MOS3370 Chapter 3 Practice Problems and Solutions

Question 1

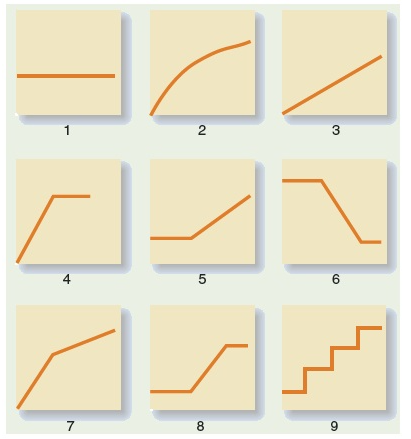

A number of scattergraphs displaying cost behaviour patterns are shown below. The vertical axis on each graph represents total cost, and the horizontal axis represents the level of activity (volume).

- Charges for data usage on a smartphone plan—a flat fixed charge for the first 500 MB, plus a variable cost per megabyte for usage above 500 MB.

- Wages for software development staff, all of whom are paid a fixed monthly salary.

- Licensing fees paid to the provincial government to operate dog sled tours. A fee of $10 per tour is paid for the first 1,000 tours, with no additional fees paid if tours exceed 1,000.

- Cost of raw materials, where the cost starts at $7.50 per unit and then decreases by 5 cents per unit for each of the first 100 units purchased, after which it remains constant at $2.50 per unit.

- Cost of a monthly high-speed Internet plan, where $50 is charged for 0–250 MB usage, $75 for 251 to 500 MB usage, $100 for 501 to 750 MB usage, and $125 for 751 MB usage and above.

- Wage expense paid to tree planters who receive $0.10 per tree planted.

- Rent on a factory building donated by the county, where the agreement calls for rent of $100,000 less $1 for each direct labour-hour worked in excess of 200,000 hours, but a minimum rental payment of $20,000 must be paid.

- Wages paid to sales staff who receive a fixed salary per month and sales commissions equal to 5% of sales for every sales dollar they generate above $250,000. No additional commissions are paid for sales above $1,000,000.

- Raw materials costs, where the first 1,000 units cost $1 per unit, with the unit cost dropping to $0.80 per unit for quantities above 1,000.

Required:

1. For each of the above situations, identify the graph that illustrates the cost behaviour pattern involved. Any graph may be used more than once.

Question 2

Crosshill Company’s total overhead costs at various levels of activity are presented below:

| Month | Machine-Hours | Total Overhead Cost | ||

| April | 70,000 | $ | 202,200 | |

| May | 60,000 | $ | 180,300 | |

| June | 80,000 | $ | 224,100 | |

| July | 90,000 | $ | 246,000 | |

Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 60,000-machine-hour level of activity in May is as follows:

| Utilities (variable) | $ | 52,200 |

| Supervisory salaries (fixed) | 21,000 | |

| Maintenance (mixed) | 107,100 | |

| Total overhead cost | $ | 180,300 |

The company wants to break down the maintenance cost into its variable and fixed cost elements.

Required:

1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: To do this, first determine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the “Variable cost per unit” to 2 decimal places.)

2. Using the high–low method, estimate a cost formula for maintenance. (Round the “Variable cost per unit” to 2 decimal places.)

3. Express the company’s total overhead cost in the form Y = a + bX. (Round the “Variable cost per unit” to 2 decimal places.)

4. What total overhead cost would you expect to be incurred at an activity level of 75,000 machine-hours? (Round the “Variable cost per unit” to 2 decimal places.)

Question 3

Colby Limited is a manufacturing company whose total factory overhead costs fluctuate somewhat from year to year, according to the number of machine-hours worked in its production facility. These costs at high and low levels of activity over recent years are given below:

| Level of Activity | ||||||

| Low | High | |||||

| Machine-hours | 82,700 | 92,700 | ||||

| Total factory overhead costs | $ | 44,626,900 | $ | 47,096,900 | ||

The factory overhead costs above consist of indirect materials, rent, and maintenance. The company has analyzed these costs at the 82,700 machine-hours level of activity as follows:

| Indirect materials (variable) | $ | 13,645,500 |

| Rent (fixed) | 20,000,000 | |

| Maintenance (mixed) | 10,981,400 | |

| Total factory overhead costs | $ | 44,626,900 |

For planning purposes, the company wants to break down the maintenance cost into its variable and fixed cost elements.

Required:

1. Estimate how much of the factory overhead cost of $47,096,900 at the high level of activity consists of maintenance cost.

2. Using the high–low method, estimate a cost formula for maintenance.

3. What total overhead costs would you expect the company to incur at an operating level of 87,700 machine-hours?

Question 4

The Ramon Company is a manufacturer that is interested in developing a cost formula to estimate the fixed and variable components of its monthly manufacturing overhead costs. The company wishes to use machine-hours as its measure of activity and has gathered the data below for this year and last year:

| Last Year | This Year | |||||||||||

| Month | Machine-Hours | Overhead Costs | Machine-Hours | Overhead Costs | ||||||||

| January | 21,000 | $ | 84,000 | 21,000 | $ | 86,000 | ||||||

| February | 25,000 | 99,000 | 24,000 | 93,000 | ||||||||

| March | 22,000 | 89,500 | 23,000 | 93,000 | ||||||||

| April | 23,000 | 90,000 | 22,000 | 87,000 | ||||||||

| May | 20,500 | 81,500 | 20,000 | 80,000 | ||||||||

| June | 19,000 | 75,500 | 18,000 | 76,500 | ||||||||

| July | 14,000 | 70,500 | 12,000 | 67,500 | ||||||||

| August | 10,000 | 64,500 | 13,000 | 71,000 | ||||||||

| September | 12,000 | 69,000 | 15,000 | 73,500 | ||||||||

| October | 17,000 | 75,000 | 17,000 | 72,500 | ||||||||

| November | 16,000 | 71,500 | 15,000 | 71,000 | ||||||||

| December | 19,000 | 78,000 | 18,000 | 75,000 | ||||||||

The company leases all of its manufacturing equipment. The lease arrangement calls for a flat monthly fee up to 19,500 machine-hours. If the machine-hours used exceed 19,500, then the fee becomes strictly variable with respect to the total number of machine-hours used during the month. Lease expense is a major element of overhead cost.

Required:

1. Using the high–low method, estimate a manufacturing overhead cost formula. (Round variable cost to 2 decimal place and fixed cost to the nearest dollar amount.)

2. This part of the question is not part of your Connect assignment.

3. This part of the question is not part of your Connect assignment.

4. Assume that the company consumes 22,500 machine-hours during a month. Using the high–low method, estimate the total overhead cost that would be incurred at this level of activity. Be sure to consider only the data points contained in the relevant range of activity when performing your computations. (Do not round intermediate calculations.)

Related: (Solution) MOS3370 Chapter 4 Practice Problems

100% Correct Solutions to Chapter 3 Practice Problems

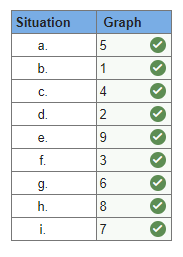

Here is the correct answer to question 1

Question 2 part 1.

Maintenance cost at the 90,000 machine-hour level of activity can be isolated as follows:

| Level of Activity | ||||||

| 60,000 MHs | 90,000 MHs | |||||

| Total overhead cost | $ | 180,300 | $ | 246,000 | ||

| Deduct: | ||||||

| Utilities cost @ $0.87 per MH* | 52,200 | 78,300 | ||||

| Supervisory salaries | 21,000 | 21,000 | ||||

| Maintenance cost | $ | 107,100 | $ | 146,700 | ||

Please click on the Icon below to purchase the full answer at only $5