MOS 3370 Managerial Accounting IF STATEMENTS 2 Assignment

The Munchkin Theater is a nonprofit organization devoted to staging plays for children. The theater has a very small full-time professional administrative staff. Through a special arrangement with the actors’ union, actors and directors rehearse without pay and are paid only for actual performances.

The Munchkin Theater has asked for your help in preparing a Planning budget at the beginning of the year and evaluating actual expenses at the end of the year. The theater expects to put on five different productions with a total of 60 performances. For example, one of the productions is Peter Rabbit, which had been budgeted for five performances. After interviewing various people affiliated with the theater you have developed the following estimated cost formulas for each of the eight expenses that will be included in your Planning budget:

| Cost Formulas | |||||||||

| Per Production | Per Performance | Fixed | |||||||

| Actors’ and directors’ wages | $ | 2,400 | |||||||

| Stagehands’ wages | $ | 450 | |||||||

| Ticket booth personnel and ushers’ wages | $ | 180 | |||||||

| Scenery, costumes, and props | $ | 8,600 | |||||||

| Theater hall rent | $ | 750 | |||||||

| Printed programs | $ | 175 | |||||||

| Publicity | $ | 2,600 | |||||||

| Administrative expenses | $ | 1,296 | $ | 72 | $ | 32,400 | |||

By the end of the year, The Munchkin Theater actually put on four productions and a total of 64 performances. The actual expenses incurred during the year were as follows:

| Actors’ and directors’ wages | $ | 159,200 |

| Stagehands’ wages | 28,600 | |

| Ticket booth personal and ushers’ wages | 12,300 | |

| Scenery, costumes, and props | 39,300 | |

| Theater hall rent | 49,600 | |

| Printed programs | 10,950 | |

| Publicity | 12,000 | |

| Administrative expenses | 41,650 | |

| Total | $ | 353,600 |

Click here to download the Excel template that you will use to create the Planning Budget and Flexible Budget Performance Report.

Once you complete the Planning Budget and Flexible Budget Performance Report, refer to your work to answer the forthcoming questions. You will upload your final file in Part 2.

Click here for a brief tutorial on IF Statements in Excel.

Click here for a brief tutorial on Conditional Formatting in Excel.

Required:

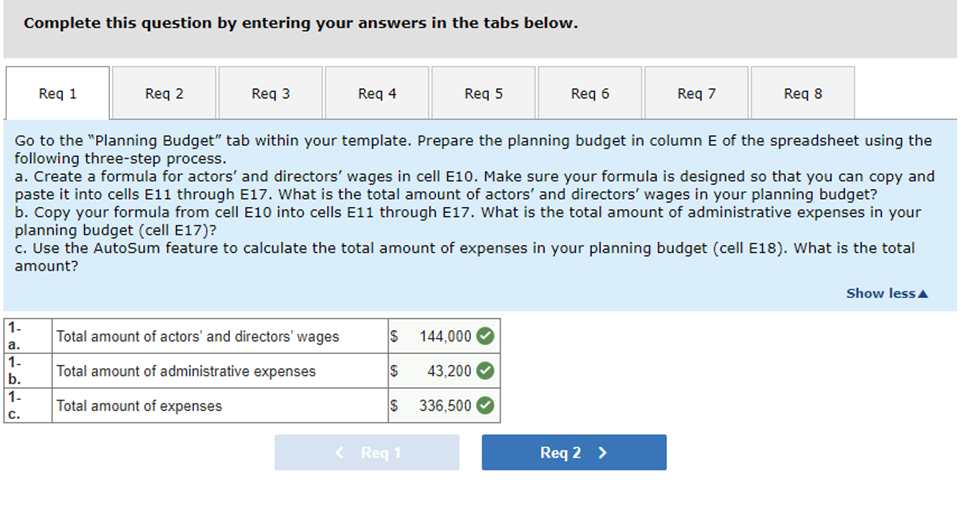

1. Go to the “Planning Budget” tab within your template. Prepare the planning budget in column E of the spreadsheet using the following three-step process.

a. Create a formula for actors’ and directors’ wages in cell E10. Make sure your formula is designed so that you can copy and paste it into cells E11 through E17. What is the total amount of actors’ and directors’ wages in your planning budget?

b. Copy your formula from cell E10 into cells E11 through E17. What is the total amount of administrative expenses in your planning budget (cell E17)?

c. Use the AutoSum feature to calculate the total amount of expenses in your planning budget (cell E18). What is the total amount?

2. Go to the “Performance Report” tab within the Excel template for the remainder of the requirements. Prepare a flexible budget in column H of the spreadsheet using the following three-step process.

a. Create a formula for actors’ and directors’ wages in cell H10. Make sure your formula is designed so that you can copy and paste it into cells H11 through H17. What is the total amount of actors’ and directors’ wages in your flexible budget?

b. Copy your formula from cell H10 into cells H11 through H17. What is the total amount of administrative expenses in your flexible budget (cell H17)?

c. Use the AutoSum feature to calculate the total amount of expenses in your flexible budget (cell H18). What is this total amount?

3. Calculate the amount of the flexible budget variances in column F using the following five-step process (Do not worry about labeling the variances as U or F at this point):

a. Create a formula for the actors’ and directors’ wages static budget variance in cell M10. What is the amount of the static budget variance for actors’ and directors’ wages?

b. Copy your formula from cell M10 into cells M11 through M17. What is the amount of the static budget variance for administrative expenses (cell M17)?

c. Use the AutoSum feature to calculate the total static budget variance in cell M18. What is the total static budget variance?

d. Using the Absolute Value function, input the absolute values of the amounts in cells M10 through M18 into cells F10 through F18.

e. Hide column M.

4. Insert a favorable (F) or unfavorable (U) label in column G for each static budget variance shown in column F using the following two-step process:

a. Create an IF-THEN statement in cell G10 that properly labels the actors’ and directors’ wages static budget variance as favorable or unfavorable. (Hint: Your If-Then statement should be focused on the amounts in cells H10 and E10.) What label appears for this variance, F or U?

b. Copy your IF-THEN statement from cell G10 into cells G11 through G18. What label appears for the administrative expense static budget variance, F or U?

5. Calculate the amount of the sales volume variances in column I using the following five-step process (Do not worry about labeling the variances as U or F at this point):

a. Create a formula for the actors’ and directors’ wages sales volume variance in cell N10. What is the amount of the sales volume variance for actors’ and directors’ wages?

b. Copy your formula from cell N10 into cells N11 through N17. What is the amount of the sales volume variance for administrative expenses (cell N17)?

c. Use the AutoSum feature to calculate the total sales volume variance in cell N18. What is the total sales volume variance?

d. Using the Absolute Value function, input the absolute values of the amounts in cells N10 through N18 into cells I10 through I18.

e. Hide column N.

6. Insert a favorable (F) or unfavorable (U) label in column J for each sales volume variance shown in column I using the following two-step process:

a. Create an IF-THEN statement in cell J10 that properly labels the actors’ and directors’ wages sales volume variance as favorable or unfavorable. (Hint: Your If-Then statement should be focused on the amounts in cells K10 and H10.) What label appears for this variance, F or U?

b. Copy your IF-THEN statement from cell J10 into cells J11 through J18. What label appears for the administrative expense sales volume variance, F or U?

7. The sales volume variances in column I are influenced by two cost drivers—number of productions and number of performances. Therefore:

a. In cell I21 create a formula that quantifies the portion of the overall sales volume variance that is caused solely by the fact that The Munchkin Theatre actually put on four productions instead of the planned number of five productions. What is the amount in cell I21?

b. In cell I22 create a formula that quantifies the portion of the overall sales volume variance that is caused solely by the fact that The Munchkin Theatre actually put on 64 performances instead of the planned number of 60 performances. What is the amount in cell I22?

c. Create IF-THEN statements in cells J21 and J22 that properly label your variances in cells I21 and I22 as favorable (F) or unfavorable (U).

8. Using Conditional Formatting, highlight all static budget variances that varied by an absolute value of $1,000 or more. How many of the static budget variances are highlighted?

9. Using Conditional Formatting, highlight all static budget variances that vary from the flexible budget by an absolute value of 5% or more. (Hint: Within the conditional formatting drop down menu look for the appropriate formula in the “More rules” section. Also, make sure your formula does not include any absolute references.) Which static budget variances deviate from the flexible budget by at least 5%? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply

- Actors’ and directors’ wagesCorrect

- Stagehands’ wagesCorrect

- Ticket booth personnel and ushers’ wagesCorrect

- Scenery, costumes, and propsCorrect

- Theater hall rentCorrect

- Printed programsCorrect

- PublicityCorrect

- Administrative expensesCorrect

Step by Step Solution with Explanation – IF STATEMENTS 2 Assignment

1.

a.

Within the Microsoft Excel template, go to the “Planning Budget” tab and do the following:

- Click in cell E10

- Create a formula for the actors’ and directors’ wages within this cell:

- (Number of productions planned x estimated cost per production) + (Number of performances planned x estimated cost per performance) + fixed cost

- =($E$6*$B10)+($E$7*$C10)+$D10

- Note the $ usage denotes absolute references that will not modify as the formula is copied and inserted into other cells

- =($E$6*$B10)+($E$7*$C10)+$D10

- (Number of productions planned x estimated cost per production) + (Number of performances planned x estimated cost per performance) + fixed cost

The total amount of actors’ and directors’ wages in the planning budget is $144,000.

b.

Continue working within the Microsoft Excel template, go to the “Planning Budget” tab:

- Copy the formula from cell E10 into each cells E11 through E17

- Look within cell E17 to see the total administrative expenses in the planning budget of $43,200

c.

Continue working within the Microsoft Excel template, go to the “Planning Budget” tab:

- Click within cell E18

- Within the “Home” ribbon, in the “Editing” section, click on the “∑ AutoSum” button (note the drop down is not needed here, but you may click on the drop down and choose “Sum”

- After selection, Excel will automatically insert a “Sum” formula that includes cells E10 through E17

- Hit Enter

- Cell E18 will now contain the formula =SUM(E10:E17)

- After selection, Excel will automatically insert a “Sum” formula that includes cells E10 through E17

The total amount of all expenses in the planning budget is $336,500.

See also: (Solution) MOS3370 Managerial Accounting VLOOKUP Assignment

2.

a.

Within the Microsoft Excel template, go to the “Performance Report” tab and do the following: Please click on the Icon below to purchase the full answer at only $5