100% Correct MOS3310 Midterm Exam Fundamentals of Corporate Finance

Questions

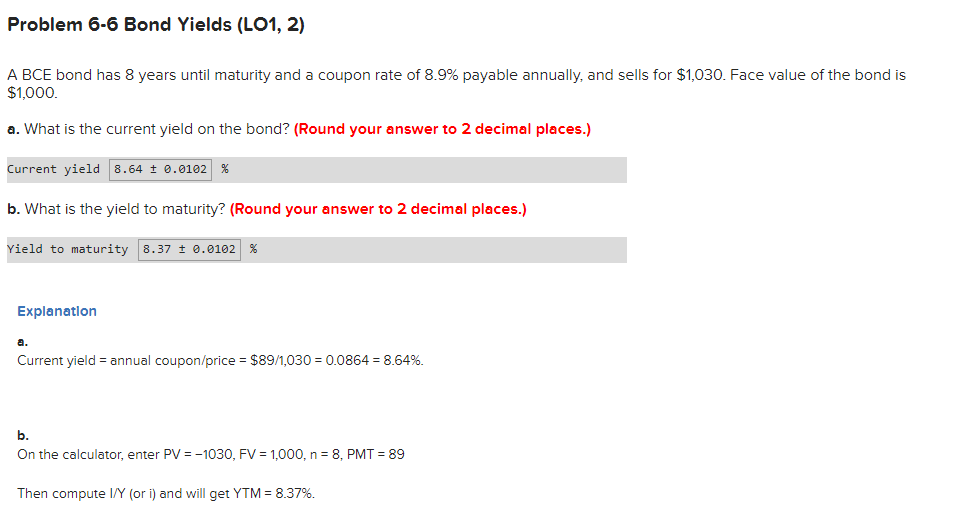

Problem 6-6 Bond Yields (LO1, 2)

A BCE bond has 8 years until maturity and a coupon rate of 8.9% payable annually, and sells for $1,030. Face value of the bond is $1,000.

a. What is the current yield on the bond? (Round your answer to 2 decimal places.)

b. What is the yield to maturity? (Round your answer to 2 decimal places.)

Problem 6-35 Real Returns (LO3)

Suppose that you buy a 1-year maturity bond for $1,000 that will pay you $1,000 plus a coupon payment of $72 at the end of the year.

a. What real rate of return will you earn if the inflation rate is 2.8 percent? (Round your answer to 2 decimal places. Use minus sign to enter negative real rate of return, if any.)

| Real rate of return |

b. What real rate of return will you earn if the inflation rate is 3.6 percent? (Round your answer to 2 decimal places. Use minus sign to enter negative real rate of return, if any.)

| Real rate of return |

c. What real rate of return will you earn if the inflation rate is 4.8 percent? (Round your answer to 2 decimal places. Use minus sign to enter negative real rate of return, if any.)

| Real rate of return |

d. What real rate of return will you earn if the inflation rate is 6.8 percent? (Round your answer to 2 decimal places. Use minus sign to enter negative real rate of return, if any.)

| Real rate of return |

Question – South Sea Baubles has the following incomplete balance sheet and income statement

South Sea Baubles has the following incomplete balance sheet and income statement.

| South Sea Baubles Balance Sheet, as of End of Year ($ millions) | |||||

| Assets | 2018 | 2017 | |||

| Current assets | $ | 126 | $ | 107 | |

| Net fixed assets | 917 | 831 | |||

| Liabilities and Shareholders’ Equity | |||||

| Current liabilities | $ | 88 | $ | 72 | |

| Long-term debt | 716 | 617 | |||

| Income Statement, 2018 ($ millions) | |||

| Revenue | $ | 1,960 | |

| Cost of goods sold | (1,013 | ) | |

| Depreciation | 367 | ||

| Interest expense | 226 | ||

a. What is shareholders’ equity in 2017 and 2018?

b. What is net working capital in 2017 and 2018?

c. What is taxable income and taxes paid in 2018? Assume the firm pays taxes equal to 35% of taxable income. (Round your answers to 2 decimal places.)

d. What is cash flow provided by operations during 2018? Pay attention to changes in net working capital. (Round your answers to 2 decimal places. Use minus sign to enter cash outflows, if any.)

Now assume that interest is an financing flow.

e. What must have been South Sea’s gross investment in fixed assets (capital expenditure) during 2018? (Enter your answer as positive value.)

f. If South Sea reduced its outstanding accounts payable by $35 million during 2018, what must have happened to its other current liabilities? (Enter your answers as positive values.)

g. What are the 2018 cash flow from assets, and cash flow to bondholders and shareholders? (Round your answers to 2 decimal places. Use minus sign to enter cash outflows, if any.)

Now assume that interest is a financing flow.

Problem 6-21 Bond Returns (LO2)

You buy an 9.5% coupon, paid annually, 14-year maturity bond for $945. A year later, the bond price is $1,025. Face value of the bond is $1,000.

a. What is the yield to maturity on the bond today? (Round your answer to 2 decimal places.)

What is the yield to maturity on the bond in one year? (Round your answer to 2 decimal places.)

b. What is your rate of return over the year? (Round your answer to 2 decimal places.)

Problem 5-31 Mortgage (LO3)

a. You are arranging a $369,000 Canadian mortgage with a 26-year amortization period and a 6.95% posted interest rate. What is the monthly mortgage payment? (Do not round intermediate calculations. Round your answer to the nearest cent.)

b. Suppose the bank offers you the opportunity to pay your monthly payments in two equal instalments (pay one-half of the monthly payment every 2 weeks). How much faster will you pay off your mortgage this way? (Do not round intermediate calculations. Round your answer to 1 decimal place.)

Problem 7-33 Stock Valuation (LO2)

A Canadian wireless communications company earned $3.4 per share in 2018 and paid dividends of $1.68 per share. Analysts forecast an annual earnings growth rate of 6.8% for the next 5 years. Based on similar-risk companies, the estimated required rate of return on the stock is 9.1%. It is assumed that after 2023 onward, the company will maintain its current reinvestment rate but earn only its cost of capital on new investments. Estimate the current stock price at the beginning of 2019. (Do not round intermediate calculations. Round your answer to the nearest cent.)

Problem 7-25 Valuing Businesses (LO3)

Consider the table given below to answer the following question. The long-run growth rate is projected at 6% and discount rate is 10%.

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | ||||||||||

| Asset value | 10.00 | 11.20 | 12.54 | 14.05 | 15.31 | 16.69 | 18.19 | 19.29 | 20.44 | 21.67 | ||||||||||

| Earnings | 1.20 | 1.34 | 1.51 | 1.69 | 1.84 | 1.92 | 2.00 | 2.03 | 1.64 | 1.73 | ||||||||||

| Net investment | 1.20 | 1.34 | 1.51 | 1.26 | 1.38 | 1.50 | 1.09 | 1.16 | 1.23 | 1.30 | ||||||||||

| Free cash flow (FCF) | 0.42 | 0.46 | 0.42 | 0.91 | 0.87 | 0.41 | 0.43 | |||||||||||||

| Return on equity (ROE) | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.115 | 0.11 | 0.105 | 0.08 | 0.08 | ||||||||||

| Asset growth rate | 0.12 | 0.12 | 0.12 | 0.09 | 0.09 | 0.09 | 0.06 | 0.06 | 0.06 | 0.06 | ||||||||||

| Earnings growth rate | 0.12 | 0.12 | 0.12 | 0.09 | 0.04 | 0.04 | 0.01 | −-0.19 | 0.06 | |||||||||||

Assuming that competition drives down profitability (on existing assets as well as new investment) to 11.5% in year 6, 11% in year 7, 10.5% in year 8, and 8% in year 9 and all later years. What is the value of the concatenator business? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)

Problem 7-37 Non-constant Growth (LO2)

Earnings per common share of ABC Industries for the current year are expected to be $2.15 and to grow 8.5% per year over the next 4 years. At the end of the 5 years, earnings growth rate is expected to fall to 5.75% and continue at that rate for the foreseeable future. ABC’s dividend payout ratio is 45%. If the expected return on ABC’s common shares is 19.5%, calculate the current share price. (Do not round intermediate calculations. Round your answer to the nearest cent.)

Problem 5-33 Annuity Value (LO3, 6)

a. You’ve borrowed $1,699.47 and agreed to pay back the loan with monthly payments of $80. If the interest rate is 12% stated as an APR, how long will it take you to pay back the loan? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

b. What is the effective annual rate on the loan?

Problem 5-61 Integrative (LO3, 4, 6)

Acme needs a new $20,500 copier machine and must decide whether to lease or buy it. If the company buys the copier, they expect to sell it for $5,100 in 5 years. The bank has offered a 5-year amortizing loan of $20,500 at 8.05%, compounded monthly. Loan payments will be due at the end of each month. If Acme leases the copier, monthly lease payments will be paid at the beginning of each month and the copier returned to the lessor at the end of five years. Calculate the monthly lease payment that would make the lease equivalent to the loan. Note: Ignore taxes. (Do not round intermediate calculations. Round your answer to the nearest cent.)

Related: (Solution) Midterm MOS3310 Questions

Correct Answers with Explanation – MOS3310 Midterm

Problem 6-6 Bond Yields (LO1, 2)

A BCE bond has 8 years until maturity and a coupon rate of 8.9% payable annually, and sells for $1,030. Face value of the bond is $1,000.

a. What is the current yield on the bond? (Round your answer to 2 decimal places.)

| Current yield | 8.64 ± 0.0102 % |

b. What is the yield to maturity? (Round your answer to 2 decimal places.)

| Yield to maturity | 8.37 ± 0.0102 % |

Explanation Problem 6-6 Bond Yields

a. Current yield = annual coupon/price = $89/1,030 = 0.0864 = 8.64%.

b. On the calculator, enter PV = −1030, FV = 1,000, n = 8, PMT = 89

Then compute I/Y (or i) and will get YTM = 8.37%.

Please click on the Icon below to purchase the full answer at only $5