gallons each time he places an order with the supplier. What is the sum of the ordering and holding costs per gallon? Note: Round your answer to 3 decimal places.

- Suppose Joe orders the quantity from part (c) that minimizes the sum of the ordering and holding costs each time he places an order with the supplier. What is the annual cost of the EOQ expressed as a percentage of the annual purchase cost? Note: Round your answer to 2 decimal places.

- If Joe’s supplier only accepts orders that are an integer multiple of 1000 gallons, how much should Joe order to minimize ordering and holding costs per gallon?

- Joe’s supplier offers a 3.00 percent discount if Joe is willing to purchase 8000 gallons or more. What would Joe’s total annual cost (purchasing, ordering, and holding) be if he were to take advantage of the discount?

PA 13-11 (Algo) Share&Care is a nonprofit car share company…

Share&Care is a nonprofit car-share company that rents cars. When customers make a reservation, they specify their pickup time and the number of time slots they will hold the vehicle, where each time slot equals 15 minutes. For example, if the pickup time is 1 p.m., then possible drop-off times are 1:15 (one slot), 1:30 (two slots), and so on. Share&Care charges $1.00 for each time slot in the reservation. To discourage customers from returning the rented cars beyond their drop-off time, it charges $35 per time slot used beyond the drop-off time. For example, if a customer’s drop-off time is 2:30 and he returns the vehicle at 2:47, then he is charged $70 for the two time slots he used beyond his reservation (and, of course, $1.00 per slot that he reserved). Larry runs a small business that makes deliveries on Fridays. To ensure availability of a car, he books his car two days in advance. However, he doesn’t know his exact needs when he books. Table 13.10 provides information regarding Larry’s demand (in terms of slots). For example, if he needs five slots but booked four slots, then he uses the car for five slots, for a total charge of (4 × $1.00 + $20 = $24). If he ends up booking the car for more time than he needs, the extra time on the car has no value to him. Use Table 13.10.

- Suppose Larry books the car for two time slots. How likely is he to pay $70 or more in late fees? Use Table 13.10. Note: Round your answer to 4 decimal places.

- To minimize his rental costs, how many time slots should Larry reserve? Use Table 13.10 and round-up rule.

- Suppose Larry books the car for two time slots. How many time slots can he expect to waste (i.e., they end up being of no use to him)? Use Table 13.10. Note: Round your answer to 2 decimal places.

- Larry hates paying any late penalty fee. Suppose he wants to be 99.0 percent sure that he will not have to pay a late fee. How many slots should he book? Use Table 13.10 and round-up rule.

PA 13-7 (Algo) Goop Incorporated needs to order a raw material to make a special …

Goop Incorporated needs to order a raw material to make a special polymer. The demand for the polymer is forecasted to be normally distributed with a mean of 200 gallons and a standard deviation of 100 gallons. Goop sells the polymer for $28 per gallon. Goop purchases raw material for $9 per gallon and must spend $10 per gallon to dispose of all unused raw material due to government regulations. (One gallon of raw material yields one gallon of polymer.) If demand is more than Goop can make, then Goop sells only what it has made and the rest of the demand is lost. Use Table 13.4.

Note: If a part of the question specifies whether to use Table 13.4, or to use Excel, then credit for a correct answer will depend on using the specified method.

- How many gallons should Goop purchase to maximize its expected profit? Use Table 13.4.Note: Enter your answer as a whole number.

- Suppose Goop purchases 120 gallons of raw material. What is the probability that it will run out of raw material? Note: Round your answer to 4 decimal places.

- Suppose Goop purchases 300 gallons of raw material. What are the expected sales (in gallons)? Use Table 13.4 and the round-up rule. Note: Round your answer to 2 decimal places.

- Suppose Goop purchases 375 gallons of raw material. How much should it expect to spend on disposal costs (in dollars)? Use Table 13.4 and the round-up rule. Note: Round your answer to 2 decimal places.

- Suppose Goop wants to ensure that there is a 93 percent probability that it will be able to satisfy its customers’ entire demand. How many gallons of the raw material should it purchase? Use Table 13.4 and the round-up rule. Note: Enter your answer as a whole number.

Additional Algo 12-2 Optimal Order Quantity

A company purchases wood for use in its products. The firm uses 720 pounds of wood per week and purchases wood for $2.25 per pound from a supplier. The cost to hold one pound of wood in inventory for one year is $0.45. Each time the firm orders wood from the supplier, the firm must pay an order processing charge of $67.

What is the optimal order quantity (in pounds)? Note: Assume there are 52 weeks in a year and round your answer to the nearest integer value.

Additional Algo 12-6 Quantity Discounts

A store estimates their holding costs at 39% and incurs a fixed cost of $57.00 for each order. Demand for an item is 1,850 units per year. A supplier offers a price of $9.00 each for quantities of 325 or fewer and a price of $8.37 for quantities over 325 units.

- How many units should the retailer order at one time?

- What is the total annual cost at this order point? Note: Round your answer to the nearest integer value.

Related: (Solution) MOS3330 Homework 16 – Operations Management

Solutions with Explanation – MOS3330 Homework 12, 13

PA 12-4 (Algo) Bruno Fruscalzo decided to start a small…

Bruno Fruscalzo decided to start a small production facility in Sydney to sell gelato to the local restaurants. His local milk supplier charges $0.50 per kilogram of milk plus a $20 delivery fee (the $20 fee is independent of the amount ordered). Bruno’s holding cost is $0.03 per kilogram per month. He needs 9,750 kilograms of milk per month.

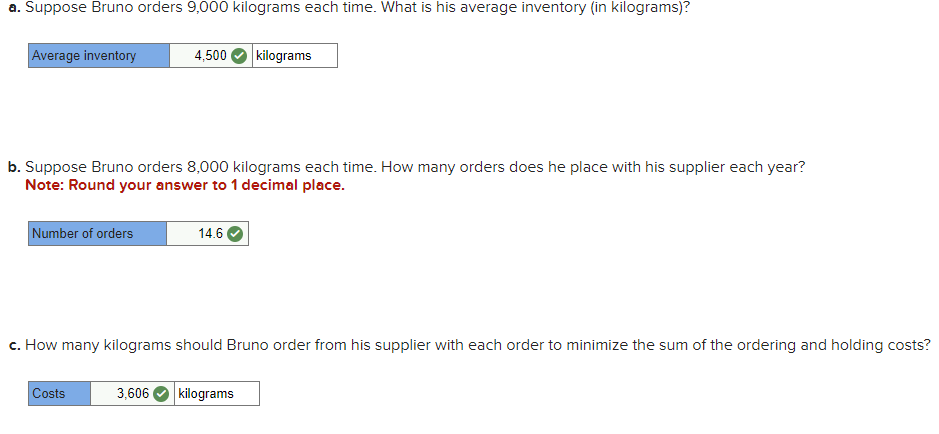

a. Suppose Bruno orders 9,000 kilograms each time. What is his average inventory (in kilograms)?

4,500 kilograms. Average inventory = 9,000 ÷ 2 = 4,500.

b. Suppose Bruno orders 8,000 kilograms each time. How many orders does he place with his supplier each year? Note: Round your answer to 1 decimal place.

14.6 orders. Annual orders = (9,750 per month × 12) ÷ 8,000 per order = 14.6 orders

c. How many kilograms should Bruno order from his supplier with each order to minimize the sum of the ordering and holding costs?

3,606 kilograms. EOQ = Square root (2 × 20 order cost × 9,750 monthly demand × 12) ÷ (0.03 holding cost per month × 12) = 3,606

d. If Bruno’s storage vessel can hold only 3,250 kilograms of milk, what would be Bruno’s annual ordering and holding costs if he orders this amount?

$1305. Annual order cost = (9,750 × 12) ÷ 3,250 orders × $20 = $720.00. Annual holding cost = 0.5 (3,250 × 0.03 × 12) = $585

720.00 Annual order + 585 holding costs = 1305

Please click on the Icon below to purchase the full answer at only $5